-

A "lighter-than-anticipated CPI report" led to UST firmness, as it "quelled fears about tariff-related inflation and boosted enthusiasm that the Fed will cut rates in the next two or three meetings," said José Torres, senior economist at Interactive Brokers.

June 11 -

Federal Reserve Vice Chair Philip Jefferson said in a speech Wednesday that elevated tariffs will likely lead to inflation, but time will tell how impactful that spike in prices might be.

May 14 -

Even with Monday's U.S.-China tariff truce and Tuesday's inflation print, the market has felt better over the past several weeks, said Jamie Iselin, managing director and head of municipal fixed income at Neuberger Berman.

May 13 -

The central bank wants to let Trump's policies play out across the economy before deciding which way to move interest rates, and it's too soon to know what the impacts will be, the Federal Reserve chair said.

April 4 -

"The supply/demand dynamic is a headwind for the muni market this week as supply is expected to be elevated," said Cooper Howard, a fixed income strategist at Charles Schwab.

March 12 -

Mass deportations and tariffs on key trade partners are expected to have a "significant" negative impact on the U.S. and California economies, according to the UCLA Anderson Forecast.

March 5 -

Inflation is front and center this week, with the consumer price index report released on Wednesday and the producer price index on Thursday.

February 12 -

Municipals are underperforming USTs month-to-date, with the Bloomberg Municipal Index showing losses of 1.02% versus 0.92% for USTs as of Tuesday, but both are outperforming losses in corporates that are seeing 1.23% losses in January.

January 15 -

The muni market also faces an elevated new-issue calendar, which may put additional pressure on muni yields. Bond Buyer 30-day visible supply sits at $17.57 billion.

January 13 -

Although a new administration means policy uncertainty, most analysts see the economy growing above trend next year, although inflation will remain a concern.

January 2 -

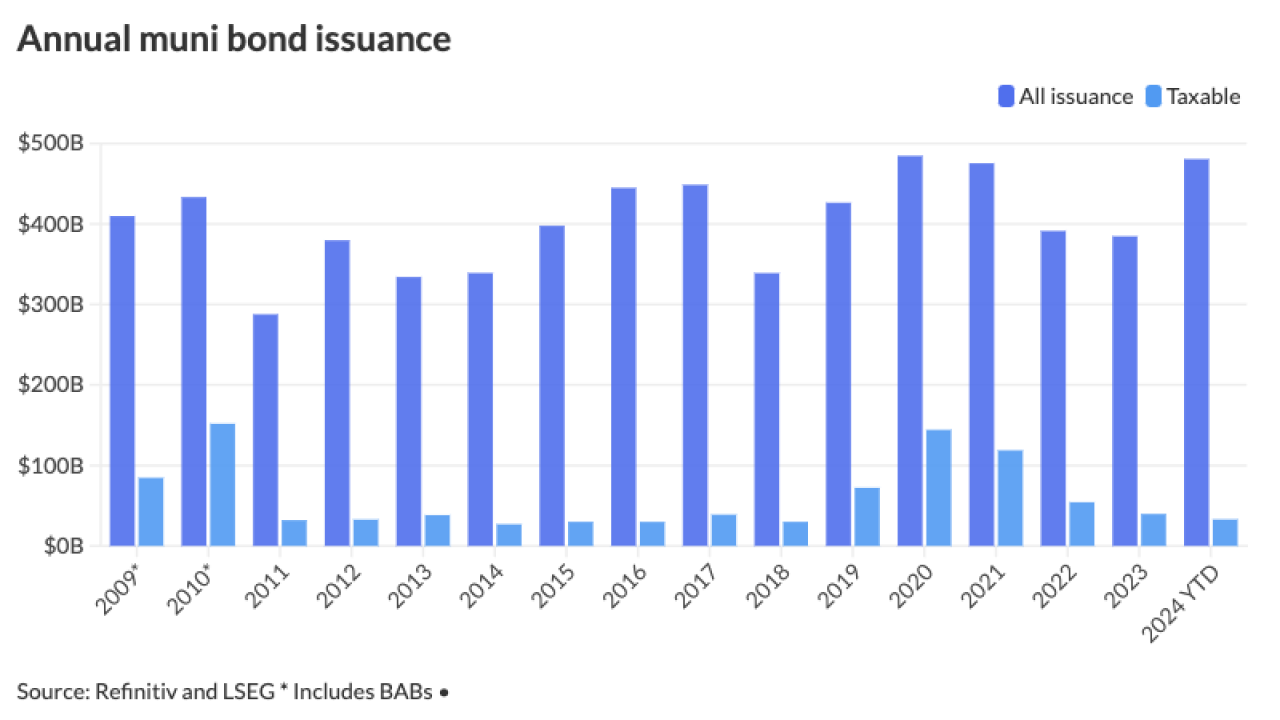

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

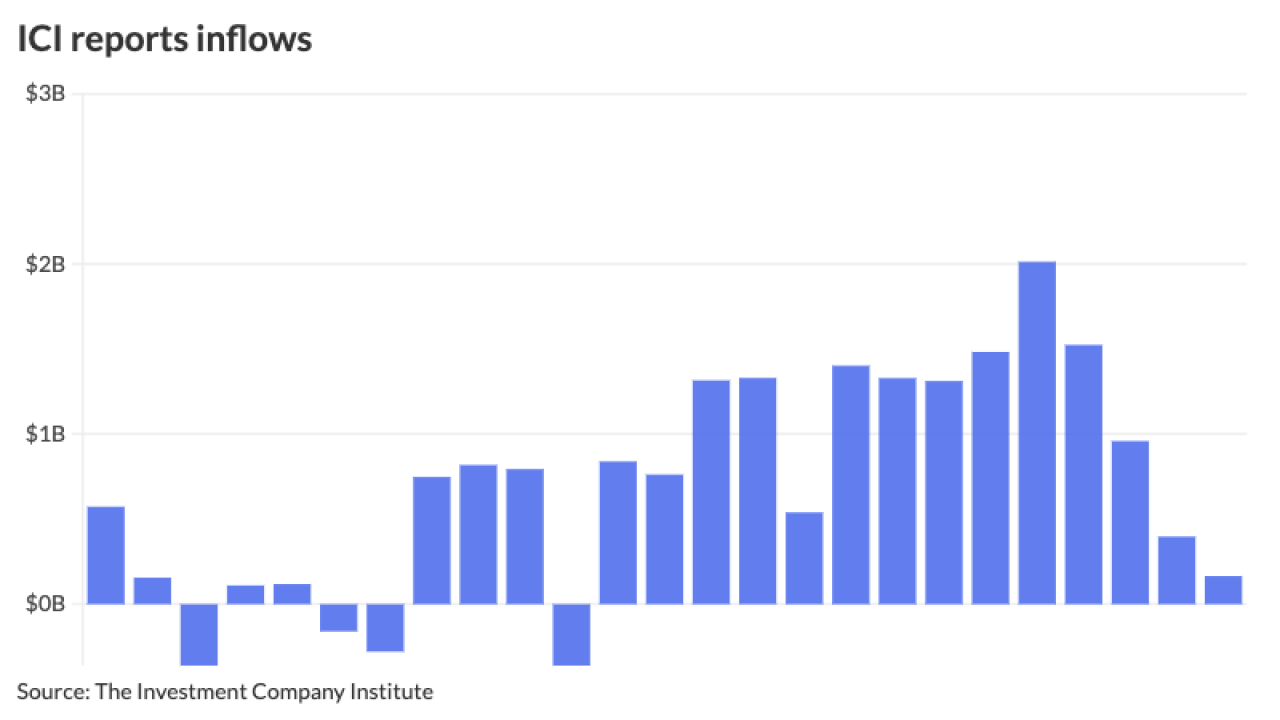

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Federal Reserve Gov. Christopher Waller, a Trump appointee, said that while recent inflation readings are concerning, monetary policy would remain restrictive even if the central bank cuts interest rates by another quarter-point this month.

December 2 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

June 12 -

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14