-

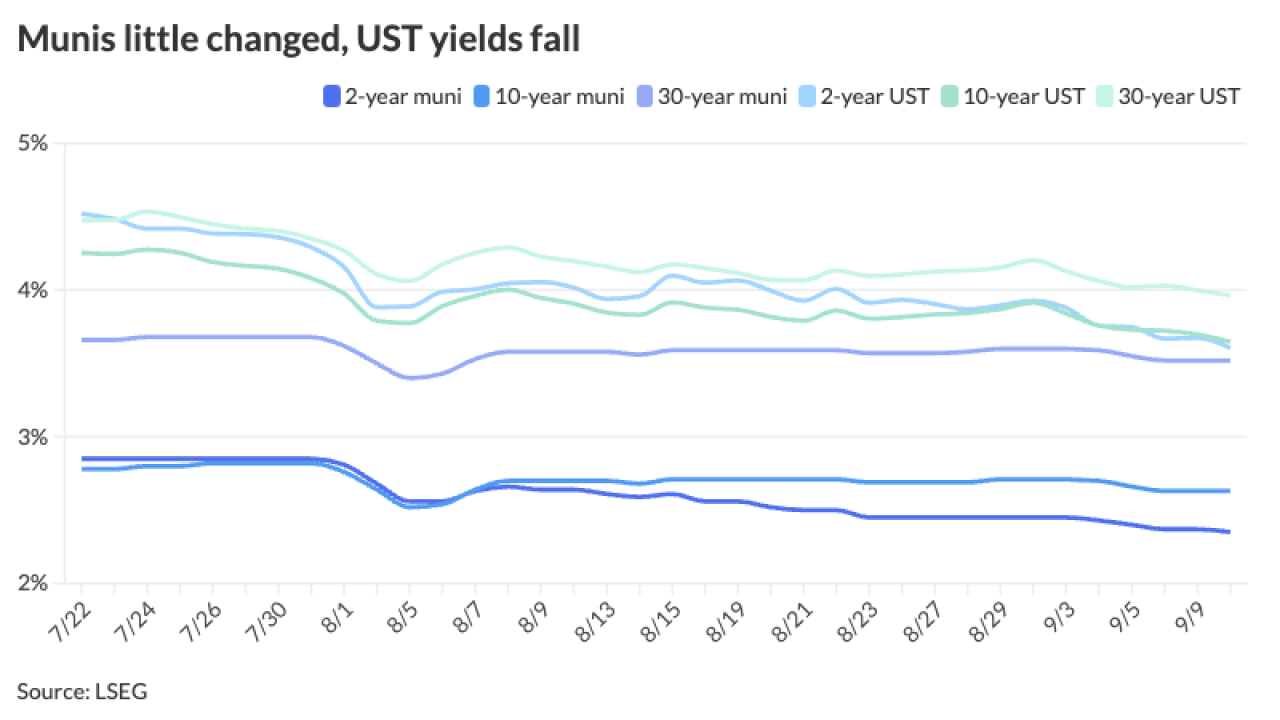

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Houston-based Texas Children's Hospital plans to sell about $222 million of tax-exempt, fixed-rate revenue bonds this week.

September 10 -

Full Moon Capital will focus on mid- and smaller-sized specialty credits that are looking to grow.

September 10 -

Fitch also upgraded the city's Georgia Municipal Association certificates of participation (city of Atlanta public safety projects) to AA-plus from AA.

September 10 -

"Investment banking has a variety of personalities working in it, depending on where you are," Rice said. "The M&A business, the trading business, private equity — all of those things fall into investment banking — but public finance is the one area where you're doing things that help provide for the public good."

September 10 -

"Despite the underperformance of tax-exempt yields last week, we could see some more pressure on both spreads and ratios due to the heavy supply calendar," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

September 9 -

Current Members Andrew Biggs and John Nixon will be reappointed for another three years.

September 9 -

Environmental regulations under fire in California.

September 9 -

Piper Sandler has hired Joe Kinder and Brent Blevins as managing directors on its public finance team. Both will focus on Missouri school districts and issuers.

September 9 -

The high-grade issue is expected to be well received by the market. D.C. joins a growing list of issuers refunding outstanding BABs amid lower rates.

September 9 -

"People could trust him and know they were in good hands," said Greg Carey, a co-worker and friend.

September 9 -

Massachusetts drew multiple bidders for all four tranches when it sold $850 million of general obligation bonds competitively last week.

September 9 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

Eisner Advisory Group Partner Allen Wilen is the chief restructuring officer for Jackson Hospital & Clinic.

September 6 -

It's the latest proposal for a type of national infrastructure financing structure in lieu of the municipal bond market.

September 6 -

"The numbers are weak, but not cusp of recession weak," Chris Low, chief economist at FHN Financial, said.

September 6 -

PREPA and its creditors have 30 more days to negotiate a possible debt-cutting deal.

September 6 -

Ciraolo, who spent more than 17 years at Goldman Sachs, has been brought on as a senior vice president in corporate and municipal short-term securities to help expand SWS' taxable muni franchise through commercial paper trading.

September 6 -

The good, the bad and the ugly for two of California's major cities when they sell debt in current market conditions.

September 6 -

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper.

September 5