-

Texas Sen. John Cornyn urged counties to continue to lobby for a bill that would allow ARPA funds to be used for transportation infrastructure and disaster relief.

February 14 -

Four Texas defaults reflect a sector that accounts for half of this year's municipal bond defaults, according to Municipal Market Analytics.

February 14 -

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

The SEC terminated its latest proceedings against the city after an independent consultant found the city was in "substantial compliance" with a 2014 judgment.

February 11 -

House fails to approve budget amendment allowing payment to bondholders.

February 11 -

Refinitiv Lipper reported the first inflows into municipal bond mutual funds at $216 million after three weeks of large outflows while high-yield saw small outflows. Exchange-traded funds reported $755 million of inflows.

February 10 -

The board said a stay would inflict serious harm on Puerto Rico by plunging it into “financial chaos,” send the bankruptcy process “back to square one,” and would “needlessly delay the commonwealth’s economic recovery.”

February 10 -

The feds said they expect states to partner with private entities to develop and operate the electric vehicle charging networks.

February 10 -

An unfortunate custom in municipal finance is to discount every cash flow with the same rate, namely by the yield of the refunding issue. This underestimates the worth of nearby savings, and overestimates that of savings in the distant future.

February 10 Andrew Kalotay Associates Inc.

Andrew Kalotay Associates Inc. -

Markets were somewhat comforted by Federal Reserve Bank of Atlanta President Raphael Bostic’s comments suggesting the Fed will not be as aggressive as the markets suspect.

February 9 -

Gross savings from the transaction is expected to be $378 million, or about $11 million a year, which would result in around $250 million in net present value debt service savings.

February 9 -

The unrest potentially has short- and long-term impacts on the local government and its finances, analysts say.

February 9 -

It's the latest salvo in a growing controversy over the Federal Highway Administration's December memo discouraging states from building new highway capacity.

February 9 -

The state of Washington sold $743 million of general obligation bonds in the competitive market at similar spreads to its November sale while some issuers have moved to the day-to-day calendar.

February 8 -

Judge Laura Taylor Swain's action allows LUMA Energy to continue to operate.

February 8 -

Mamtek US's long-running Chapter 7 bankruptcy is expected to pay out $1.6 million to the trustee for the $39 million defaulted Moberly, Missouri, bond issue.

February 8 -

Many Infrastructure Investment and Jobs Act funds can't flow without a FY22 budget

February 8 -

Washington will bring $742 million of general obligation bonds in competitive sales Tuesday, providing guidance for triple-A benchmark yields.

February 7 -

The school board, caught between budget pressure and angry parents, could vote Tuesday to close or merge 16 schools in the California school district amid waning enrollment.

February 7 -

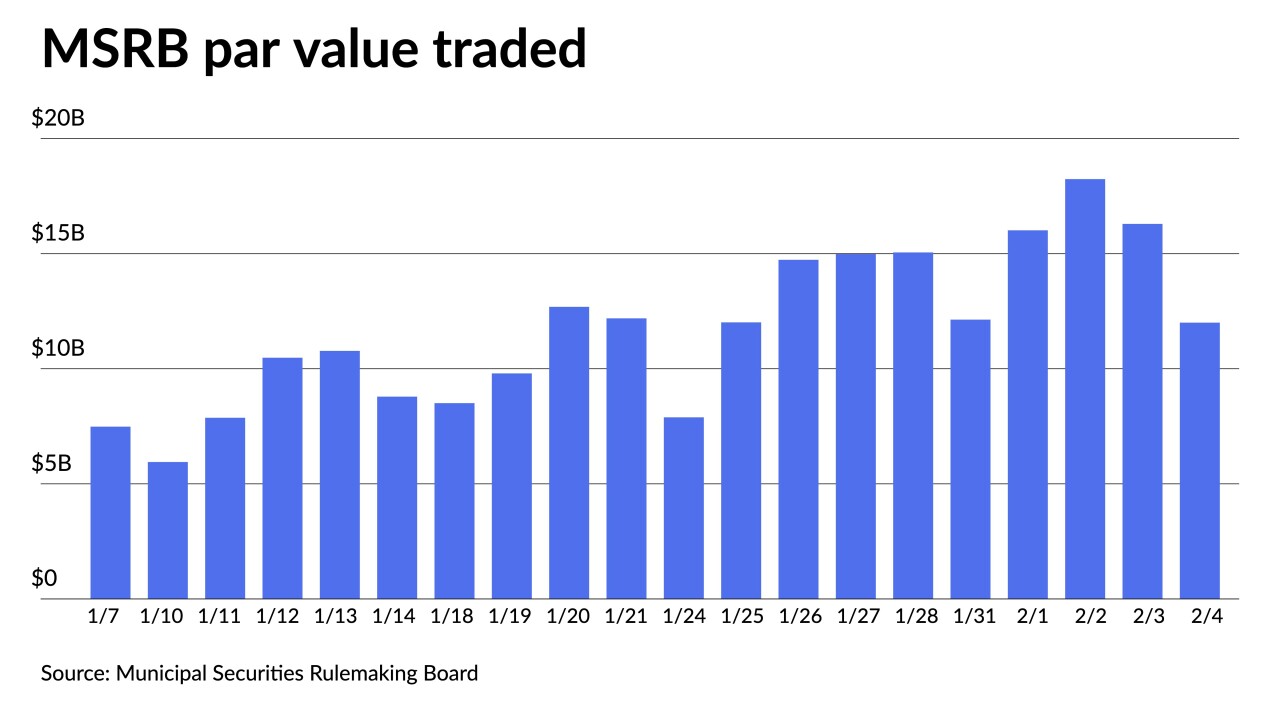

Municipal to UST ratios hit highs earlier in the week, creating entry points for buyers to return to the market even as ratios fell on the week. The primary will see a smaller calendar at $5.4 billion.

February 4