-

At 2.5%, Florida's September unemployment rate is the second lowest in the state's history and the lowest since October 2006.

October 21 -

Investors will be greeted Tuesday with a larger new-issue calendar, estimated at $6.087 billion, up from total sales of $5.551 billion in the week of Aug. 29.

September 2 -

Nearly all construction firms have job openings, and more than half said they're seeing projects being scaled back, postponed or canceled.

September 2 -

The Miami metro area saw the most private-sector job growth among all metro areas in the state in June and year-over-year.

July 25 -

Ten states, includeing five in the Southeast, pre-pandemic employment levels in January, according to Fitch Ratings. In an update, the U.S. Labor Department reported Florida’s seasonally adjusted unemployment rate fell to 3.3% in February.

March 25 -

Market volatility has risen significantly, particularly in the last several weeks, with daily Treasury yield swings of 10 basis points or more becoming the norm with municipals struggling to stabilize.

March 4 -

Buyers appeared to return to the market the past two sessions after the January correction moved yields and ratios higher. Secondary trading was up again on Wednesday and new deals were well-received.

February 2 -

Munis followed UST weaker while stocks sold off after the employment report, which offered many messages. Analysts believe the bottom line is the Fed will liftoff in March.

January 7 -

“Our state’s strong economic recovery has accelerated back to pre-pandemic levels for unemployment and GDP,” said Gov. Bill Lee.

December 17 -

The weaker-than-expected employment report sent U.S. Treasury yields lower and equities sold off. Munis did what they've been doing — mostly ignored it.

December 3 -

The Investment Company Institute reported $974 million of inflows into municipal bond mutual funds in the week ending Nov. 23, down from $1.430 billion in the previous week.

December 1 -

State economies are generally stronger than anticipated in the first half of 2021.

November 16 -

The long end of the municipal curve rallied under a backdrop of stronger-than-expected October jobs data and upward revesions to the prior two months ahead of the arrival of $9.6 billion next week.

November 5 -

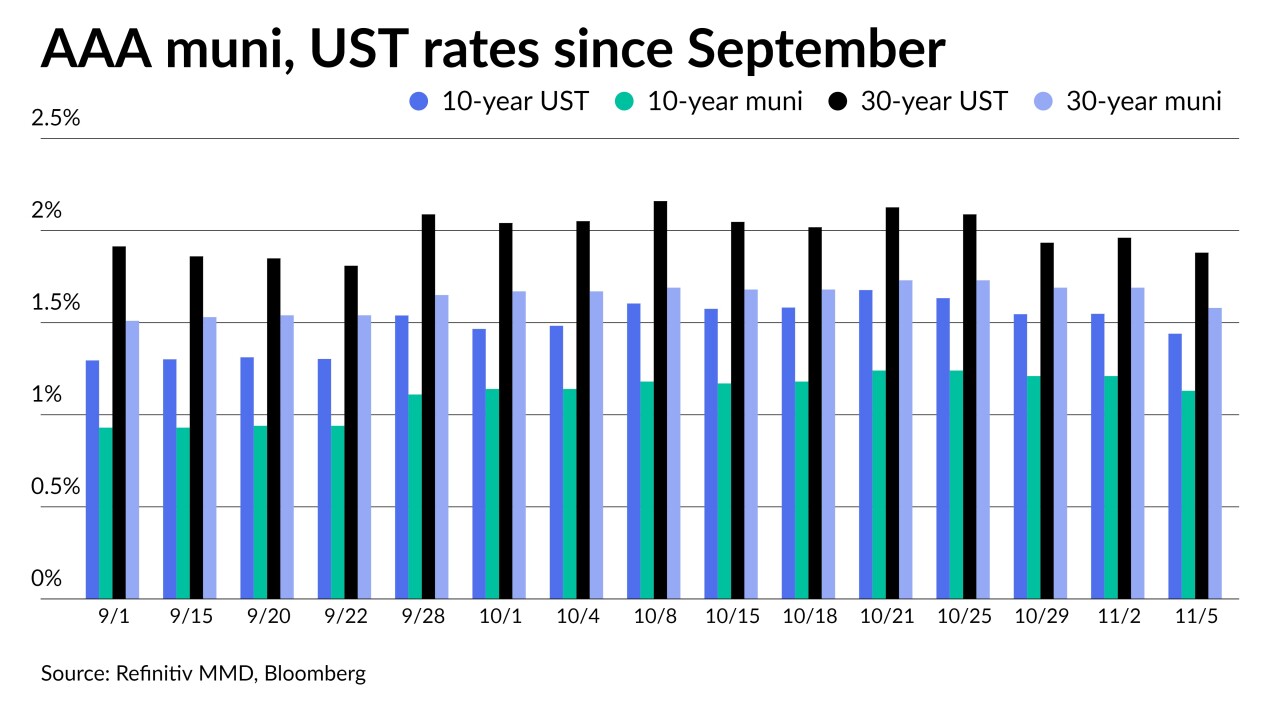

Municipals outperformed the move in taxables Friday but weakness hangs over the market as fund flows lessen and supply increases. Taxable munis may be keeping exempt rates from moving higher.

October 8 -

ICI reported $704 million of inflows, a $1.1 billion drop from the week prior, bringing the total to $76 billion year to date.

October 6 -

In both states, jobs have recovered past where they were prior to last March when the pandemic hit the U.S.

September 13 -

Better-than-expected job gains, a rising UST complex and an increase in supply to test municipals' resolve.

August 6 -

With all eyes on Friday’s employment report, since several additional strong months of gains are needed for the Federal Reserve to be comfortable announcing a tapering of its asset purchases, Wednesday’s news could signal trouble.

August 4 -

Florida’s unemployment rate rose 0.1% to 5.0% in June while gaining more than 69,300 jobs, as active job seekers look to rejoin the workforce.

July 16 -

With better-than-expected payrolls, economists still caution full recovery is a ways away. Muni participants are closely following how the Fed's action — or inaction — will affect the municipal market going forward.

July 2