-

The Treasury Department issued a "systemic risk exception" allowing it to cover uninsured deposits at SVB and Signature Bank, which New York State closed on Sunday.

March 12 -

The amount of money parked at a major Federal Reserve facility climbed to yet another all-time high, surpassing the $2 trillion milestone for the first time, as investors struggled to find places to invest their cash in the short term.

May 24 -

Another swing in U.S. Treasury market pushes muni to UST ratios out long even cheaper.

April 25 -

The Treasury’s latest tax collection may preview how the shrinking of the Federal Reserve’s $9 trillion balance sheet, or quantitative tightening, will unfold for the markets and global liquidity.

April 25 -

Properly designed public banks would be safer than private banks while promoting economic growth.

April 22 ArentFox

ArentFox -

The MSRB has issued a warning that with the rise in interest rates in recent months, bonds trading at a discount may be less liquid than those trading at par.

March 18 -

With volatility and illiquidity realities for the foreseeable future, insights into new-issue and secondary pricing are critical.

March 18 Lumesis

Lumesis -

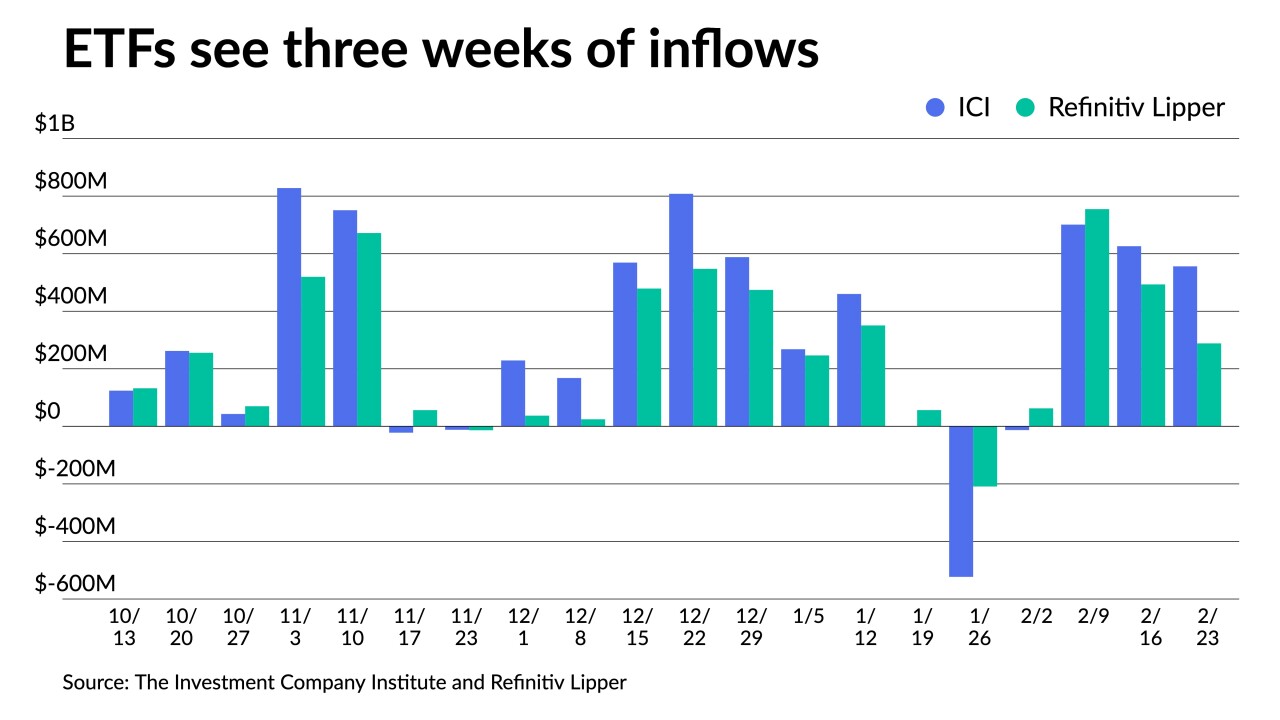

ETFs pulled in just more than $2 billion in February while muni mutual funds saw $8.5 billion of outflows.

March 4 -

A HilltopSecurities survey found skilled nursing and senior living as the sectors they were most concerned about for 2022.

December 30 -

The Municipal Securities Rulemaking Board’s new report on the use of internal and external liquidity in the municipal bond market shows that for transactions under $100,000 external liquidity has steadily increased since 2011.

November 18 -

A proposal from the Ohio Treasury would provide a new enhancement for state-purchased public university debt and offer a backstop for hospitals' VRDOs.

October 13 -

Congress should pass legislation that would allow Home Loan banks to backstop deposits by local governments at commercial banks and lower the cost of bond financing, two mayors argue.

September 16 City of Miami

City of Miami -

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

June 2 -

The congressional letter emphasizes that Congress wants the Fed to expand its support for the municipal bond market beyond the scope of the Municipal Liquidity Facility.

May 4 -

Chris Brigati, managing director of Advisors Asset Management talks about approaching the market with strategies in mind, but adapting to the realities of today. He shares concerns over liquidity and the challenges for cautious investors. The session was recorded two weeks ago. John Hallacy hosts.

March 25 -

The central bank said its program to support money market mutual funds will also serve as a backstop for state and local governments.

March 20 -

Career veterans call fallout from COVID-19 concerns on the municipal market worse than that of 9/11 and the 2008 financial crisis combined.

March 12 -

Municipals will join corporates, Treasuries, agencies and certificates of deposit in the suite of products.

February 20 -

Improved liquidity, spreads, and flows prompt some first-quarter adjustments.

February 5 -

Strategists adjust their municipal holdings on signs the worst may be over after a difficult 2018.

December 12