-

Existing home sales and the Federal Reserve Bank of Richmond’s manufacturing index support a 25 basis point Fed rate cut next week.

July 23 -

While Federal Reserve officials made it clear they intend to cut interest rates at their July 30-31 meeting, not all of the regional presidents are on board with this move.

July 22 -

With a rate cut all but certain at this month’s Federal Open Market Committee meeting, the discussion has again turned to the magnitude.

July 19 -

With the neutral rate of interest rate extremely low, New York Fed President John Williams suggested the keys are acting quickly and keeping rates lower longer.

July 18 -

The economy was chugging along at about the same pace from mid-May through early July as it had in the previous period, according to the Federal Reserve’s Beige Book.

July 17 -

Federal Reserve Board Chair Jerome Powell added little to his recent Congressional testimony, so despite strong retail sales data, it appears the Fed will cut rates later this month.

July 16 -

The Empire State Manufacturing Survey’s general business conditions index turned positive in July.

July 15 -

Federal Reserve Chair Jerome Powell’s testimony before Congress this week made it seem a rate cut at the end of the month is a done deal.

July 12 -

After President Trump's criticism, the Fed Chairman told the Senate Banking Committee a move would be based on what’s best for the economy.

July 11 -

With the economy strong, Federal Reserve Bank of Philadelphia President Patrick Harker said interest rates should be held for now.

July 9 -

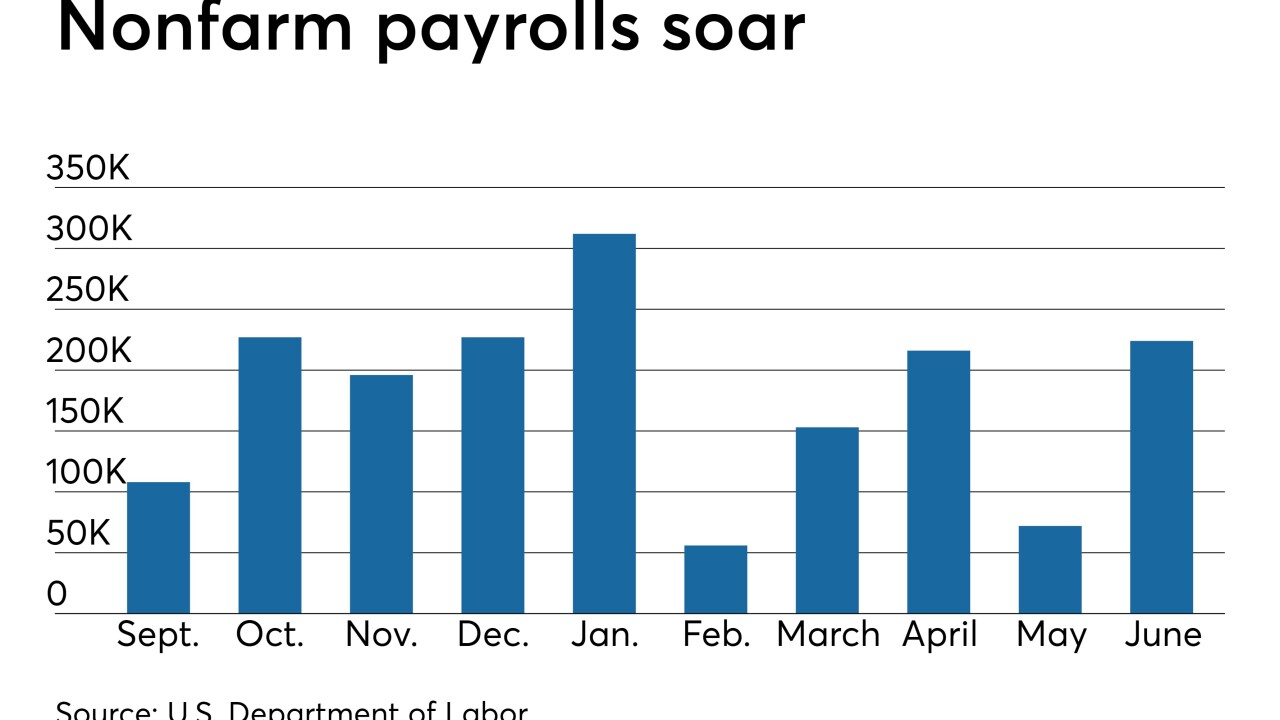

Nonfarm payrolls rose 224,000 in June, more than expected, throwing cold water on expectation that the Federal Open Market Committee will cut rates at its July meeting.

July 5 -

After a string of proposed candidates who didn’t pan out, Trump picks new Fed nominees.

July 3 -

The dot plot showed the Federal Open Market Committee evenly split between cutting and holding rates, but it's not clear whose dots are whose.

July 2 -

The U.S. and China are again attempting to work out trade differences, and manufacturing numbers show somewhat weaker expansion. Will this be enough to spur the Federal Reserve to lower interest rates later this month?

July 1 -

Data were mixed from Commerce Department reports on personal income and spending and the University of Michigan's indexes.

June 28 -

The U.S. economy is expanding even as some data hint at possible future weaknesses.

June 27 -

If data remain mixed before the next FOMC meeting, Federal Reserve Bank of San Francisco President Mary C. Daly said a rate cut would be “something to think about.”

June 26 -

Declining consumer confidence and home sales back Powell's assessment that uncertainties are rising.

June 25 -

Despite “solid” growth in gross domestic product in the past year, it will be difficult for GDP to rise more than 1.5% to 1.75% on a longer run basis.

June 24 -

While leaders Powell and Clarida see a growing case for accommodation, Kashkari, Bullard say the need for a rate cut is already here.

June 21