-

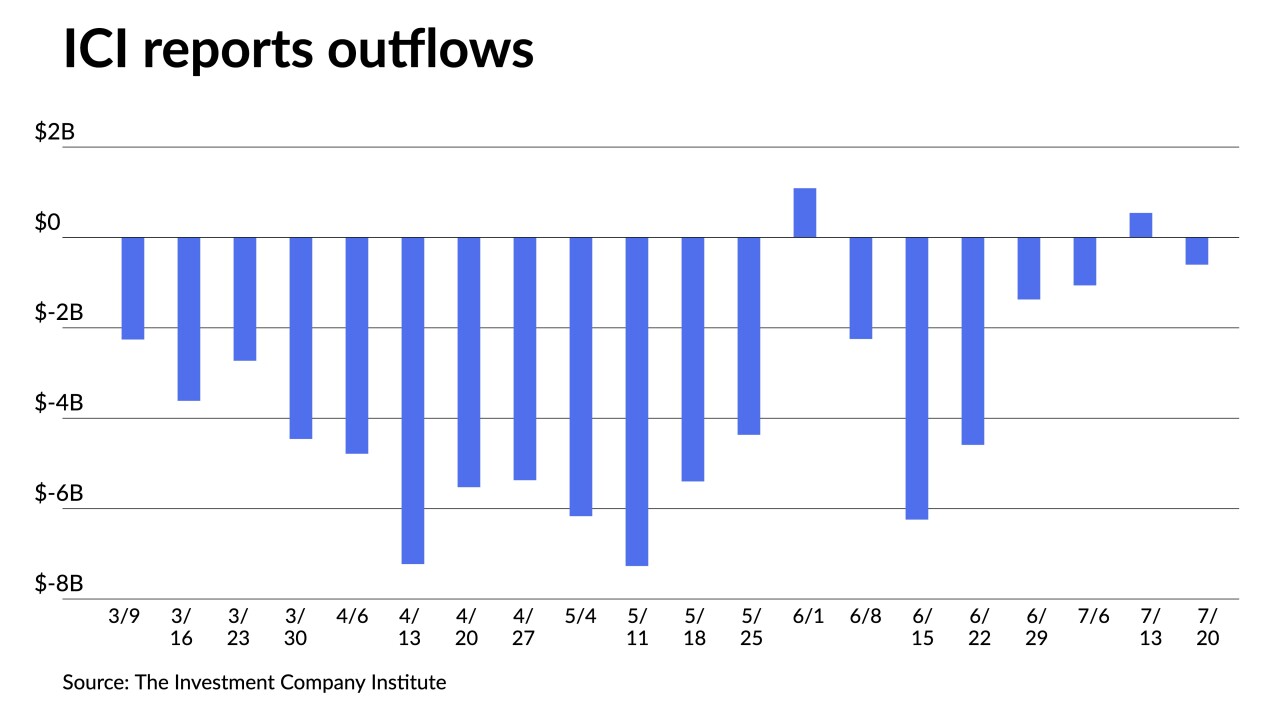

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

Since 2011, the city has issued about $5.6 billion of debt, with the most issuance occurring in 2021 when it sold $785 million.

August 3 -

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

Summer redemption season starts winding down; Net negative supply stands at $18.777 while 30-day visible is at $12-plus billion.

August 1 -

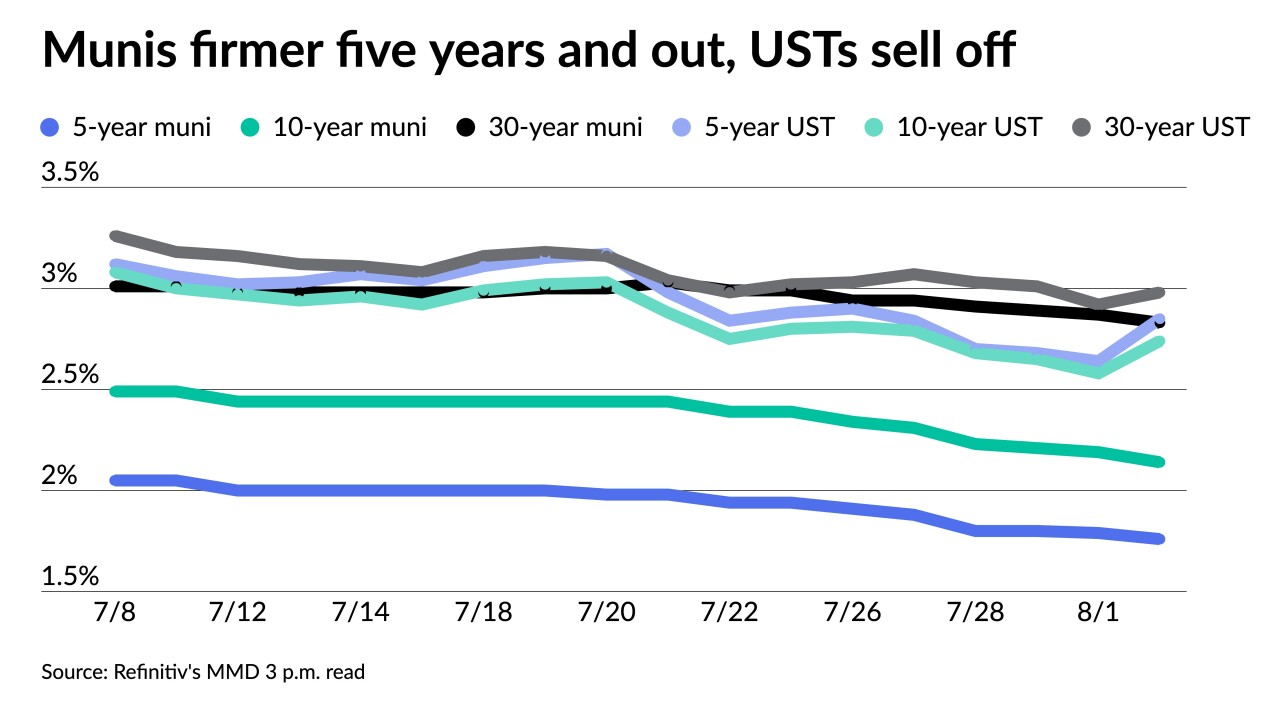

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

The deal is the latest in a series of credit offerings the city is using to incentivize and grow the local charter school industry for the future.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

July 27