-

When it comes to sectors, Miller said he likes charter schools, healthcare, land-secured debt and some industrial revenue bond positions.

January 12 -

Nuveen's marquee fund has seen the worst performance among the largest high-yield funds so far this year.

December 11 -

-

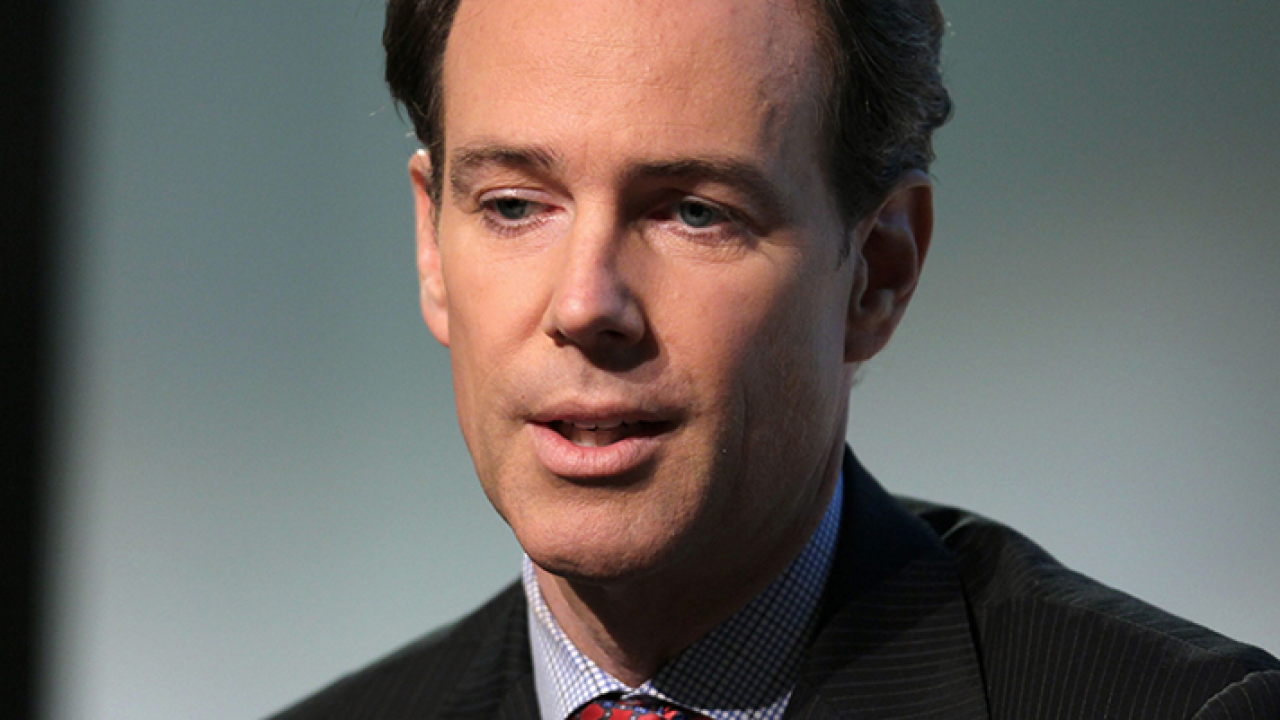

The long-time high-yield muni manager left Nuveen in April when the firm settled a contentious lawsuit with Preston Hollow.

September 22 -

Ocean Capital's next move is to attemot to have its elected directors seated on the funds' board of directors.

September 21 -

Loop Capital Markets CEO Jim Reynolds, Jr. said he would gladly pay a bit more for a muni bond that tackled gang violence in Chicago during a debate on ESG factors among market veterans at The Bond Buyer's infrastructure conference this week.

September 15 -

With around 30% of bonds trading near the de minimis threshold, a new study takes a deep dive into how the rule drives illiquidity as mutual funds dump paper that's approaching the threshold.

September 7 -

-

Brightline's luxury train in Florida accounts for half of the Nuveen High Yield Municipal Bond Fund's top 10 positions.

May 18 -

A John Miller-less speculative bond market may mean more diversification and price transparency, say some investors.

April 14