-

Municipal bond buyers looking for yield need look no further than the OTB's non-rated tax-exempt revenue bond deal that's set to be priced this week.

March 18 -

The state Supreme Court ruled that prevailing wage rules for public projects don't apply to private entities that borrow using tax-exempt conduit bonds.

March 18 -

"While rate volatility returned this week, should the market return to range-bound levels for a protracted period of time, investors might want to add exposure to sectors that provide the most value and have underperformed thus far," Barclays said.

March 15 -

The $650 million settlement will fund back pay for firefighters, who will also get future wage hikes.

March 15 -

"Insurance rationing by the leading insurers is becoming the mechanism by which climate risk is starting to impact municipal issuers," said Triet Nguyen, vice president of strategic data operations at DPC Data.

March 15 -

Fitch analysts cited improved financial metrics, a full recovery on enplanements and great clarity on its capital program.

March 15 -

"My 'One Philly Budget' invests $2 billion over five years in new operating and capital dollars focusing on five pillars — public safety, clean and green, economic opportunity, housing and education," said Mayor Cherelle Parker, the city's first woman mayor.

March 15 -

Gov. Tina Kotek sent a letter to transportation commissioners asking them to scrap a tolling plan for Portland-area highways that was seven years in the making.

March 15 -

Inflows continued for the third consecutive week as LSEG Lipper report fund inflows of $295.5 million for the week ending Wednesday with high-yield hitting the 10th consecutive week of positive flows.

March 14 -

Under a settlement agreement, the Texas Education Agency assigned two conservators to oversee IDEA Public Schools, which was the target of a probe into alleged financial and operational improprieties.

March 14 -

In an April 2 special election, voters in Jackson County, home of Kansas City, will decide whether to impose a sales tax to fund a new baseball ballpark.

March 14 -

BofA Securities is the latest firm to scoop up former employees from Citi, which decided to shutter its muni division late last year.

March 14 -

Separately, Fitch raised Orlando's $159.87 million of Series 2017A senior tourist development tax revenue bonds, 6th-cent contract payments, to A from BBB.

March 14 -

While the SEC's cybersecurity rule does not apply to municipal issuers, there are a few points discussed in the Adopting Release that may be useful for municipal market participants.

March 14

-

Federal officials are pushing for reauthorization while cities tout their planning.

March 14 -

Since Gov. Ron DeSantis took office in 2019, Florida has paid down $5.3 billion of state debt, or about 25% of the Sunshine State's total debt.

March 14 -

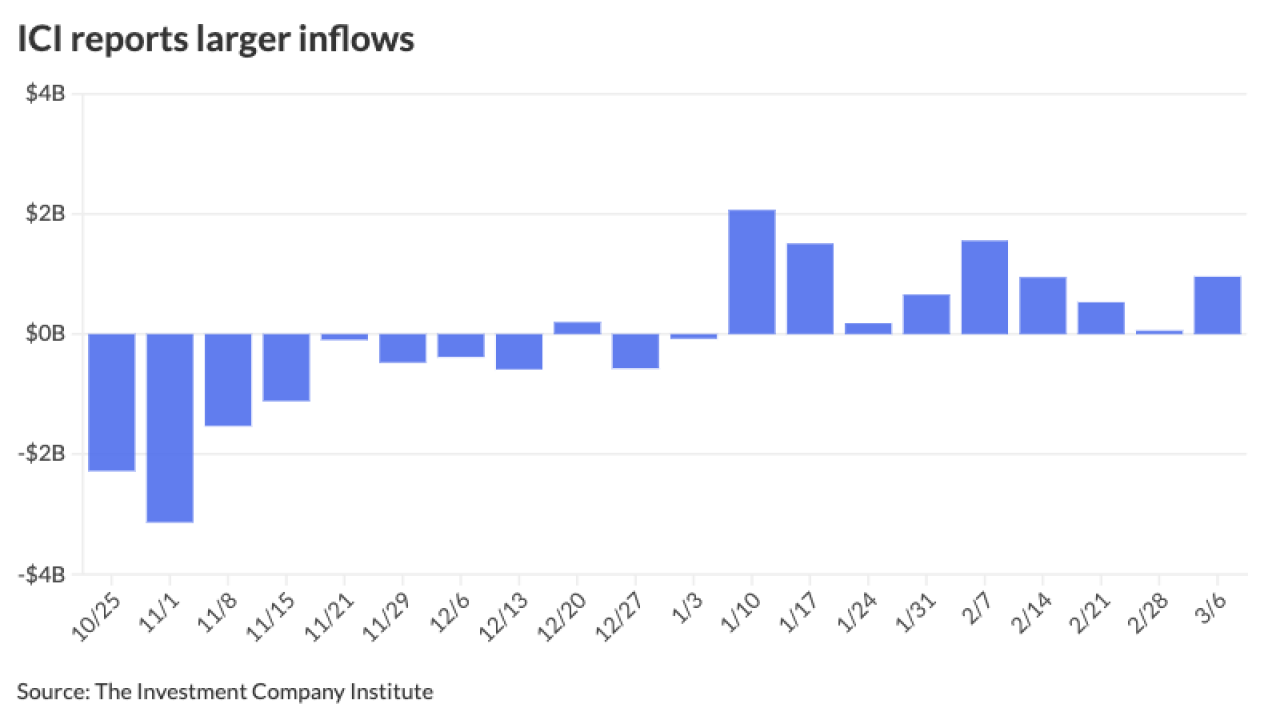

The Investment Company Institute reported larger inflows into municipal bond mutual funds for the week ending March 6, with investors adding $956 million to funds following $57 million the week prior.

March 13 -

The state's transportation department plans to sell $200 million of highway fund revenue bonds this summer for its Eisenhower Legacy Transportation Program.

March 13 -

The American High-Speed Rail Act has seen "some initial interest from Republican lawmakers – I'm working hard to get them on board too," said bill sponsor Rep. Seth Moulton, D-Mass.

March 13 -

Narens' hiring complements Stifel's public finance practice and the types of deals the firm is doing, said Betsy Kiehn, managing director and head of Stifel's Municipal Capital Markets Group.

March 13