-

Outflows continue with the Investment Company Institute reporting $5.371 billion pulled from muni bond mutual funds in the week ending April 27. Exchange-traded funds saw inflows at $1 billion.

May 4 -

The municipal market was marked by some skittishness among investors on Tuesday as a new month gets underway.

May 3 -

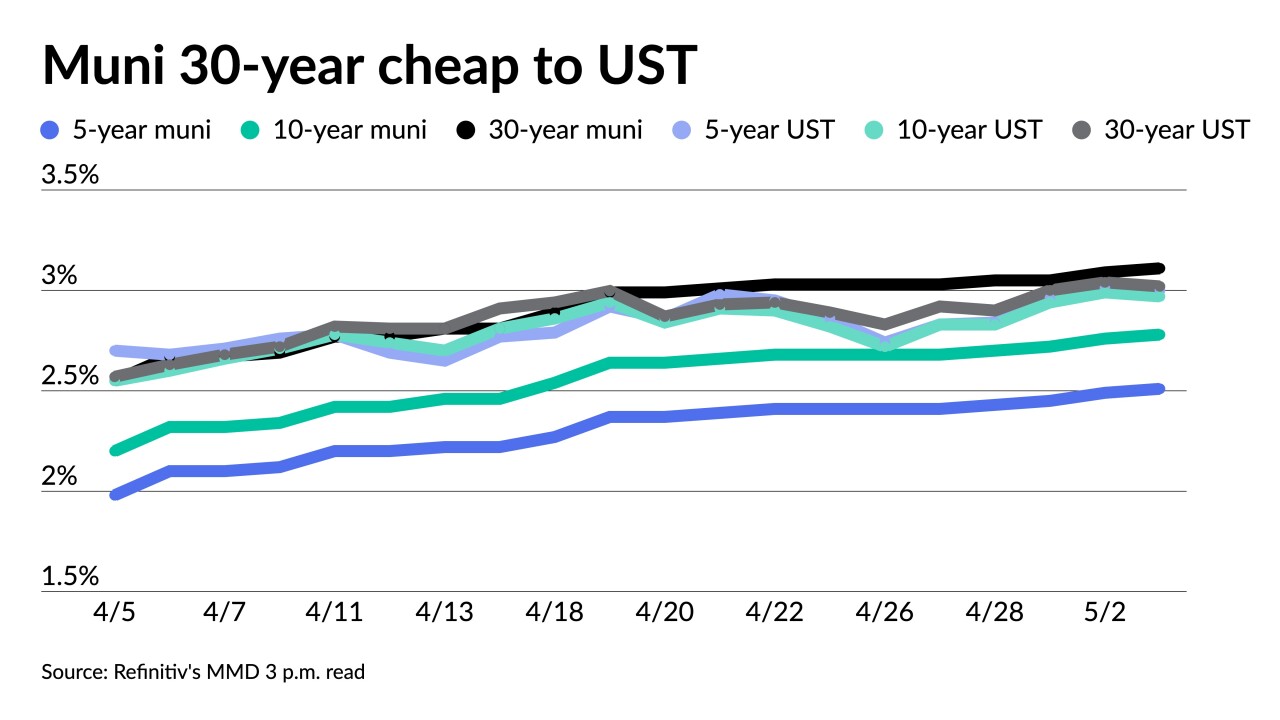

Municipal returns in April were deeply negative, bringing the year-to-date figure to near 9% losses, the largest posted on the Bloomberg Muni Index since its inception in the 1980s.

May 2 -

Illinois expects to sell about $1 billion of new-money general obligation debt but the deal could grow if market conditions permit savings on a refunding piece.

May 2 -

Investors will be greeted Monday with a steep drop in volume, with the new-issue calendar estimated at $4.583 billion — less than half of this week's supply.

April 29 -

Total April volume was $34.329 billion in 729 deals versus $37.105 billion in 1,124 issues a year earlier.

April 29 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.875 billion of outflows, down from $3.548 billion of outflows in the previous week.

April 28 -

Several firms' ability to underwrite municipal bond issues in Texas is under review.

April 28 -

In the week ending April 13, investors pulled $5.526 billion from the funds, down from $7.227 billion of outflows in the previous week, ICI reported.

April 27 -

The city's share of American Relief Plan Act funds eased fiscal pressures and provides runway for the city to work on a pension funding fix.

April 27