-

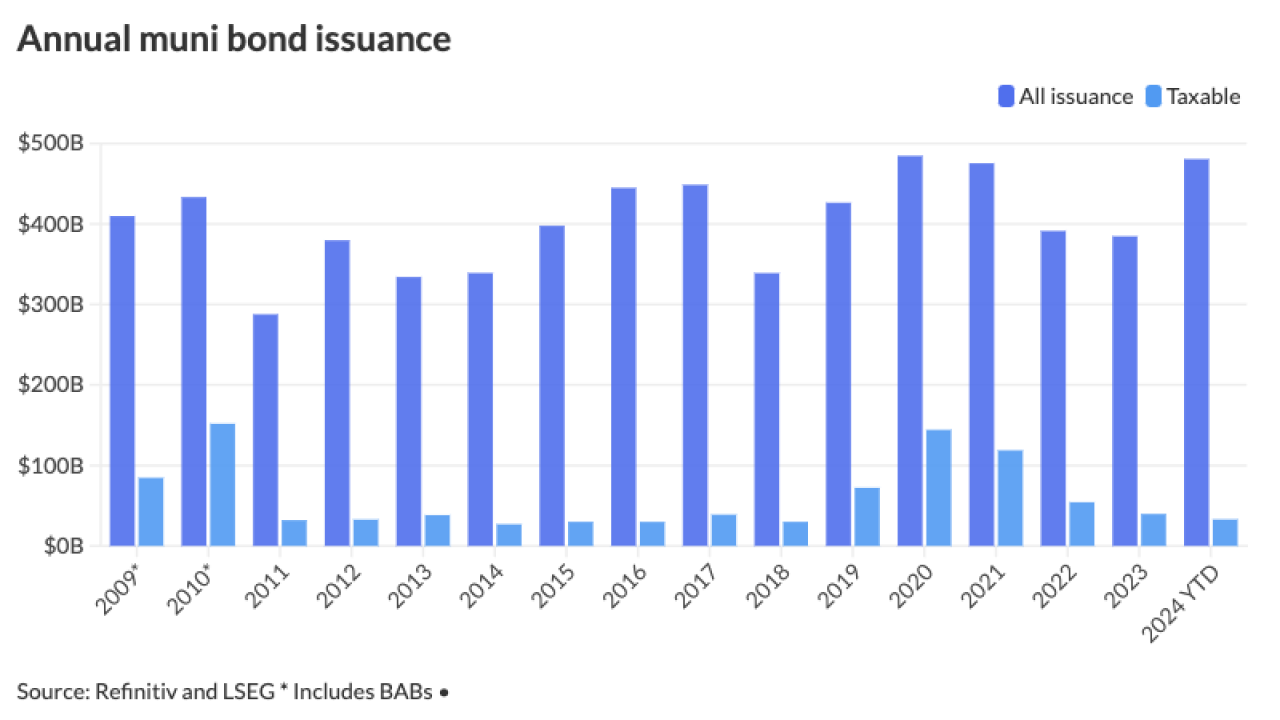

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

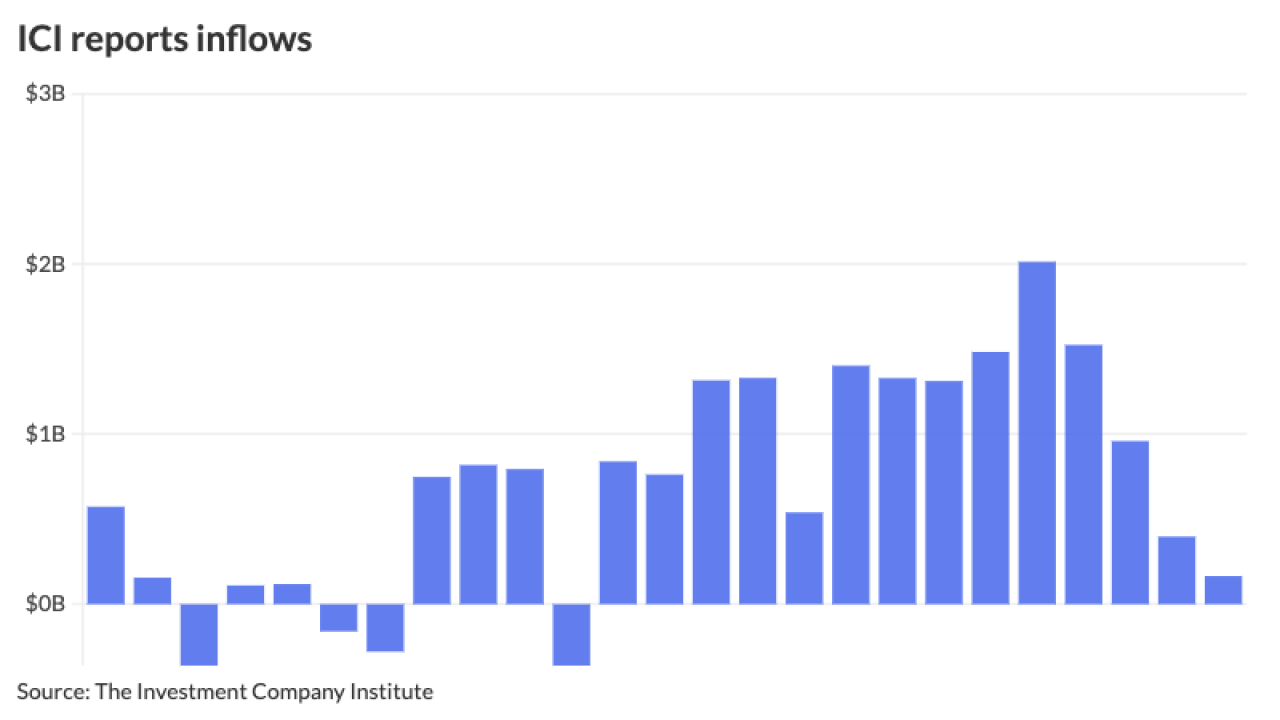

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Federal Reserve Gov. Christopher Waller, a Trump appointee, said that while recent inflation readings are concerning, monetary policy would remain restrictive even if the central bank cuts interest rates by another quarter-point this month.

December 2 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

June 12 -

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14 -

The consumer price index number further complicates market expectations of Fed rate cuts and muni investors may want "to keep their powder dry" until they have a better idea of the Fed's timing, said CreditSights' Pat Luby.

February 13 -

The December consumer price index came in slightly stronger than expected, perhaps eliminating the possibility of a rate cut in March, analysts said.

January 11 -

Large reserves will insulate states against downgrades in the near future, one rating agency says.

November 2 -

The state managed to grow revenues above forecast for the first two months of the fiscal year despite the delayed tax filing deadline.

September 19 -

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

Despite this, August saw the largest monthly volume of 2023, helped by several billion-dollar deals and multiple Texas school district deals.

August 31 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

Another day of mixed inflation data led Treasury yields to rise but munis mostly stayed put after underperforming a UST rally earlier in the week. The market is also focused on the $9 billion of redemption flows coming on Tuesday.

August 11 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

Eric Merlis, managing director and co-head of global markets at Citizens Bank, talks with Chip Barnett about the economy and financial markets and what the Federal Reserve might do. He also discusses possible near- and long-term economic scenarios. (15 minutes)

July 25