-

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

November 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29 -

Amid a flattening municipal yield curve and inversion of the Treasury market, new issues fared better than the secondary on Thursday as participants prepared for month end.

October 28 -

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year.

October 26 -

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25 -

Profits were up in New York City's securities industry, according to the state comptroller's annual report, even as job losses accelerated.

October 21 -

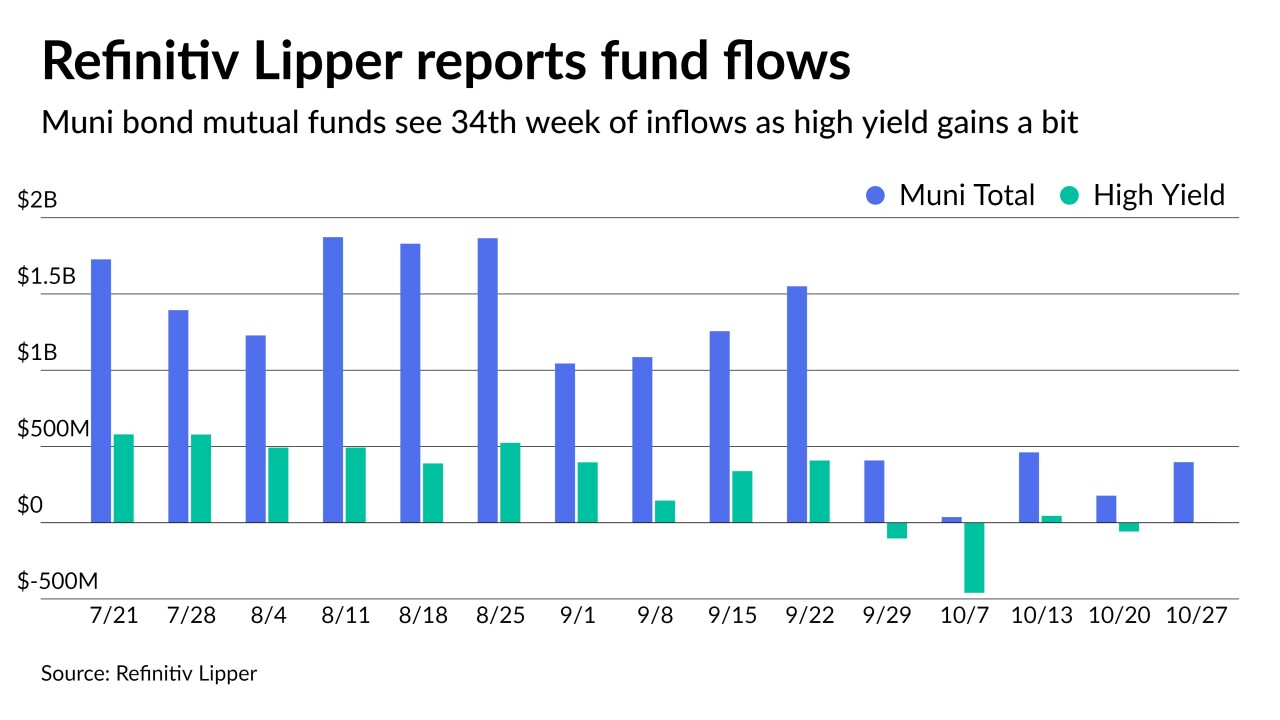

The Investment Company Institute reported $385 million of inflows while ETFs fell to $124 million.

October 20 -

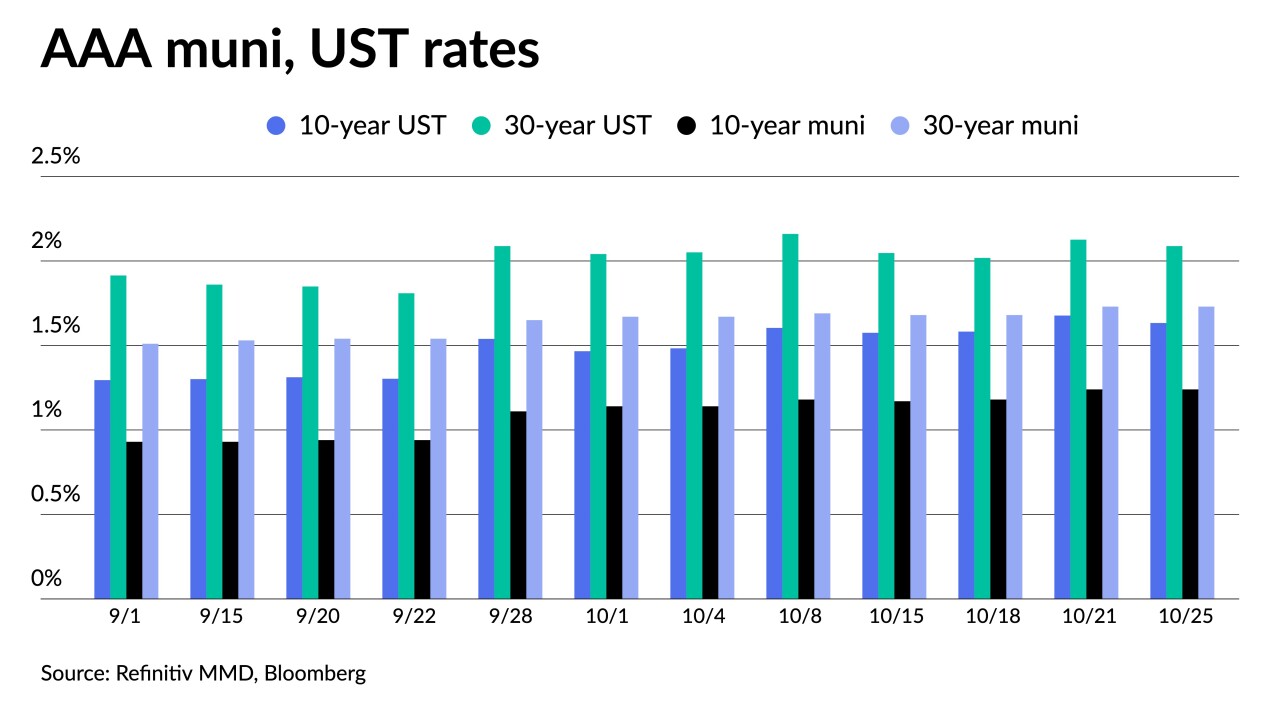

Triple-A benchmarks saw one basis point cuts in spots inside 10 years while the five-year U.S. Treasury hit a high of 1.154%.

October 18 -

Friday’s data suggested inflation remains a problem, as the voices calling for Federal Reserve action increase.

October 15 -

Municipals outperformed the move in taxables Friday but weakness hangs over the market as fund flows lessen and supply increases. Taxable munis may be keeping exempt rates from moving higher.

October 8