-

Caine Mitter & Associates and RBC Capital Markets moved into the top 10, while Piper Sandler & Co. and Kaufman Hall & Associates were bumped to the top 15.

January 8 -

Half of the top 10 issuers were new entrants: the California Community Choice Finance Authority, Main Street Natural Gas, the state of Washington, the Texas Natural Gas Securitization Finance Corp. and Illinois.

January 8 -

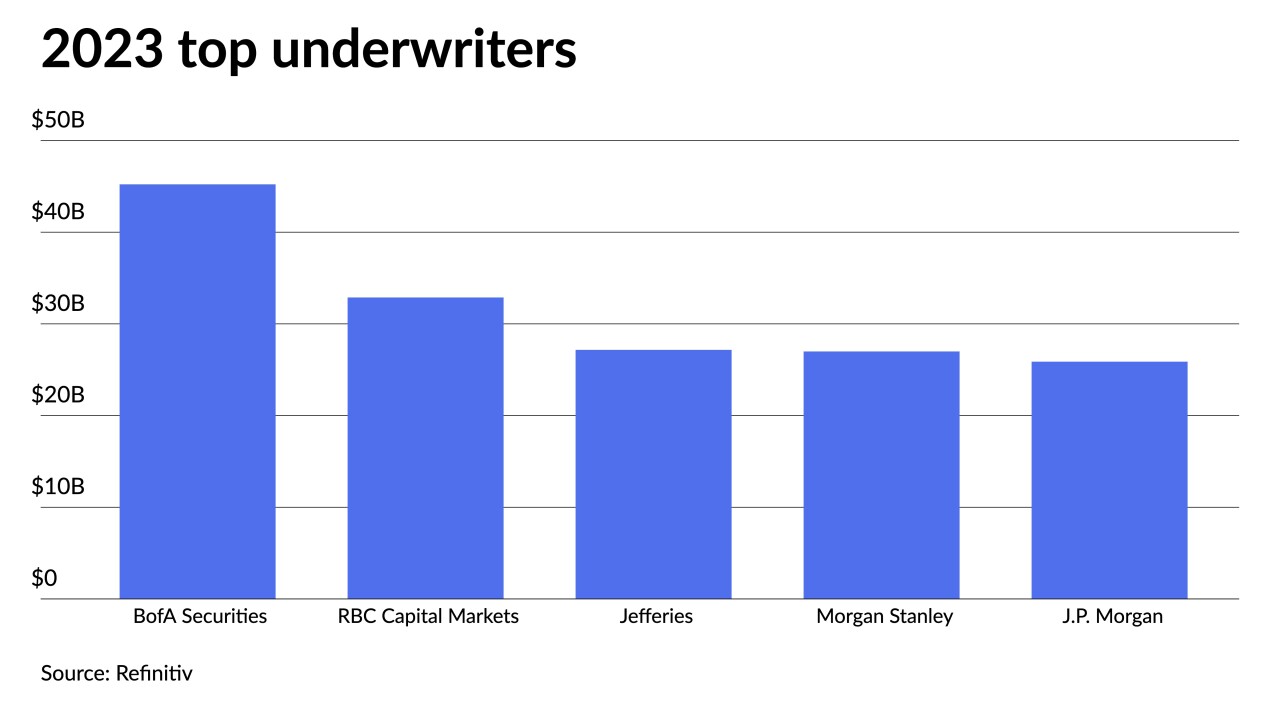

RBC ramped up business to land at second place and Jefferies rose to third while Raymond James entered the top 10, knocking Barclays to 11th. Citi, which exited the business, closed at sixth place.

January 8 -

After this week's sale, the state intends to issue another series of refunding bonds in February in connection with a potential tender offer for taxable GOs and a current refunding of some tax-exempt GOs.

January 8 -

A bill before the state legislature would create a public infrastructure bank, where municipalities could go to finance projects from affordable housing to bridges.

January 7 -

Despite the outperformance this week, and while the asset class had "a stellar December, which rounded out a very solid year," Barclays PLC strategists said the high-grade muni market has become "quite rich."

January 5 -

Judge says the issues can be considered at March's confirmation hearing.

January 5 -

"It's inevitable there will be spending cuts," said Emily Brock, federal liaison for the Government Finance Officers Association.

January 5 -

Without admitting or denying the findings, David Elgart of Sequoia Investments has agreed to a $20,000 fine and an 18-month suspension from association with any FINRA member firm for acting as an unregistered dealer.

January 5 -

"The work done by our agency often focuses on the long-term," said Connecticut State Treasurer Erick Russell.

January 5 -

Labor costs that continue to squeeze operating margins remain the biggest obstacle for the nonprofit healthcare sector.

January 5 -

Moody's also affirmed the A1 rating on the authority's $3.2 billion of general revenue bonds and the A2 rating on the $2.5 billion of general revenue junior indebtedness obligations.

January 5 -

Bonds used to buy eight senior living properties in Michigan and Ohio are likely to default within six months, S&P Global Ratings said.

January 4 -

The muni market enters this year from a relative position of strength, said Jeff Lipton, managing director and head of municipal research and strategy at Oppenheimer.

January 4 -

The Senate Committee on Homeland Security and Governmental Affairs unanimously passed the bill in October.

January 4 -

Blaylock Van is bolstering its overall institutional capabilities and reaffirming its commitment to the muni market, said Leonard Jones, executive director of municipal banking and head of public finance, at the firm.

January 4 -

The Municipal Securities Rulemaking Board is coming under fire from broker-dealer and municipal advisor groups for what those groups see as an opaque process.

January 4 -

Musalem, an economist, is a former executive vice president of the Federal Reserve Bank of New York.

January 4 -

Three districts are under Washington's state fiscal oversight and the largest, Marysville School District, took a multi-notch Moody's bond rating downgrade.

January 4 -

Fitch Ratings said the trajectory of the city's AA rating could depend on how Mayor John Whitmire, who took office this week, resolves the years-long impasse over firefighter pay.

January 4