-

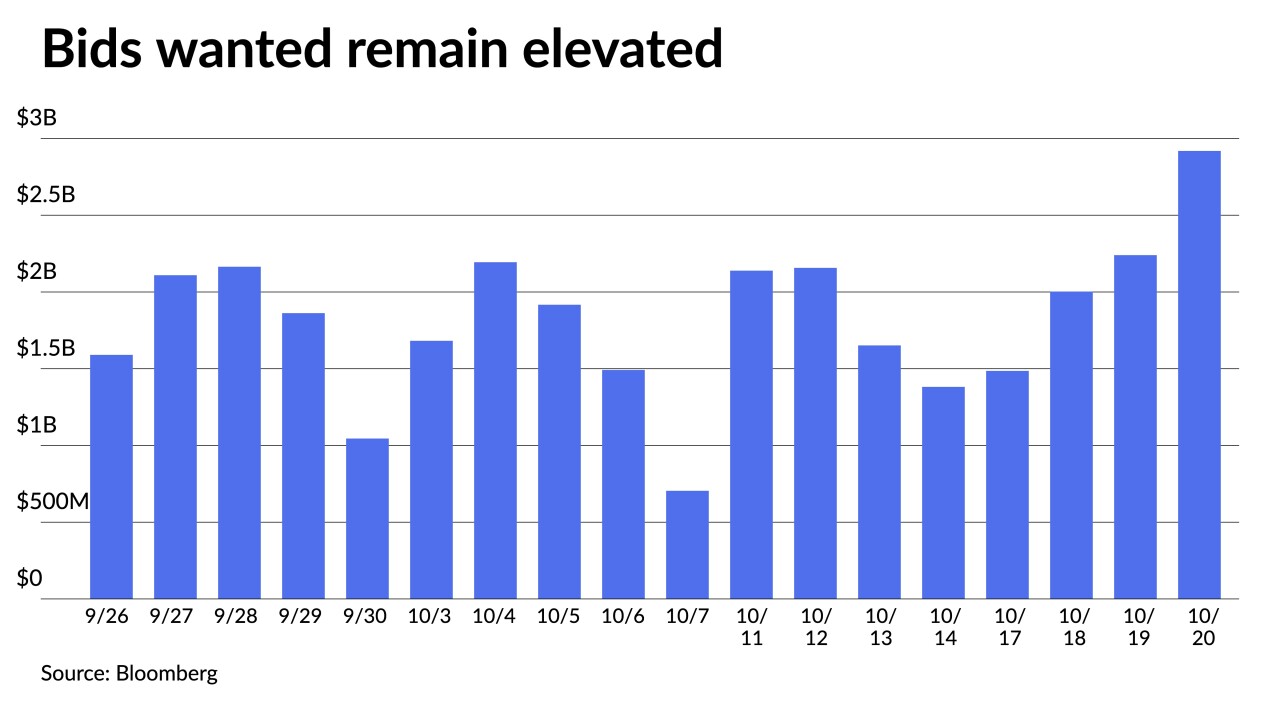

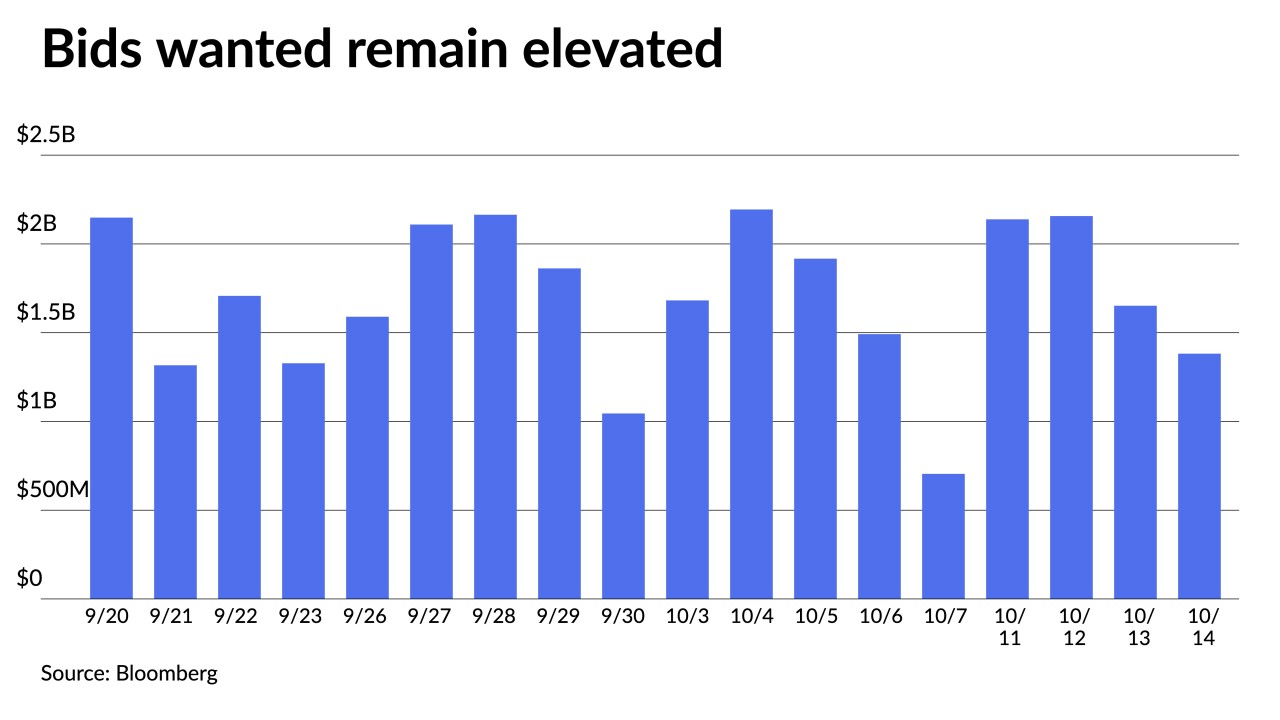

Selling pressure was on the rise again this week. Thursday's $2.919 billion of bonds out for the bid was only surpassed on March 19, 2020, when they hit $4.115 billion. A larger calendar closes out October.

October 21 -

Corporate CUSIPs can reach a different, broader set of investors than even taxable munis and offer more issuing flexibility for well-known universities.

October 21 -

The sale will fund improvements and repairs to public parks, waterfronts, and roads across the double-A-plus rated city.

October 21 -

"The curve slope has undergone a massive flattening this year and recent trends suggest demand pockets are developing in specific ranges," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

October 20 -

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

CommonSpirit Health priced more than $1 billion of debt on schedule Tuesday after disclosing a ransomware attack that has impacted some IT operations.

October 19 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

Volume rebounds eightfold this week with a new-issue calendar of $8.5 billion, including several billion-dollar deals.

October 17 -

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

The nation's largest not-for-profit health system returns to the market with a mix of new money and refunding debt offering tax-exempts and taxables.

October 14