-

Apollo will make an equity and credit investment that will significantly increase SWS’s underwriting capacity for municipal and corporate debt, as well as equity offerings, the firms said.

April 13 -

“The firm was founded on the principle that there should be a high performing investment banking firm wholly owned by women and minorities," says president and CEO Suzanne Shank.

February 1 -

About 84% of minority- and women-owned business enterprises still do not have access to city government spending, according to the latest report.

October 18 -

Goldman Sachs Asset Management, BlackRock, Lord Abbett, Morgan Stanley Investment Management and Vanguard have partnered with Loop Capital and Siebert Williams Shank to send a survey to issuers on racial equity and inclusion.

September 27 -

SWS Capital Management, which manages the Clear Vision Impact Fund, has hired a Detroit-based analyst/investor.

July 21 -

The New Jersey Educational Facilities Authority and the Ivy League university named Ramirez Asset Management, in their first collaboration with an MWBE firm.

July 19 -

AmeriVet Securities appointed Mercedes Elias and Michael Naidrich as Co-CEOs.

May 25 -

Nearly 40% of the fees it pays for bond sales go to women-owned, minority-owned and service-disabled veteran-owned investment banks.

April 16 -

The NYC comptroller will hold six webinars as part of the Minority- and Women-Owned Business Enterprises University series as Siebert Williams Shank's affiliated Clear Vision Impact Fund announced it has received $100 million in capital commitments from big business.

March 15 -

The philanthropic arm of Siebert Williams Shank & Co. announced donations to support Howard University and Spelman College.

February 3 -

Michael Roth, managing partner at Next Street, talks with Chip Barnett about how Black and Brown businesses are doing during the coronavirus pandemic. He looks at what our industry can do to help, from capital delivery to investment; beyond the usual solutions so small businesses and entrepreneurs in communities of color can succeed in an inclusive economy. (22 minutes) For more on this topic, see: Arizent's 'Access Denied' podcast series.

November 3 -

Thirty-four more S&P 100 companies will publicly disclose the composition of their workforce by race, ethnicity and gender, NYC Comptroller Scott Stringer said Monday.

September 28 -

Investment banker Suzanne Shank and professor Michael Barr to serve on its Board of Trustees.

September 21 -

The minority and woman-owned Siebert Williams Shank bolsters its Texas business profile with the hiring of Austin school district chief financial officer Nicole Conley.

August 25 -

The fund has a target size of $250 million and will target minority- and women-owned business enterprises to maximize social impact.

August 13 -

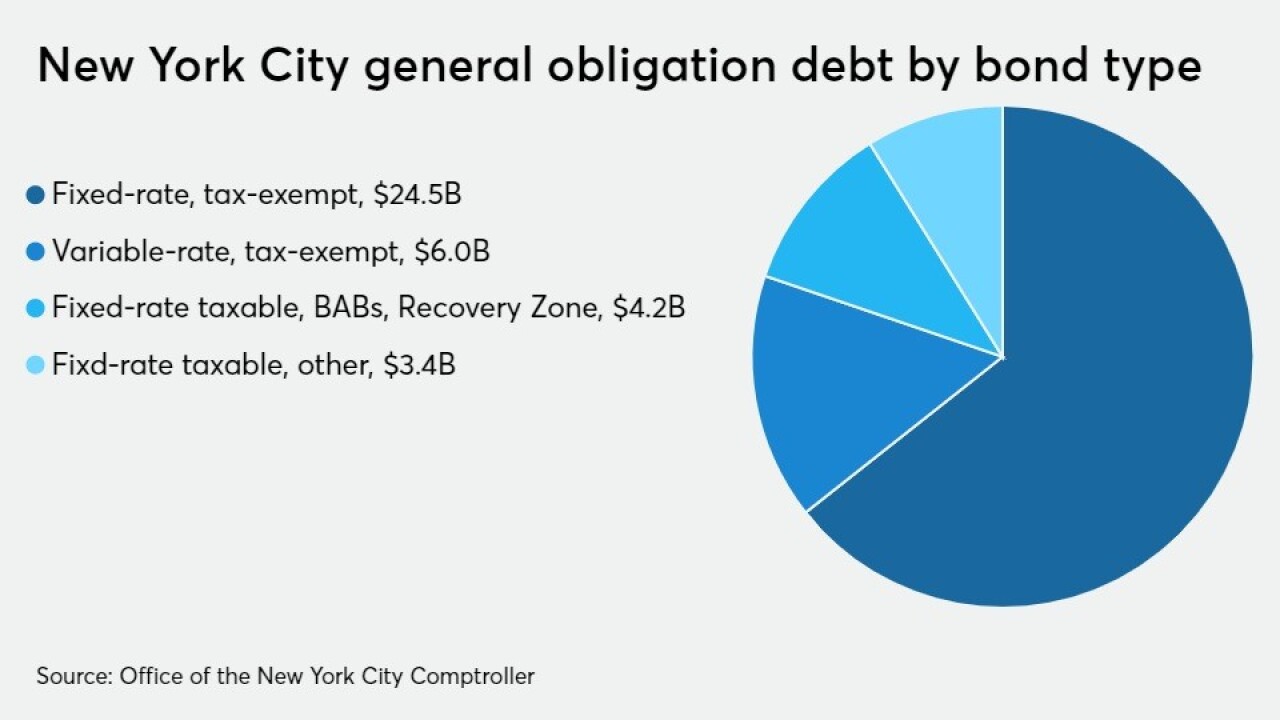

Minority and women-owned business enterprises will now comprise 33% of city GO bond and Transitional Finance Authority book-runners and 40% for New York Water.

August 10 -

The order also creates a chief diversity officer in all city agencies to help with the efforts.

July 28 -

Major deals that produced record savings have enhanced the firm's credentials among municipal bond senior managers in Texas.

July 27 -

Many minority and women-owned businesses say they can't make it through the next six months without financial help.

July 13 -

Getting crisis leadership right is vital to the well-being of employees, customers, and ultimately the business itself.

June 4