-

Former U.S. Treasury Secretary Lawrence Summers said Federal Reserve policy makers are signaling a “new era” in which they recognize the U.S. economy is overheating as inflation runs at its fastest in three decades.

November 24 -

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

November 23 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

State economies are generally stronger than anticipated in the first half of 2021.

November 16 -

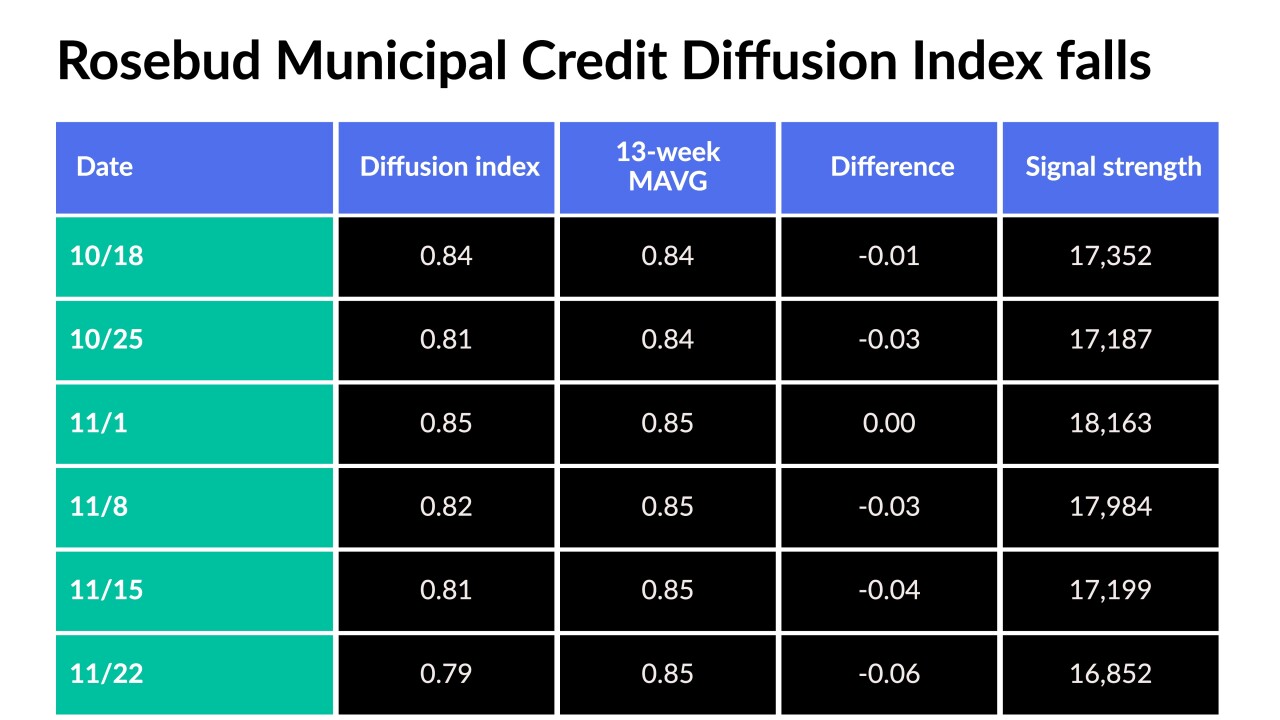

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

November 15 -

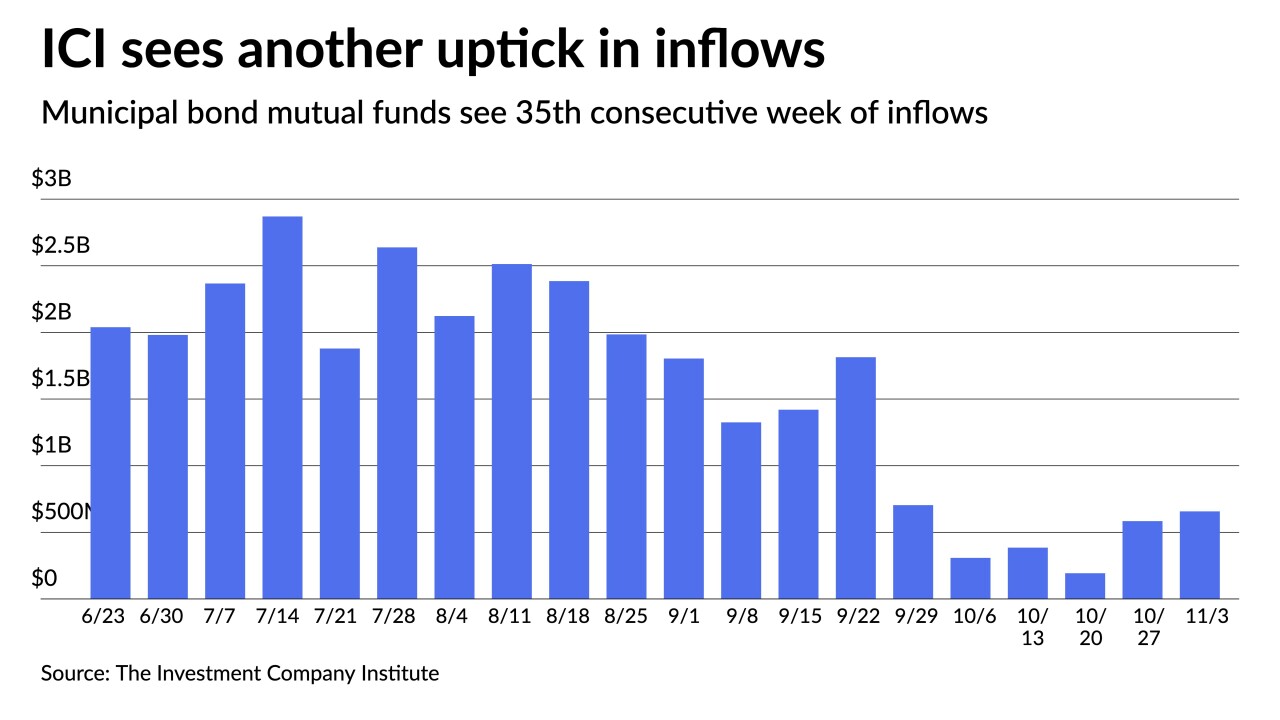

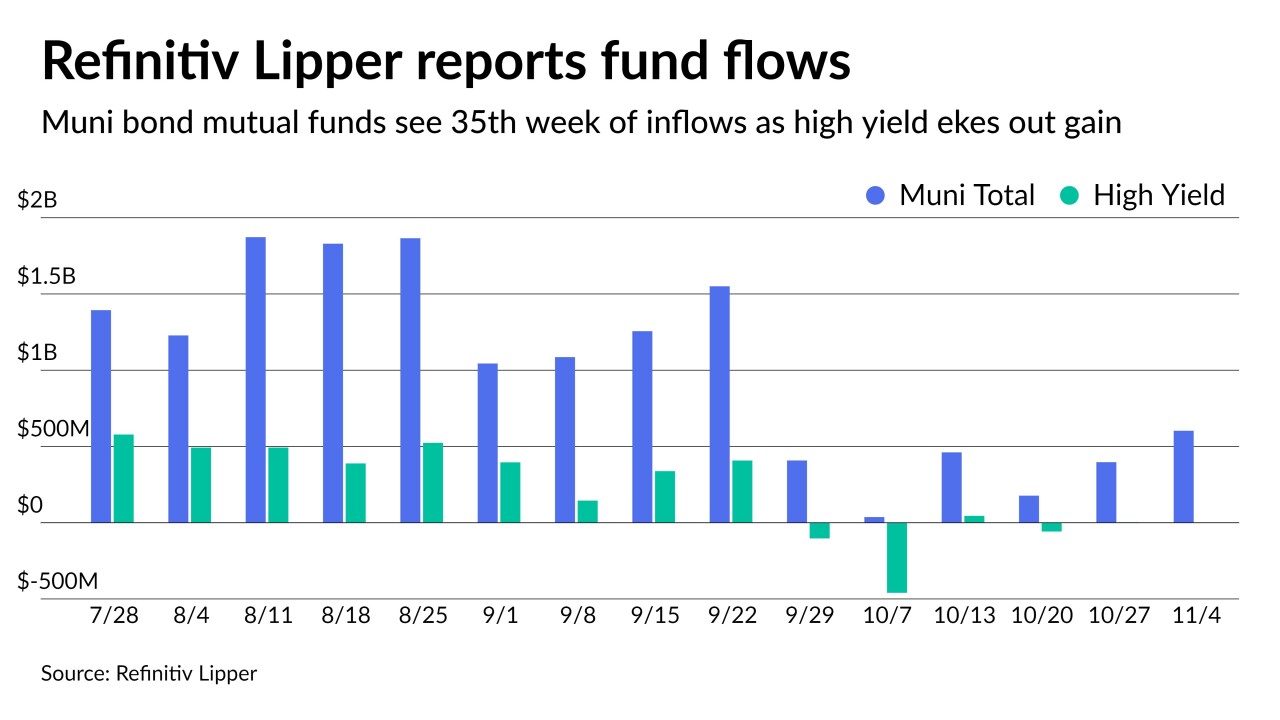

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

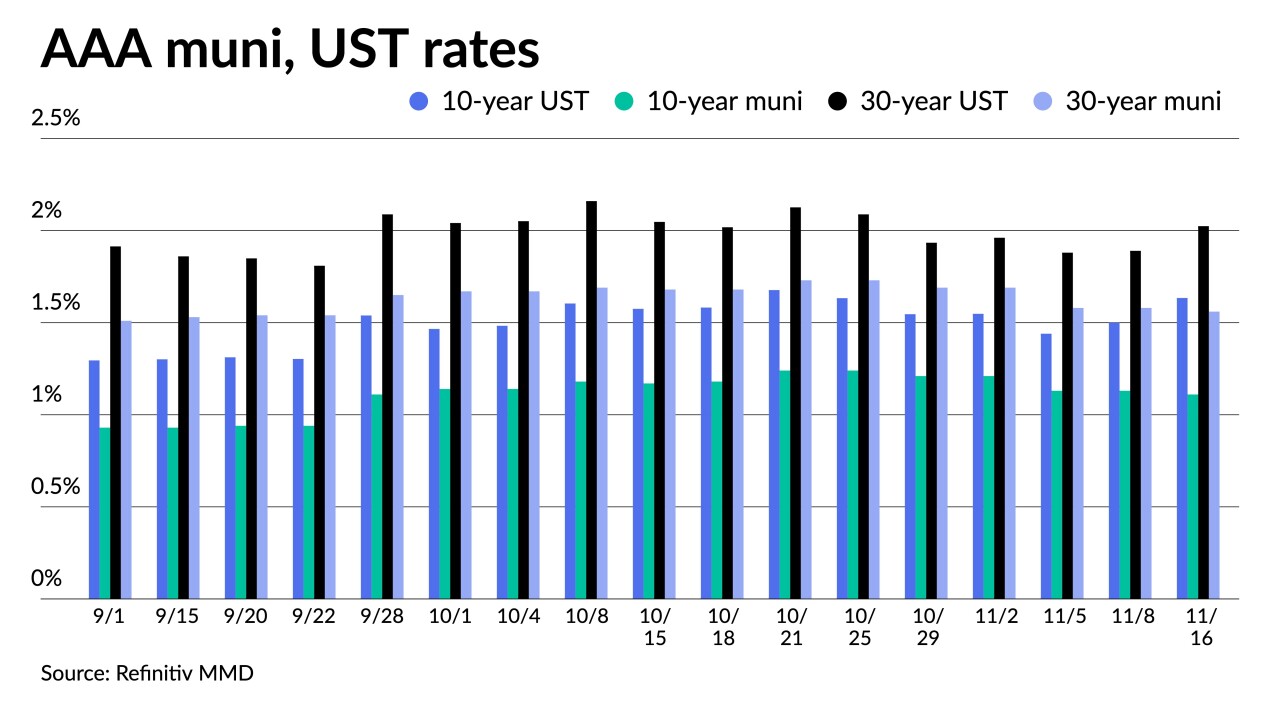

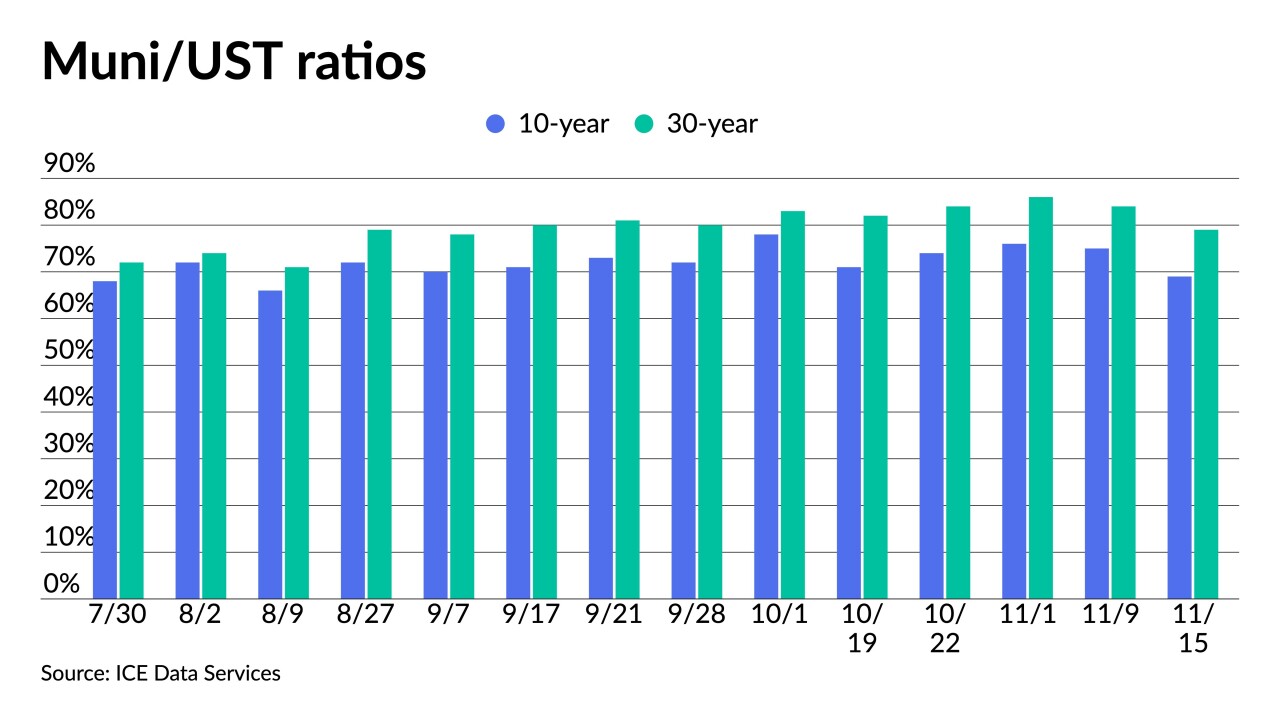

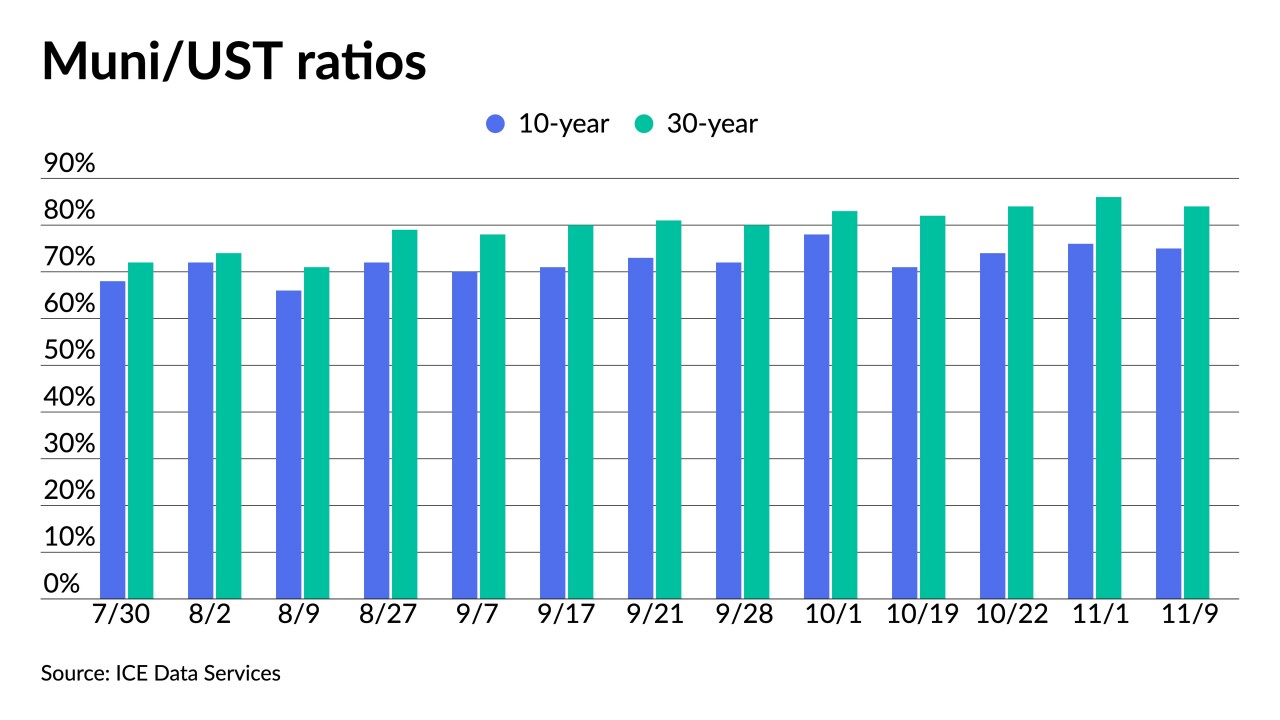

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9 -

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

November 3 -

The FOMC will likely take the opportunity to profess its reliance on data to decide liftoff and reiterate the threshold for a rate hike remains higher than for taper.

November 2