-

The federal tax issue that is at stake in both audits involve the federal payments for the direct-pay subsidy.

March 1 -

The National Association of Bond Lawyers's letter to lawmakers emphasized the infrastructure benefit of protecting the muni market.

February 14 -

Common Good founder Philip Howard discusses his new book "Try Common Sense." His approach to simplifying government including moving federal agencies out of Washington. Paul Burton hosts.

February 12 -

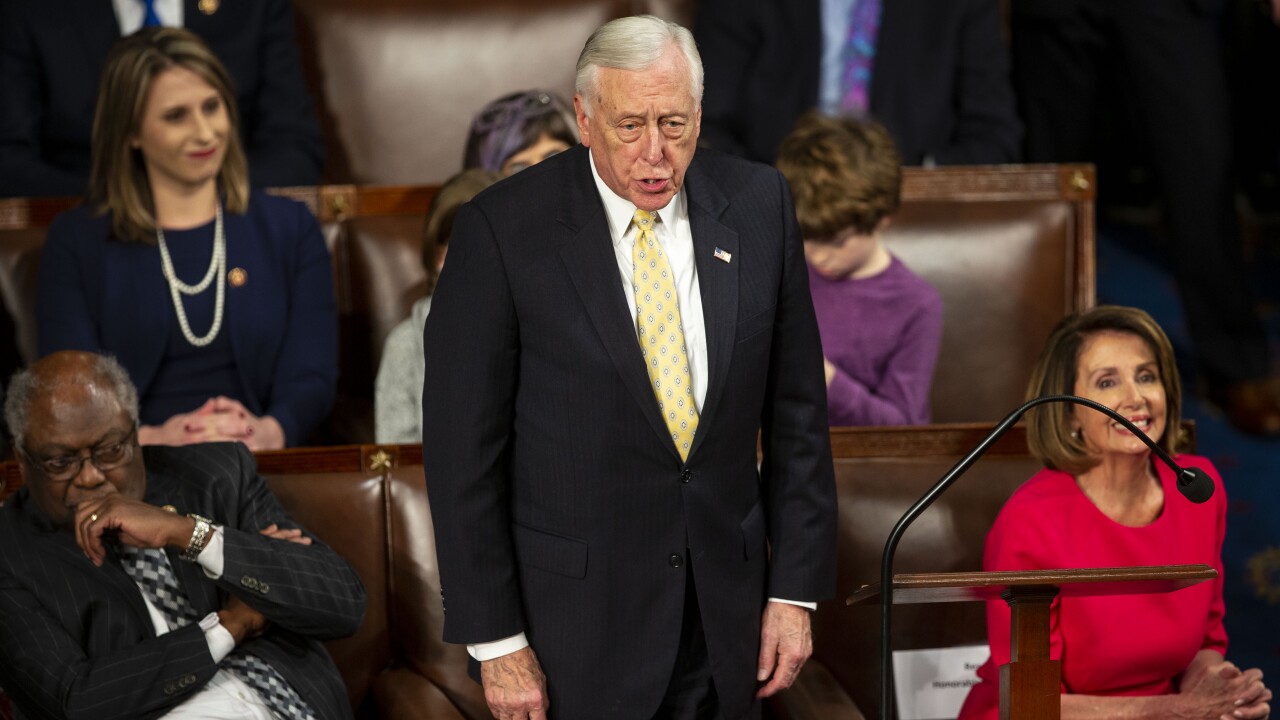

A top House Democrat warned the Trump administration not to engage in debt limit brinksmanship that could halt trading in state and local government securities.

January 30 -

GFOA’s goal is to get a majority of House members to sign a letter pledging not to touch the tax exemption as they debate new infrastructure funding proposals.

January 28 -

Federal formula aid and grants have been cut off for providers ranging from small rural agencies to the nation's biggest mass transit systems.

January 14 -

A city task force has restored nearly $40 million in unreconciled cash accounts that was driven largely by duplicate debt service entries.

January 11 -

Moody’s Investor’s Service said the shutdown “has had minimal impact on municipal credits,’’ but warned that “economic disruption will grow as the shutdown lingers.”

January 10 -

Emily Brock, director of GFOA’s federal liaison center, said restoration of advance refundings and increasing the limit on bank qualified debt to $30 million also are among the legislative priorities for 2019.

January 7 -

The House approved rules changes Thursday that include restoration of the so-called Gephardt rule that links passage of the annual budget resolution to a debt ceiling increase.

January 4 -

Funding levels for grant programs won't be set until next year.

December 20 -

Budget officers in another 14 states have reported early fiscal 2019 revenues running within a half percentage of projections with only five telling the National Association of States Budget Officers they were collecting less than projected.

December 13 -

Americans place almost $150 billion in illegal sports bets annually, according to the American Gaming Association.

December 7 -

Christian Sobrino Vega, the commonwealth’s representative to the Puerto Rico Financial Oversight and Management Board, made clear in an interview with The Bond Buyer that the commonwealth has not and will not intermingle federal disaster aid with debt payments to the island’s bondholders.

November 16 -

The dollar value of net pension liabilities rose in 43 states while the dollar value of outstanding tax-supported debt rose in 17 states, the report said.

November 12 -

The vote ends the effort to create a new city and ends the legal debate over who would have been responsible for Stockbridge bond debt.

November 9 -

Katano Kasaine, director of finance for the City of Oakland, Calif., and Noreen White, co-founder of Acacia Financial Group, will receive the 2018 Freda Johnson Award for Trailblazing Women in Public Finance.

November 9 -

The results stand to influence the municipal market through capital planning and budget actions with potential impacts on ratings and borrowing levels.

November 7 -

If the workarounds states are using by creating charitable foundations as a way to pay property taxes or state and local income taxes are legal, Suffolk County Executive Steven Bellone said it’s up to Congress to decide whether to end them.

November 5 -

Most state and local governments are concerned the ceiling will make it harder to raise taxes to pay for public services and infrastructure.

November 1