Municipals ended the week steady to slightly weaker in spots, even as U.S. Treasuries sold off and equities ended mixed on inflation concerns and more hawkish Fed speak.

Municipal yields have risen in response to Treasuries, but were mostly unmoved by Friday's selloff, again lagging taxable counterparts as munis are wont to do on a Friday ahead of a holiday. Municipal triple-A benchmarks were little changed to one to two basis point cuts while the UST 5-year and 10-year hit new highs and the long end lost up to eight basis points.

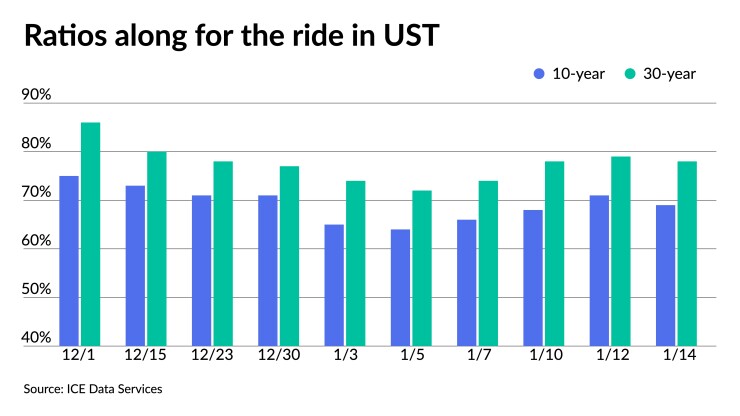

Municipal to UST ratios fell on the day's moves. The five-year was at 52%, 67% in 10 and 78% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 51%, the 10 at 70% and the 30 at 78%.

The new issue calendar grows to $7.12 billion for the holiday-shortened week, with $5.783 billion of negotiated deals and $1.332 billion of competitive loans. The largest deal of the week comes from the New York City Transitional Finance Authority with $950 million of exempts and $250 million of taxables with other large notable deals scheduled from the BBB-rated New Jersey Transportation Trust Fund Authority, the Metropolitan Washington Airports Authority, Texas PSF school deals and a few large corporate CUSIP healthcare deals.

Gilt-edged Fairfax County, Virginia, and the Virginia Public School Authority lead the competitive calendar.

After a rocky start to the year, rates appear to have stabilized for now, but inflation breakevens have continued to decline, according to Barclays PLC.

Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said as muni ratios have risen, supply has begun to ramp up, and fund flows have fallen, more volatility may ensue, which they see as an opportunity.

The front end of the tax-exempt yield curve has underperformed as a result of a spike in rate volatility and market recognition that a hiking cycle is on the horizon.

“Going into 2022, we have been especially cautious on the five-year part of the curve due to its richness and vulnerability to rate hikes, and it has finally started adjusting this week, with five-year ratios moving higher, and we might see further underperformance later in the year, with our year-end target of 60%,” they said.

The 5s10s muni curve is presently at its flattest position in over two years as a result of this week's move, but Barclays expects it to flatten significantly further in the coming weeks, perhaps approaching its pre-pandemic lows from the summer of 2019.

They would ordinarily advocate longer-dated municipal securities as the Fed's rate hike cycle approaches, as yield curves tend to flatten once the Fed begins raising rates. However, they are concerned about rate volatility spilling over into the municipal market, which would likely have a big impact on the long end.

The optimum risk-reward for investors remains in the belly of the curve at this time, they said.

They said this week's trading activity has been rather subdued mainly because lower supply. The Bond Buyer's 30-day visible supply sits at $10.56 billion while net negative supply is at $12.996 billion, per Bloomberg data.

“With issuance expected to ramp up in the coming weeks, and muni flows finally responding to rate volatility, activity will likely start picking up again,” they said. “Although the market environment might remain challenging, investors will likely find some attractive opportunities in the near future.”

Secondary trading

Maryland 5s of 2023 at 0.35%. Harford County, Maryland, 5s of 2023 at 0.43%-0.41%. University of California 5s of 2023 at 0.40%.

Los Angeles Department of Power and Water 5s of 2024 at 0.58%. North Dakota Public Finance Authority 5s of 2024 at 0.60%. Connecticut 5s of 2025 at 0.69%. Georgia 5s of 2026 at 0.85%.

Florida Board of Education 5s of 2029 at 1.18%. Washington County School District, Utah, 5s of 2030 at 1.18%. Harris County, Texas, 5s of 2034 at 1.39%.

Massachusetts 5s of 2048 at 1.77%. Los Angeles DWP 5s of 2051 at 1.84%.

AAA scales

Refinitiv MMD's scale was unchanged at the 3 p.m. read: the one-year at 0.33% and 0.46% in two years. The 10-year at 1.18% and the 30-year at 1.64%.

The ICE municipal yield curve showed yields were slightly weaker across the curve: 0.33% (+1) in 2023 and 0.52% (+2) in 2024. The 10-year was up two at 1.24% and the 30-year yield was up one basis point to 1.65% in a 4 p.m. read.

The IHS Markit municipal analytics curve was unchanged: 0.34% in 2023 and 0.47% in 2024. The 10-year at 1.19% and the 30-year at 1.67% as of a 4 p.m. read.

Bloomberg BVAL was softer in spots: 0.34% (+1) in 2023 and 0.47% in 2024. The 10-year steady at 1.21% and the 30-year down sat at 1.65% at a 4 p.m. read.

Treasuries and equities sold off.

The five-year UST was yielding 1.554%, the 10-year yielding 1.781%, the 20-year at 2.178% and the 30-year Treasury was yielding 2.118% at the close. The Dow Jones Industrial Average lost 201 points or 0.56%, the S&P was up 0.08% while the Nasdaq gained 0.59% at the close.

Economy

Data released Friday were termed “disappointing” by analysts, as inflation and the Omicron variant took their toll on consumers.

“Our argument that consumers will be resilient in the face of the Omicron variant took a few body blows,” Wells Fargo Securities Senior Economist Tim Quinlan and Economic Analyst Sara Cotsakis said. They had contended that each new COVID variant fazed consumers less than previous waves, but Omicron’s widespread infections are “hard to ignore.”

“Still, we suspect that Omicron is more of a boogeyman that makes for easy explanations,” they said. “Our take is that inflation is the more warranted concern with prices rising the fastest pace in nearly 40 years.”

Retail sales plunged 1.9% in December after a downwardly revised 0.2% gain in November. Economists polled by IFR Markets expected a flat reading. Excluding automobiles, sales dropped 2.3% after a 0.1% rise in November. Economists expected a 0.2% rise.

“The drop was even larger after adjusting for the 0.5% advance in inflation during the month,” said Grant Thornton Chief Economist Diane Swonk. “The drop in spending overall was the largest monthly pullback since February 2021, which occurred as hospitalizations surged last winter. That bodes poorly for January and underscores the risk of a hard stop or contraction in growth during the first quarter.”

Sales fell as price increases “are beginning to dampen demand,” said Berenberg Capital Markets Chief Economist for the U.S. Americas and Asia Mickey Levy. They also reflect “the impact of the highly transmissible Omicron variant, ongoing supply constraints, and a ‘pulling’ forward of holiday spending.”

The impact of inflation is “evidenced by the broad-based December slump in retail sales, in which 10 of 13 major categories experienced a decline in sales over the month,” he said. But, Levy added, the Omicron impact is also seen.

The University of Michigan consumer sentiment index fell to 68.6 in January from 70.6 in December, while the current conditions index slipped to 73.2 from 74.2 and expectations declined to 65.9 from 68.3. Economists expected readings of 70.0, 73.5 and 69.0, respectively.

“While the Delta and Omicron variants certainly contributed to this downward shift, the decline was also due to an escalating inflation rate,” said Richard Curtin, the survey's chief economist.

Quinlan and Cotsakis expect consumer spending will be above-trend in 2022, although the consumer sentiment report notes “prices are certainly weighing on consumers’ mindsets.” They expect “confidence will likely be shaken in the next couple of months amid these lingering risks.” While Omicron “will disrupt activity,” they don’t expect it to be the headwind to consumption that the Delta variant was.

“For now, inflation is the bigger danger to the consumer outlook,” they said.

Also released Friday, industrial production fell 0.1% and capacity utilization dipped 0.1-point to 76.5%. economists expected a 0.3% rise in production and a 77.0% capacity use level.

Nominations

Early Friday, Sarah Bloom Raskin was

Raskin previously served as a Fed governor from October 2010 through March 2014, she also serves as deputy Treasury Secretary.

Cook, a professor of Economics and International Relations at Michigan State University, would be the first Black woman to serve as governor, if confirmed.

Jefferson is vice president for academic affairs and dean of faculty and the Paul B. Freeland professor of economics at Davidson College.

Raskin’s nomination will be challenged by Republicans, with Sen. Pat Toomey of Pennsylvania, the top Republican on the Banking Committee, on record that he has “serious concerns” about Raskin and extending the Fed’s mandate beyond price stability and maximum employment.

Cook and Jefferson may have dovish tendencies, said Peter Ireland, an economics professor at Boston College and member of the Shadow Open Market Committee, but “their policy decisions won't deviate too much from the consensus shaped by Chair Powell,” given persistently high inflation being the major economic risk to the economy now.

“Raskin has views on bank and financial regulation that are very different from Randal Quarles,” whom she would replace, Ireland said. “Assuming she's confirmed, it's on the regulatory front that we're likely to see the biggest changes.”

Primary to come

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Thursday $950 million of tax-exempt future tax secured subordinate bonds, Fiscal 2022 Series C, Subseries C-1. J.P. Morgan Securities.

The New Jersey Transportation Trust Fund Authority (Baa1/BBB/BBB+/A-) is set to price Wednesday $750 million of transportation program bonds, 2022 Series BB. J.P. Morgan Securities.

The Metropolitan Washington Airports Authority (A2/AA//) is set to price Thursday $739.815 million of Dulles Toll Road revenue refunding bonds, Series 2022, insured by Assured Guaranty Municipal Corp., consisting of $418.64 million of second senior lien revenue refunding bonds, Series 2022A, serials 2051-2053 and $321.175 million of federally taxable second senior lien revenue refunding bonds, Series 2022B, serials 2025-2037, term 2041. Wells Fargo.

Main Street Natural Gas (/BBB-///) is set to price Wednesday $600 million of gas supply revenue bonds, Series 2022C. J.P. Morgan Securities.

Dallas Independent School District in Texas (Aaa/AAA/AAA/) is set to price Thursday $387.07 million of unlimited tax school building bonds, Series 2022, serials 2023-2052. HilltopSecurities.

WakeMed Health and Hospitals in North Carolina (A2//A+/) is set to price Thursday $300 million of corporate CUSIP taxable bonds, Series 2022A J.P. Morgan Securities.

Claremont McKenna College in California (Aa3///) is set to price Wednesday $300 million of corporate CUSIP taxable bonds, Series 2022. Morgan Stanley & Co.

Hawaii (A1/A+/A+//) is set to price Wednesday $273.655 million of alternative minimum tax airports system revenue bonds, Series 2022A and refunding Series 2022B, consisting of $219.26 million of Series 1 and $54.395 million of Series 2. Morgan Stanley & Co.

Hidalgo County Regional Mobility Authority in Texas (Baa3/BB+///) is set to price Thursday $211.315 million of senior lien toll and vehicle registration fee revenue bonds, Series 2022A and junior lien toll and vehicle registration fee revenue and refunding bonds, Series 2022B, consisting of $69.205 million of Series 1, $79.153 million of Series 2, $30.6 million of Series 3 and $32.358 million of Series 4. Morgan Stanley & Co.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price Wednesday $190 million of non-alternative minimum tax social residential mortgage revenue bonds, Series 2022A, serials 2023-2033, terms 2037, 2042, 2047 and 2052. RBC Capital Markets.

The village of Skokie, Illinois, (/AA/AA+/) is set to price Thursday $177.335 million, consisting of $151.060 million, Series 2022A, serials 2022-2040 and $26.275 million, Series 2022B, serials 2022-2041. Baird.

The Wisconsin Health And Educational Facilities Authority (Aa3/AA-//) is set to price Thursday $172.085 million of revenue bonds, Series 2022. J.P. Morgan Securities.

Georgetown Independent School District, Texas, (/AAA//) is set to price Wednesday $165.845 million of unlimited tax school building bonds, Series 2022, PSF. FHN Financial Capital Markets. Georgetown ISD is also set to price Wednesday $103.88 million of taxable unlimited tax refunding bonds, Series 2022-A. FHN Financial Capital Markets.

Orange County Health Facilities Authority, Florida, (//A-//) is set to price Thursday $140.64 million of revenue bonds, Series 2023A. Ziegler.

Ohio (Baa1///) is set to price Thursday $105.2 million of higher educational facility revenue bonds, serials 2027-2037, terms 2042, 2047 and 2052. KeyBanc Capital Markets.

Missouri Public Utilities Commission (///) is set to price Thursday $100 million of interim construction notes, Series 2022. D.A. Davidson & Co.

Competitive:

Virginia Public School Authority (Aaa/AAA/AAA/) is set to sell $115.11 million of special obligation school financing bonds, Chesterfield County Series 2022 at 10:30 a.m. eastern Tuesday.

Fairfax County, Virginia, (Aaa/AAA/AAA/) is set to sell $272.255 million of public improvement bonds, Series 2022A at 10:45 a.m. eastern Wednesday.

New York City Transitional Finance Authority (/AAA//) is set to sell $69.005 million of future tax secured taxable subordinate bonds, Fiscal 2022 Subseries C-3 at 11:15 a.m. eastern Thursday.

New York City Transitional Finance Authority (/AAA//) is set to sell $180.995 million of future tax secured taxable subordinate bonds, Fiscal 2022 Subseries C-2 at 10:45 a.m. Thursday.

Cobb County School District in Georgia (MIG1/A-1+//) is set to sell $100 million of short-term construction notes, Series 2022 at 10:30 a.m. Thursday.