-

A state judge issued a temporary injunction against enforcement of the Energy Discrimination Elimination Act, which has led to the ban of seven financial firms, including four big municipal bond underwriters, from government contracts.

May 8 -

The deal comes after months of disagreements over ballooning costs for the project, which was first announced in 2018.

May 8 -

April's "poor performance" pushed munis further into negative territory, but "despite the poor start to the year, they may still end the year positive," said Cooper Howard, a fixed-income strategist at Charles Schwab.

May 7 -

The driving force behind the trend is the overall strength of the economy, according to Fitch Ratings' Michael Rinaldi. Revenue sources for municipalities, such as sales and property taxes, are doing very well.

May 7 -

Syncora and GoldenTree Asset Management want an accounting of what happened to PREPA net revenues.

May 7 -

"It'll be very interesting to see when an event happens or the market get sloppy, what the secondary market does," said a sellside panelist at a Bond Buyer market outlook panel in Florida.

May 7 -

Delivery delays for Boeing planes are impacting airports, with Southwest Airlines recently announcing it is pulling out or reducing flights at some facilities.

May 7 -

The rating agency revised the outlook on the state's AA general obligation rating to positive from stable and said there is a one-in-three chance of a future rating upgrade.

May 7 -

"We remain cautious with respect to duration given the uncertain macro and geopolitical environment though optically, yields seem attractive in the current range," said Wells Fargo's Vikram Rai.

May 6 -

This week's deal will fund accelerated pension payments and Rebuild Illinois expenditures. A $250 million piece will be taxable.

May 6 -

In the wake of Citi's and UBS's exit from the municipal industry, other firms are seizing the opportunity to expand with new hires.

May 6 -

A supply surge hits the market as The Bond Buyer 30-day visible bond volume ticks in at $17.67 billion, $10 billion of which will come the first full week of May, just as macroeconomic data moves all markets to rally.

May 3 -

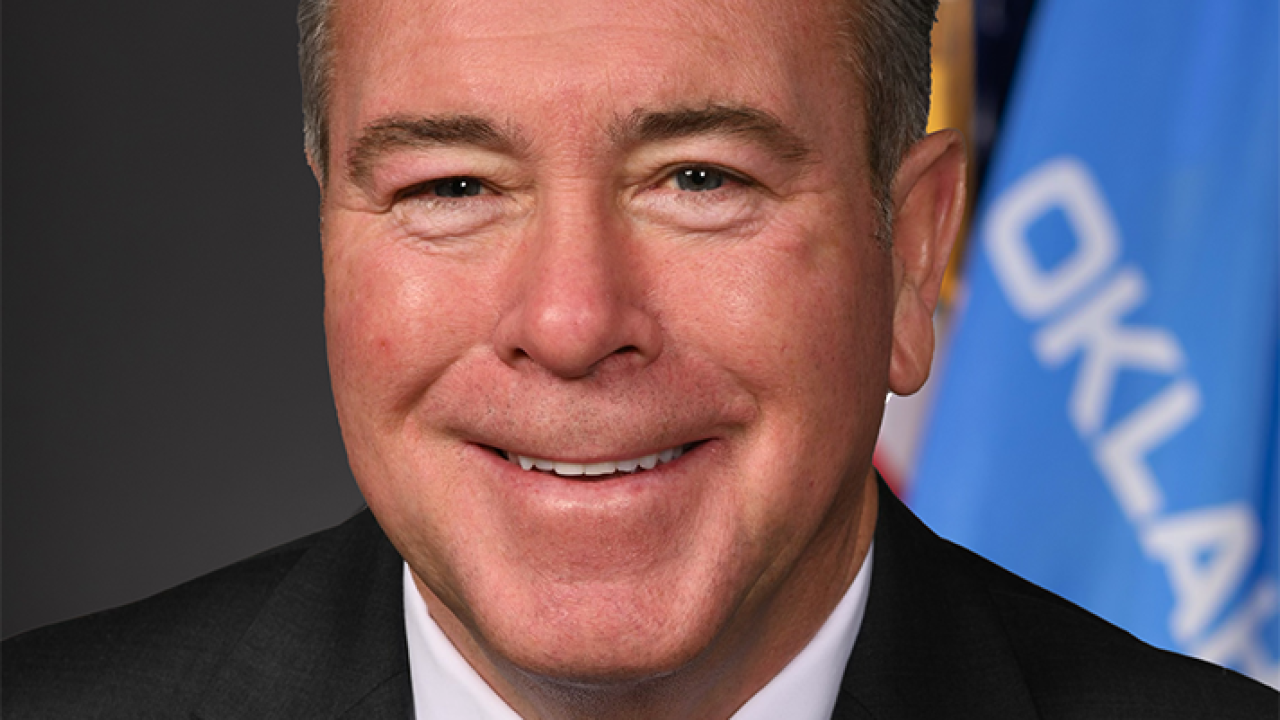

The latest revision of Oklahoma's fossil fuel "boycotter" list added Barclays, which joins three other municipal bond underwriters placed there last year.

May 3 -

The Oversight Board has given the local government until Tuesday to introduce a bill to revoke or amend a law that would reduce the Puerto Rico Electric Power Authority's revenues.

May 3 -

Assured's controlling vote is "important to investors who were reassured to hear that there would be a large sophisticated party with a significant economic interest in the success of the project," the insurer said.

May 3 -

The $380 million request for the zoo to voters in three Portland-area counties is the largest bond measure on the May 21 statewide primary ballot.

May 3 -

The "historical runway" heading into Memorial Day is favorable, rolling into the summer redemption months of June through August, said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 2 -

The Build America Bureau has $100 million in grants available over the next five years for public entities doing pre-development work to structure public private partnerships for transportation and transit-oriented development projects.

May 2 -

The loan, which features a 2.5% interest rate, will finance nearly half of a community building in downtown Mount Vernon, Washington.

May 2 -

An amended bill that would clear the way for the Colorado Educational and Cultural Facilities Authority to issue bonds for its purchase of the Stanley Hotel, which inspired Stephen King's The Shining, advanced out of a Senate committee.

May 2