-

Twelve banks agreed to stricter antitrust oversight under the $250 million accord, said Pennsylvania Treasurer Joe Torsella.

December 20 -

John Williams said Friday that the Federal Reserve's three interest rate cuts this year have bolstered the housing market and consumer spending.

December 13 -

California, Massachusetts and New York came closest to utilizing their volume caps for PABs in 2018, according to a recent survey by the Council of Development Finance Agencies.

November 7 -

Consumer confidence remained high even after a dip this month, and a rate cut by the Federal Reserve could send it higher.

October 29 -

Richard "Ad" Eichner was known as a pioneer for his work in multifamily housing and tax-exempt charter school bonds.

October 25 -

S&P Global reports state HFAs are maintaining high ratings this year, “buoyed by demand for affordable housing and mortgages, low interest rates, relatively low unemployment, increasing wages, and the overall strong domestic economy.”

October 24 -

The U.S. Department of Housing and Urban Development said Thursday it is expanding the Rental Assistance Demonstration program to Section 202 PRAC units that house senior citizens.

September 6 -

HFAs have been quite active in the secondary and are now originating more mortgages to retain on their balance sheets, according to Florence Zeman, associate managing director, Moody's Investors Service. Down payment assistance is a common feature of these mortgages. Spread is all important. Delinquencies have been manageable. Learn about RAD. John Hallacy hosts.

September 5 -

China's recently announced suspension of U.S. agricultural imports escalated trade-related risks to U.S. agriculture, said Fitch Ratings.

August 30 -

Nearly $300 million of municipal debt sold 12 years ago to expand Central New York's Destiny USA shopping mall were dropped to junk-level Ba2 by Moody's Investors Service.

June 17 -

About half of the multifamily housing units built nationally that use the federal 4% Low Income Housing Tax Credit are financed with tax-exempt PABs.

June 5 -

Softness in consumer spending may be ending, which would increase gross domestic product.

May 28 -

The bond package includes $50 million for affordable housing in a first for the Ohio capital.

May 9 -

The last day of the month brings a host of economic indicators, which showed much good news for housing and labor, strong consumer confidence, but mostly softer manufacturing conditions.

April 30 -

The Stockton City Council voted to issue multifamily housing revenue bonds.

April 3 -

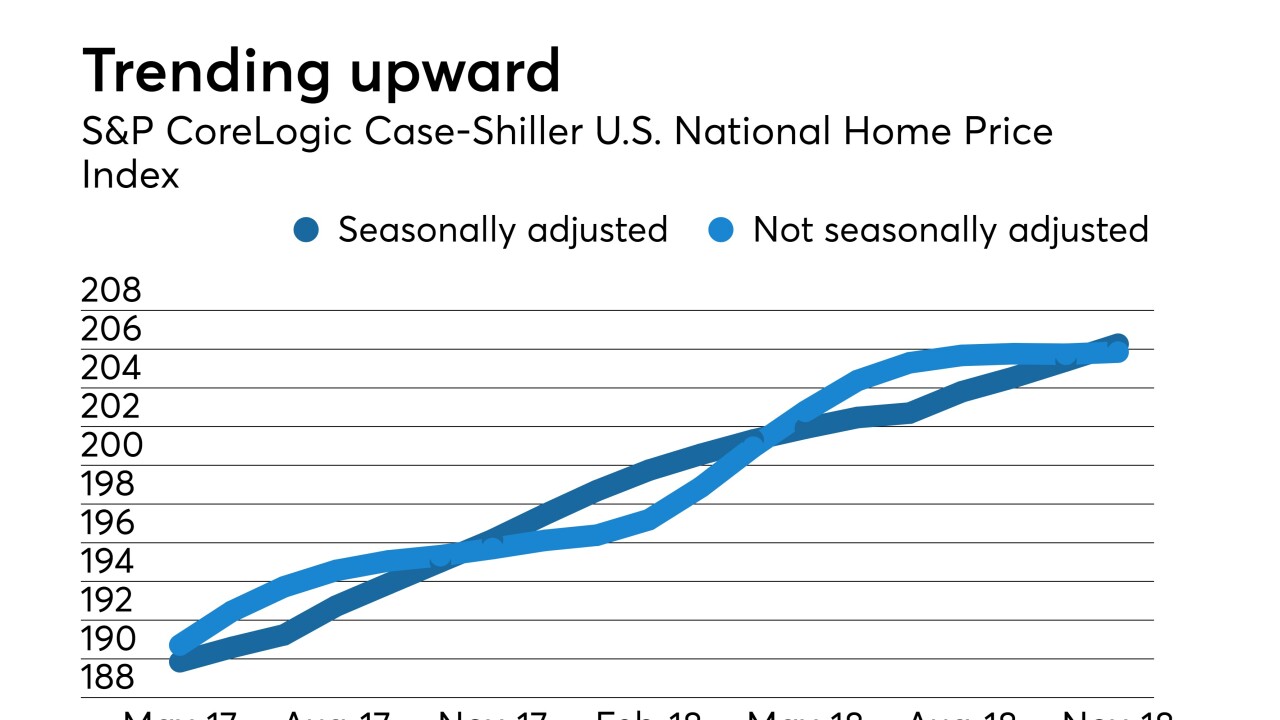

Home prices in 20 U.S. cities slowed in November for an eighth consecutive month, extending the longest streak since 2014, as affordability issues remain.

January 29 -

Until a clarification is issued, bond lawyers are requiring that the rental units be open to all who qualify without any preferences for special groups such as veterans.

January 28 -

California's Governor and San Diego's mayor launch separate efforts to combat housing crisis

January 16 -

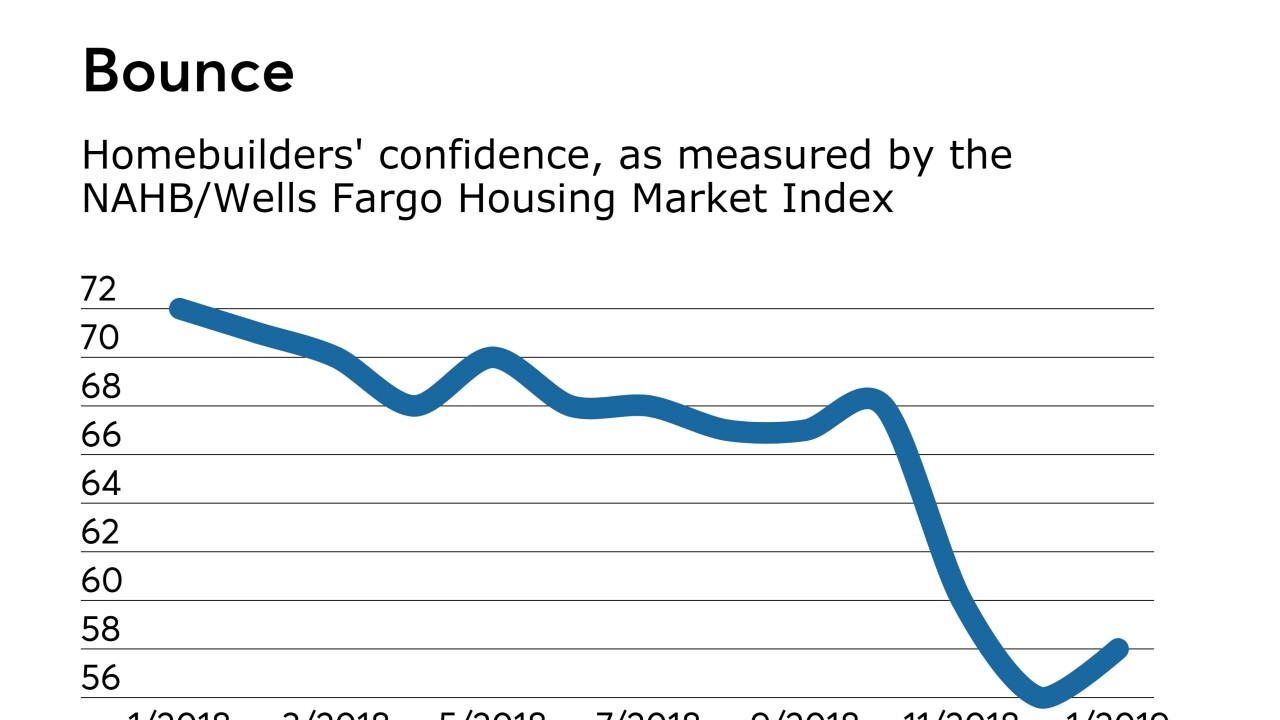

Builders’ confidence in the market for new single-family homes grew as the National Association of Home Builders' housing market index rebounded to 58 in January from 56 in December.

January 16 -

The Sacramento Housing and Redevelopment Agency plans to issue up to $25 million in tax-exempt mortgage revenue bonds to finance the renovation of 74 low-income housing units in south Sacramento. The financing does not include the addition of any new affordable housing units.

January 14