-

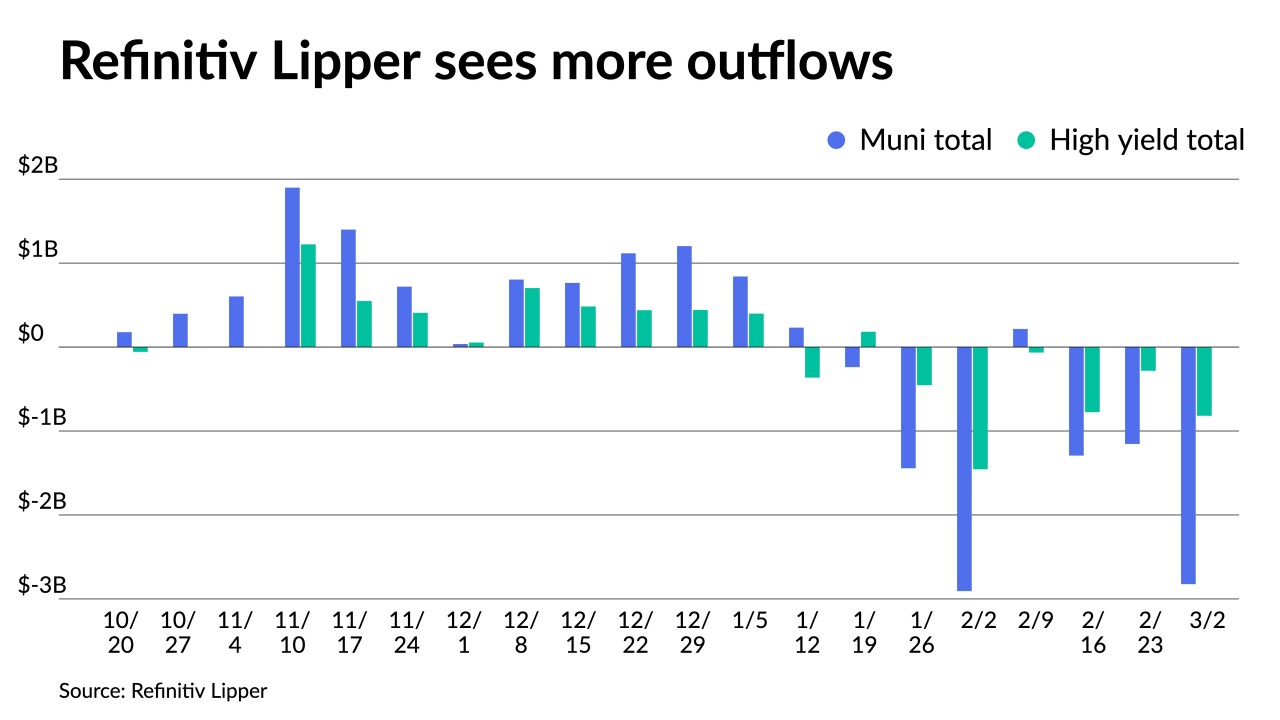

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.875 billion of outflows, down from $3.548 billion of outflows in the previous week.

April 28 -

In a recent survey, just over half of community bankers expressed concern that the central bank will harm the U.S. economy by raising rates too fast in its quest to contain inflation.

April 28 -

The Economic Development Bank estimated the first half of fiscal 2022 had experienced a 5.5% increase in growth, upward from a 3.6% increase in previous estimates.

April 6 -

Ten states, includeing five in the Southeast, pre-pandemic employment levels in January, according to Fitch Ratings. In an update, the U.S. Labor Department reported Florida’s seasonally adjusted unemployment rate fell to 3.3% in February.

March 25 -

Outflows continue but dropped significantly in the latest week with Refinitiv Lipper reporting $662 million of outflows from municipal bond mutual funds following $2.823 billion the week prior.

March 10 -

Russia’s invasion upends a return to normal as the economic impact of COVID-19 wanes, UCLA Anderson Forecast economists said.

March 9 -

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

Between the long holiday weekend and investors trying to absorb the Russia-Ukraine developments, it was a slow start to the week in the municipal market.

February 22 -

Refinitiv Lipper reported $238.926 million of outflows, but $182.035 million of inflows to high-yield, reversing last week's outflows. New-issues faced concessions.

January 20 -

The 2-, 5- and 10-year UST is higher than before the pandemic began as investors factor in a rate hike as soon as March.

January 18