-

Municipals returned 0.83% in July with a year-to-date return of 1.90%. High-yield returned 1.20% in July and 7.40% year-to-date. Taxables led July with 1.65% returns and 1.95% for the year.

August 2 -

Michigan is bringing $855 million of state trunk line fund bonds to market Tuesday for road and bridge projects.

August 2 -

The city sees room for a new convention hotel, despite nearby competition and pandemic-related setbacks.

August 2 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

July 30 -

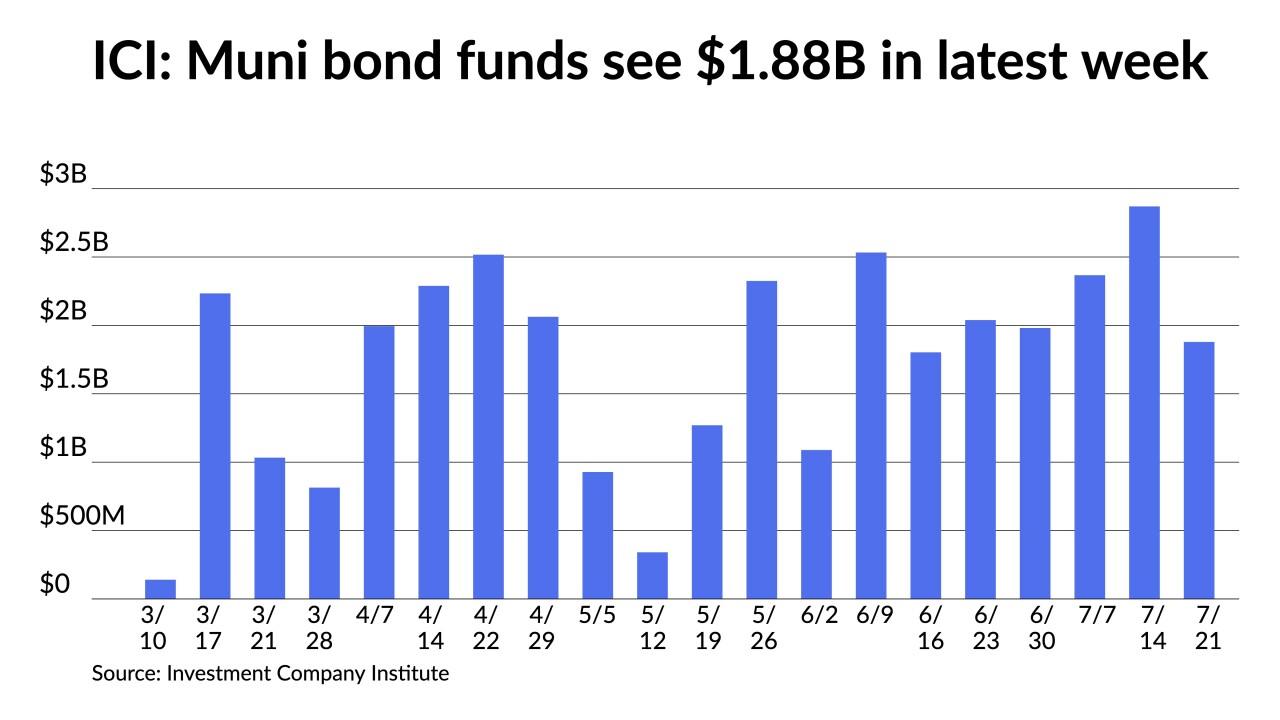

July volume was $31.9 billion keeping the annual pace ahead of last year's record-breaking total. Issuance still lags demand by a large amount — $60 billion by many accounts for August alone — as redemptions coupon payments pile up.

July 30 -

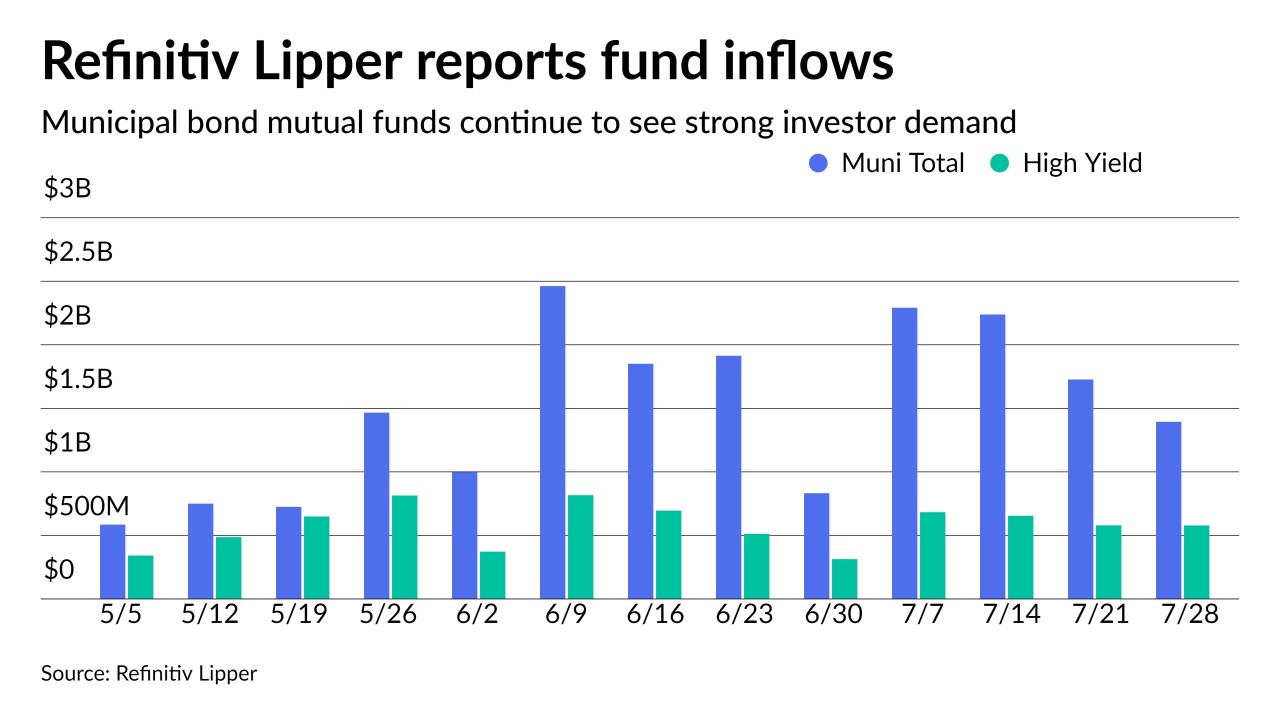

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

July 29 -

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

July 28 -

The economy continues to recover, with durable goods orders and consumer confidence suggesting strength, but concerns about the Delta variant of COVID-19 and continued supply-chain problems cloud the future outlook.

July 27 -

With municipal yields at exceedingly low absolute levels, the spread tightening between credits also continues.

July 26 -

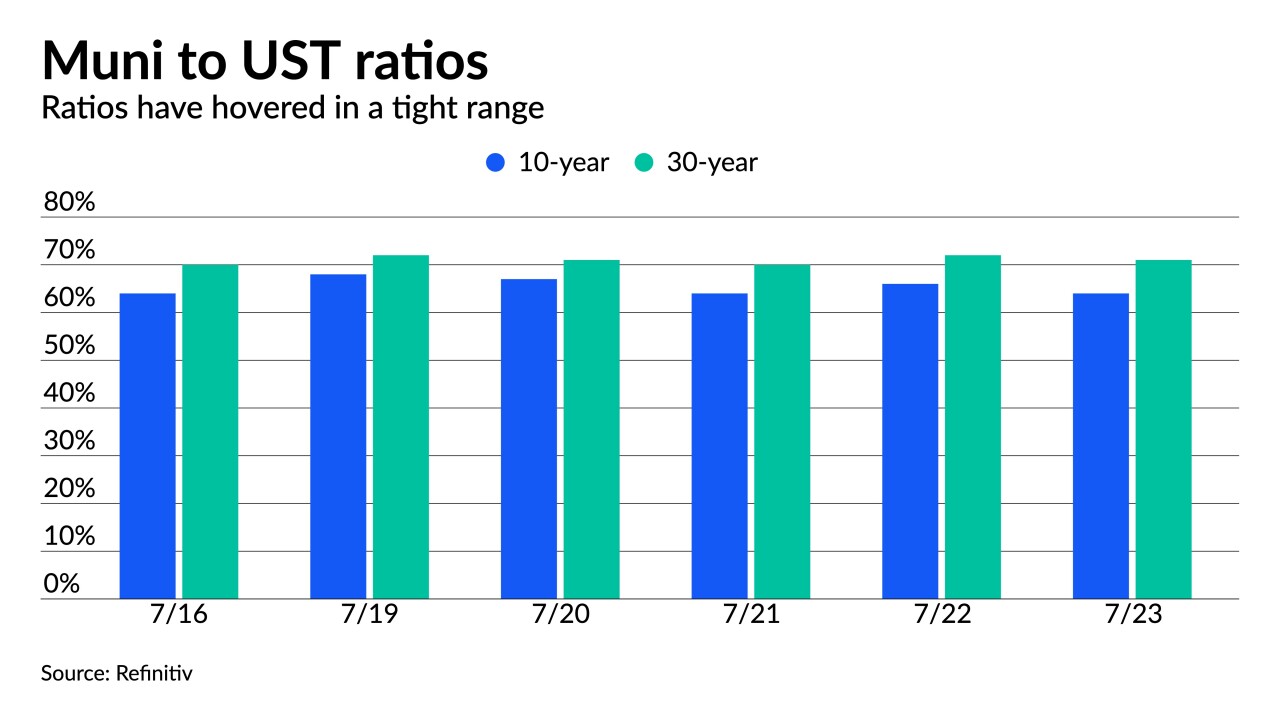

The last week of July marks a lighter calendar while August redemptions are huge compared to the expected supply. Investors need to get in line and likely accept lower yields and continued historically low ratios.

July 23