-

The largest deal of the week comes from the New York City Transitional Finance Authority with $950 million of exempts and $250 million of taxables.

January 14 -

Net supply pressure among tax-exempts is expected to worsen in January compared to last year and the move toward richer tax-exempts is unlikely to reverse. "Dealers seem to be acknowledging this looming challenge," MMA notes.

December 29 -

Investors will also receive $139 billion of interest payments in 2022, about $593 million more than in 2021, according to a report from CreditSights.

December 28 -

Municipals are sitting out the ups and downs in equities and UST, with $12 million scheduled for the primary in the final week of 2021.

December 23 -

“Our state’s strong economic recovery has accelerated back to pre-pandemic levels for unemployment and GDP,” said Gov. Bill Lee.

December 17 -

The weaker-than-expected employment report sent U.S. Treasury yields lower and equities sold off. Munis did what they've been doing — mostly ignored it.

December 3 -

Refinitiv Lipper reported a significant drop in municipal bond mutual fund inflows at $36 million in the latest week, a signal the volatility of other markets may be creeping in. High-yield saw $53 million of inflows.

December 2 -

ICI reported $1.43 billion of inflows into municipal bond mutual funds in the week ending Nov. 17, down from $1.61 billion in the previous week.

November 24 -

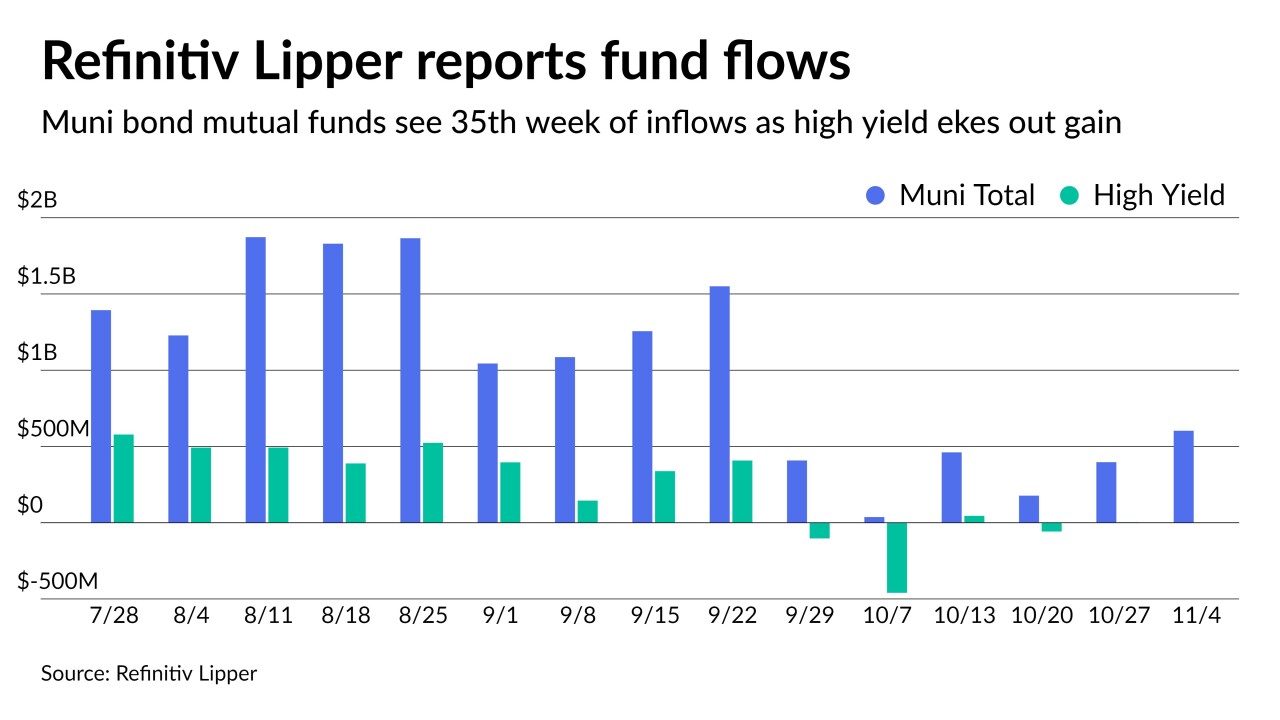

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

November 3