-

The markets are pricing in a 25 basis point Fed rate cut in July, as Thursday’s indicators showed continued manufacturing weakness.

June 20 -

While the markets are pricing in two or three interest rate cuts this year, doubters remain.

June 18 -

Business activity in New York contracted in June, as tariffs and a slight softening in the labor market took a toll on conditions.

June 17 -

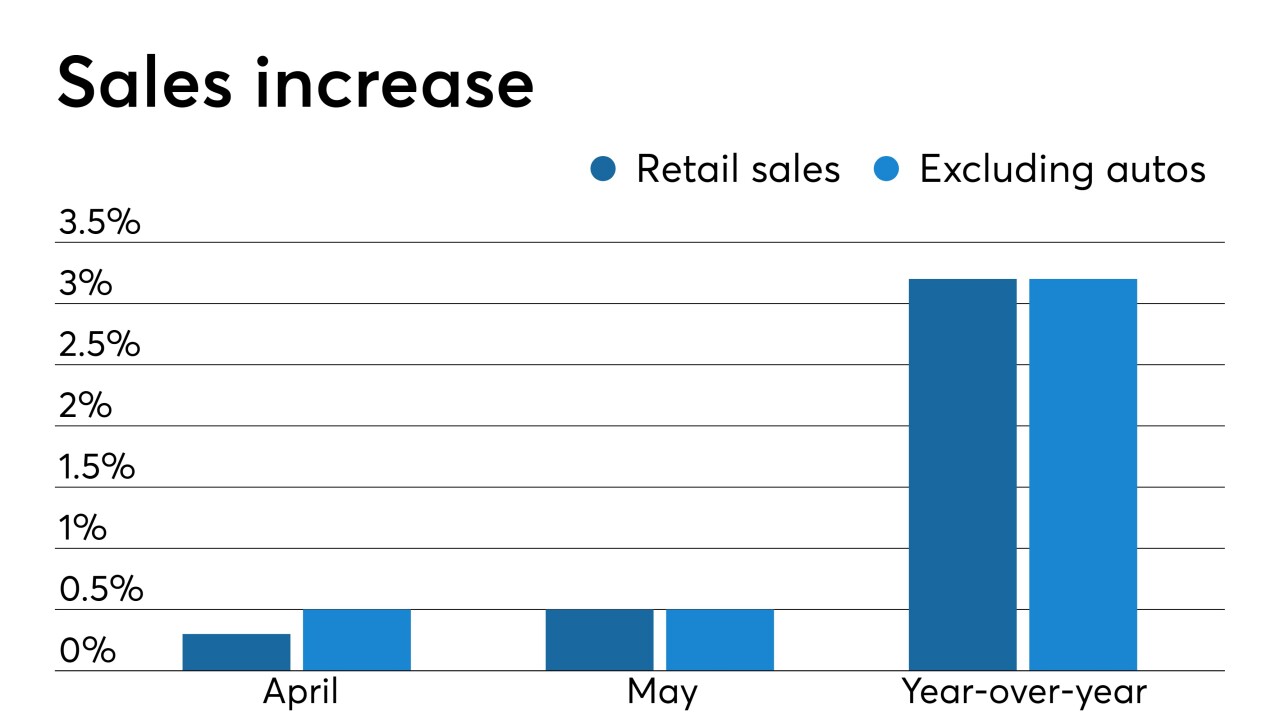

Consumers put a crimp in expectations for rate cuts this year.

June 14 -

Further increases in weekly jobless claims would bolster the case for lower interest rates.

June 13 -

Next week's Summary of Economic Projections will be watched closely.

June 12 -

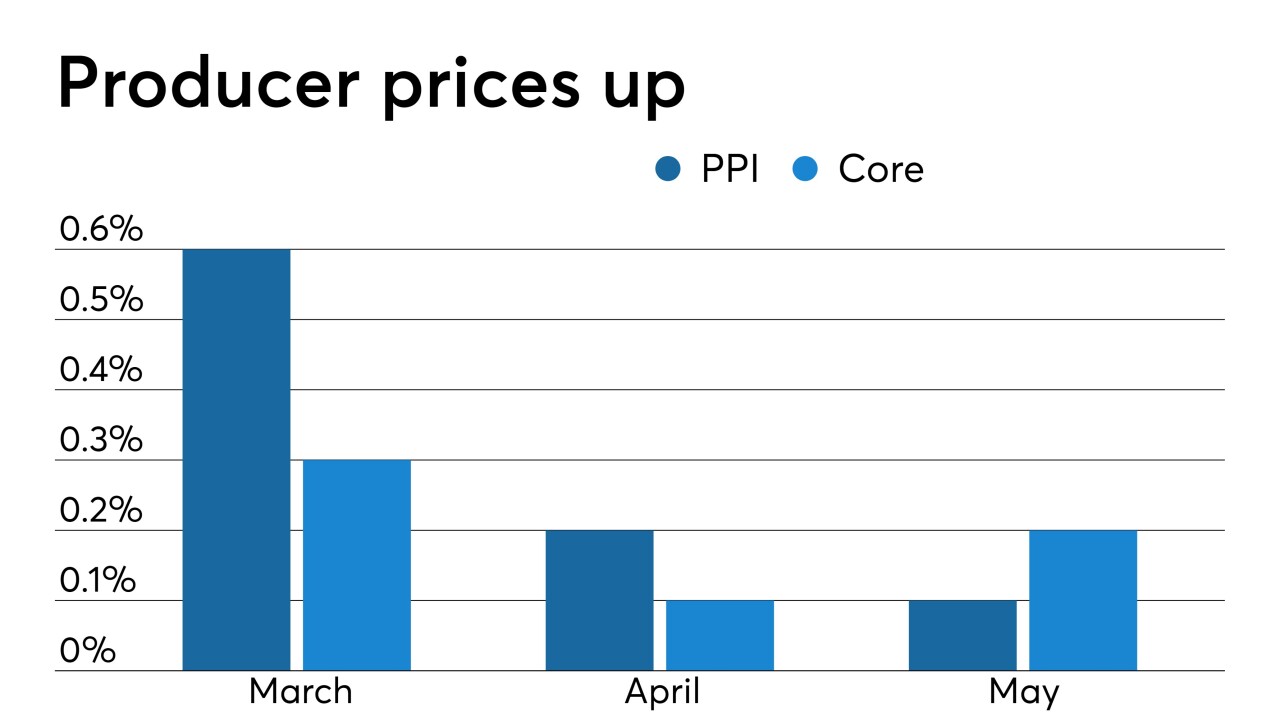

With no surprises in the producer price index, the Federal Reserve will have flexibility on rates.

June 11 -

The municipal bond market watched and waited on Monday as President Trump lamented his lack of control over monetary policy as data show the economy humming along.

June 10 -

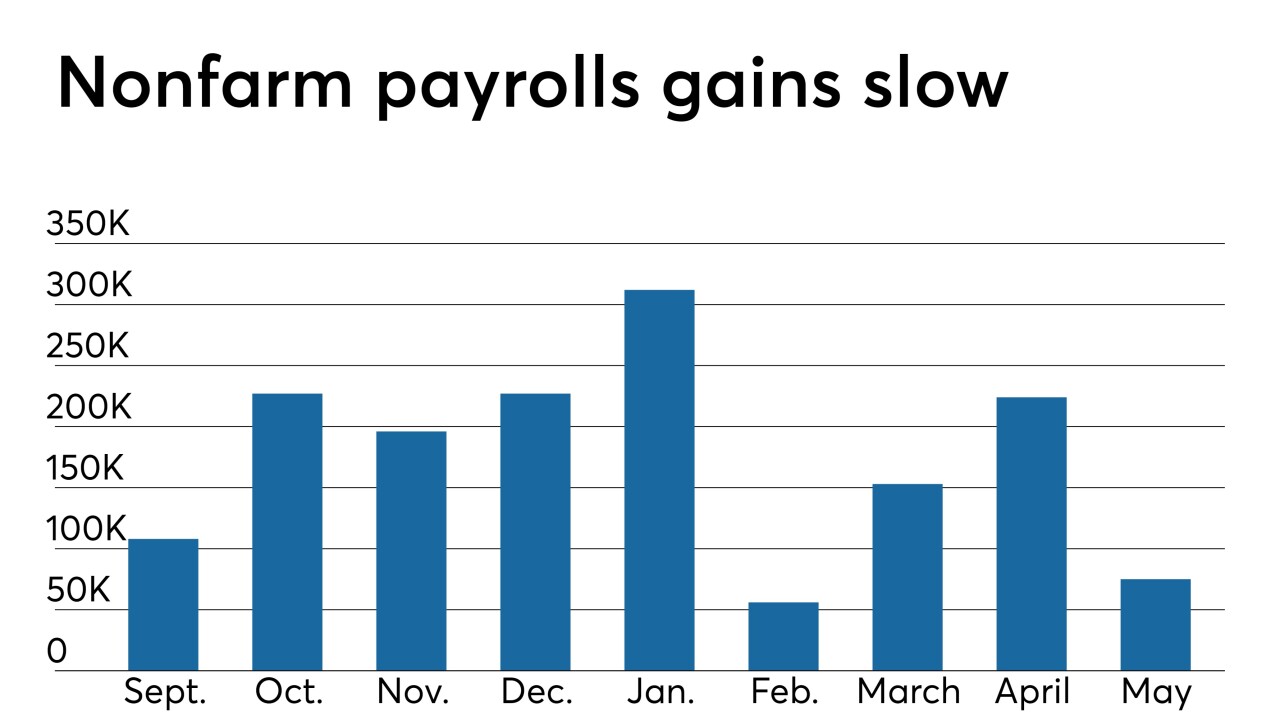

Bonds rallied as market observers gauged whether Friday’s weak employment report will spur the Federal Reserve to cut rates.

June 7 -

The standoff continues as the Fed won't talk rate cuts and the market continues to expect more.

June 6 -

A disappointing read from the ADP employment report overshadowed a positive read on the service sector, and the markets upped expectations for rate cuts through next year.

June 5 -

The St. Louis Fed's James Bullard and the San Francisco Fed's Mary Daly said economic conditions may justify lower interest rates.

June 3 -

An uptick in inflation may be a sign that Federal Reserve Chair Jerome Powell was right when he said a dip in prices could be brief, allowing patience on rates.

May 31 -

A decline in pending home sales and a widening trade deficit suggest growth will slow this year.

May 30 -

The markets have priced in a Federal Reserve rate cut this year, with the likelihood of a September reduction rising to 62% on Wednesday from a 50-50 shot on Tuesday and about a 91% of a 25 basis point cut by yearend.

May 29 -

Softness in consumer spending may be ending, which would increase gross domestic product.

May 28 -

A 2.1% drop in durable goods orders shows businesses are holding off on equipment purchases as trade tensions with China increase.

May 24 -

Analysts homed in on the phrase “some time” and the absence of rate cut discussion in the minutes of the last Federal Open Market Committee meeting..

May 23 -

Trade issues with China should end with a deal, leaving the U.S. economy mostly unscathed, the Federal Reserve Bank of Boston president said.

May 21 -

Two Federal Reserve Bank presidents discussed how trade policy is effecting the economy; neither seemed ready to cut interest rates.

May 20