-

The reverberations from the Silicon Valley Bank and Signature Bank failures make the outcome of this week's Federal Open Market Committee meeting unpredictable.

March 20 -

Shares in Silicon Valley Bank's parent company plunged 60% after executives announced they would sell a large bond portfolio at a big loss. The market "seems to be pricing in greater liquidity needs" than the bank currently anticipates, one analyst said.

March 9 -

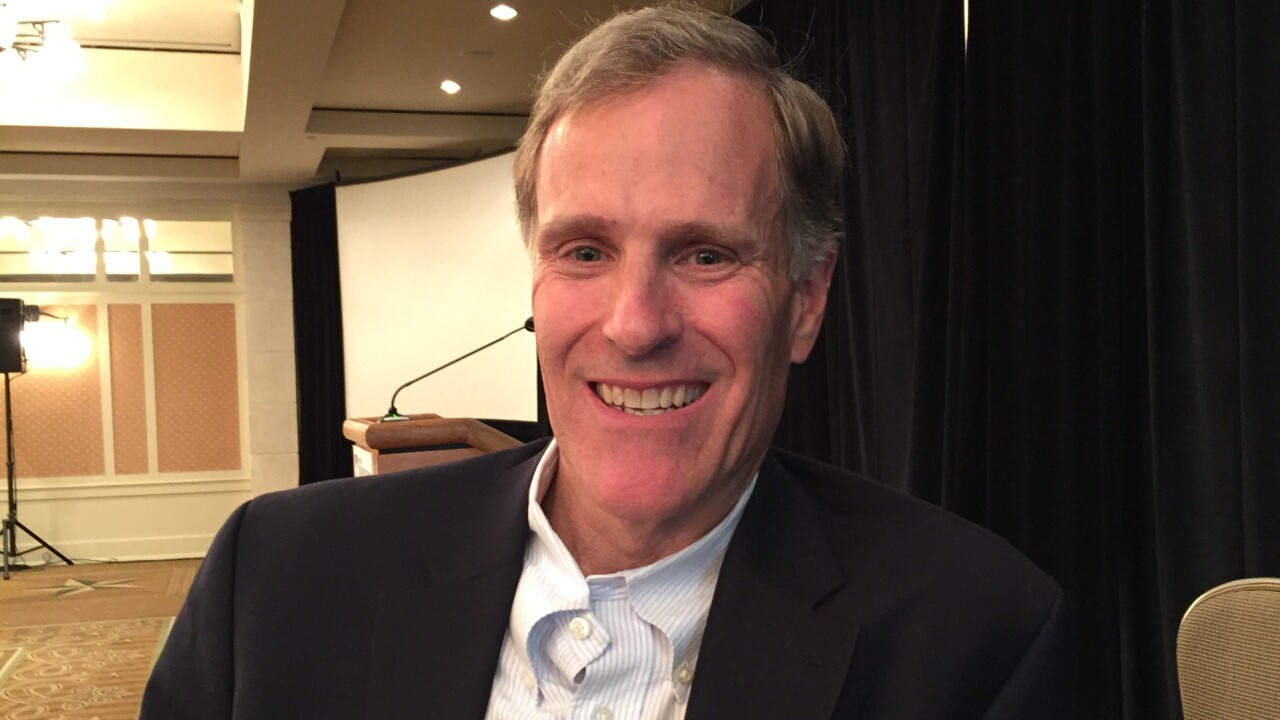

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

The Federal Reserve's quantitative-tightening program risks being propelled toward an early end as U.S. politicians bicker in Washington over raising the national debt limit, according to some economists and bond market participants.

January 24 -

The JPMorgan Chase CEO said the Federal Reserve's rate hikes might need to go beyond what's currently expected, but he's in favor of a pause to see the full impact of last year's increases.

January 10 -

The Federal Reserve will slow the pace of interest-rate increases next month, Federal Reserve Chair Jerome Powel suggested Wednesday, while stressing borrowing costs will need to keep rising.

November 30 -

North Carolina Republican Patrick McHenry — who's in line to lead the House Financial Services Committee after the GOP won control of the chamber in the midterm elections — has called for the Fed to stay focused on controlling inflation. Democrats, who retained the Senate, have begun to voice concerns that higher borrowing costs will hurt jobs and potentially cause a recession.

November 17 -

Massive mutual fund selloffs this year have returned the market to a pre-1976 investor landscape, when portfolios focused on individual demand, said MMA's Tom Doe.

October 21 -

Variable-rate debt, tender option bonds and even prepaid gas bonds may stage a comeback in the current market, panelists at a GFOA conference said.

October 20 -

A shift is underway at the Federal Reserve in how to describe neutral — the interest rate level that neither stimulates nor restrains growth — as it debates how much higher to hike.

September 6 -

The Federal Reserve's balance-sheet unwind is set to ramp up this week, which means the central bank will finally begin unloading the Treasury bills it started amassing almost three years ago.

August 29 -

Directors at two of the Federal Reserve's 12 regional branches favored a 100-basis-point increase in the discount rate in July, minutes of discount-rate meetings show.

August 23 -

U.S. central bankers offered divergent signals over the size of the next interest rate hike, with St. Louis's James Bullard urging another 75-basis-point move while Kansas City's Esther George struck a more cautious tone.

August 18 -

The MSRB has released a mid-year research report showing the sharp decline of taxable issuances, significant outflows from mutual funds and a particularly fruitful last few months for individual investors.

July 18 -

The amount of money parked at a major Federal Reserve facility climbed to yet another all-time high, surpassing the $2 trillion milestone for the first time, as investors struggled to find places to invest their cash in the short term.

May 24 -

In a recent survey, just over half of community bankers expressed concern that the central bank will harm the U.S. economy by raising rates too fast in its quest to contain inflation.

April 28 -

The Treasury’s latest tax collection may preview how the shrinking of the Federal Reserve’s $9 trillion balance sheet, or quantitative tightening, will unfold for the markets and global liquidity.

April 25 -

“With inflation well above the FOMC’s longer-run objective and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the Fed said.

February 25 -

January issuance declined by 14.7% year-over-year amid a rising-rate and volatile environment.

January 31 -

John Hallacy of John Hallacy Consulting LLC sits down with Chip Barnett to talk about what the municipal bond market will face in 2022. He discusses inflation, new issuance volume, and the future of infrastructure this year amid the lingering effects of COVID and Omicron. (19 minutes)

January 25