-

During more than a half century in the municipal bond business, Edward A. Moos was proprietor of E.A. Moos & Co. and a past governor of the Municipal Bond Club of New York.

June 12 -

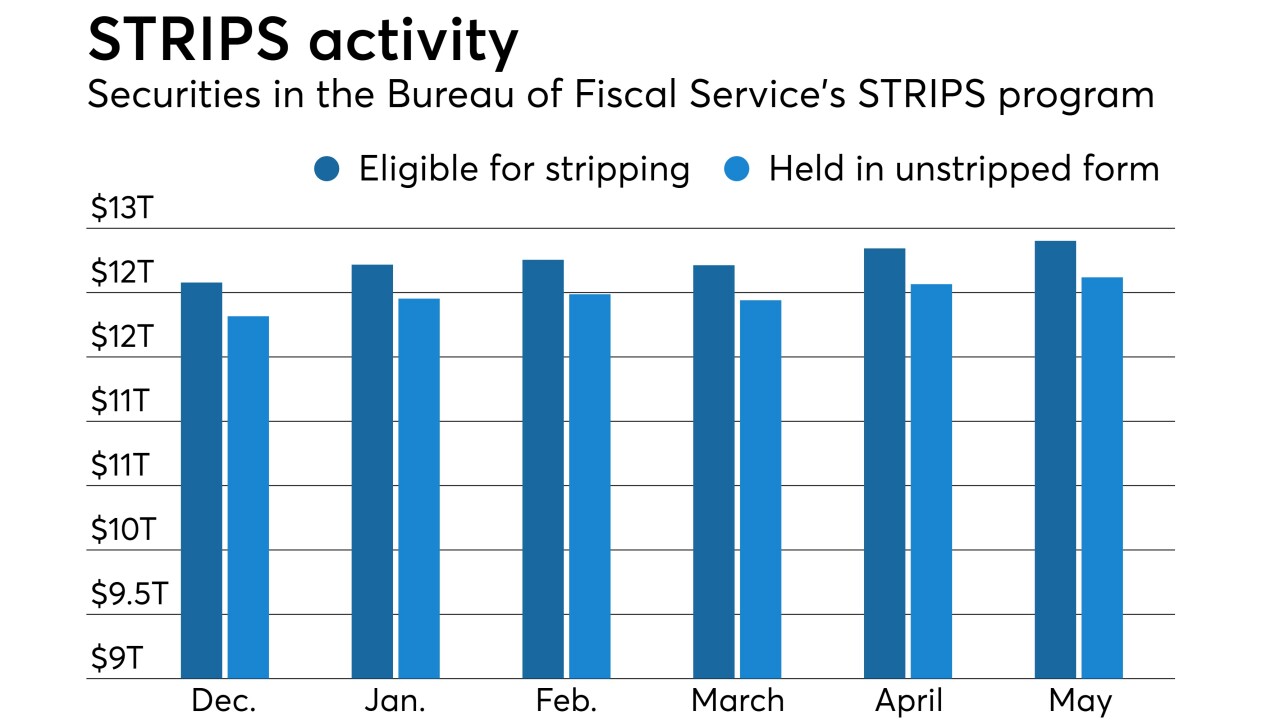

Newly issued Treasury securities held in stripped form increased about $5.881 billion in April to a total of $283.836 billion, the Bureau of the Public Debt reported Wednesday.

June 6 -

Scarcity mixed with strong demand and Fed announcements on rates and inflation helped munis outperform most fixed-income assets so far this year.

May 24 -

Muni portfolio manager J.B. Golden combats spread compression with defensive duration, laddering, premium bonds, and a tilt toward credit opportunities.

May 14 -

Newly issued Treasury securities held in stripped form increased about $5.475 billion in April to a total of $279.954 billion.

May 4 -

Municipal bond buyers had billions of new paper flow into the primary market - which took it all down but overall the market was weaker for the second day in a row as Treasury yields continue to climb.

April 24 -

Newly issued Treasury securities held in stripped form increased about $5.302 billion in February to a total of $272.479 billion.

April 5 -

Declining volume and demand shifts won't stop the muni market from delivering positive returns in 2018, says Oppenheimer & Co.'s Jeffrey Lipton.

March 15 -

Newly issued Treasury securities held in stripped form increased about $2.944 billion in February to a total of $267.178 billion.

March 6 -

Newly issued Treasury securities held in stripped form increased about $2.132 billion in January to a total of $264.234 billion.

February 6 -

The Treasury Department's November quarterly refunding of $66.0 billion will raise $19.4 billion new cash, Treasury announced Wednesday.

January 31 -

The Treasury Monday estimated it will borrow $441 billion of net marketable debt in the first quarter of 2018, assuming a $210 billion cash balance on March 31.

January 29 -

The Treasury Department Tuesday auctioned $45 billion of four-week bills at a 1.295% high yield, a price of 99.899278.

January 16 -

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed.

January 16 -

The Treasury Department Thursday auctioned $12 billion of 29-year 10-month bonds with a 2 3/4% coupon at a 2.867% high yield (2.801% at original auction), a price of 97.660428.

January 11 -

The Treasury Department said Thursday it will sell $45 billion of four-week discount bills Tuesday, down from $50 billion last week.

January 11 -

The Treasury Department auctioned $20 billion of nine-year 10-month notes with a 2 1/4% coupon at a 2.579% high yield, a price of 97.156278.

January 10 -

The Treasury Department Tuesday auctioned $24 billion of three-year notes at a 2.080% high yield, a price of 99. 768648.

January 9 -

The Treasury Department Tuesday auctioned $45 billion of four-week bills at a 1.280% high yield, a price of 99.900444.

January 9 -

The Treasury Department auctioned $42 billion of 26-week bills at a high yield of 1.575% on Monday.

January 8