-

Analysts had mixed reactions on what could have caused the decline, pointing to some municipalities closing out their fiscal years at the end of June.

July 7 -

More market participants are introducing FinTech into the public finance space, hoping to provide more transparency and clarity for issuers and investors alike.

July 7 -

The Garden State defers nearly $2 billion of spending into the new fiscal year, which could force them to make difficult choices in the fall.

July 7 -

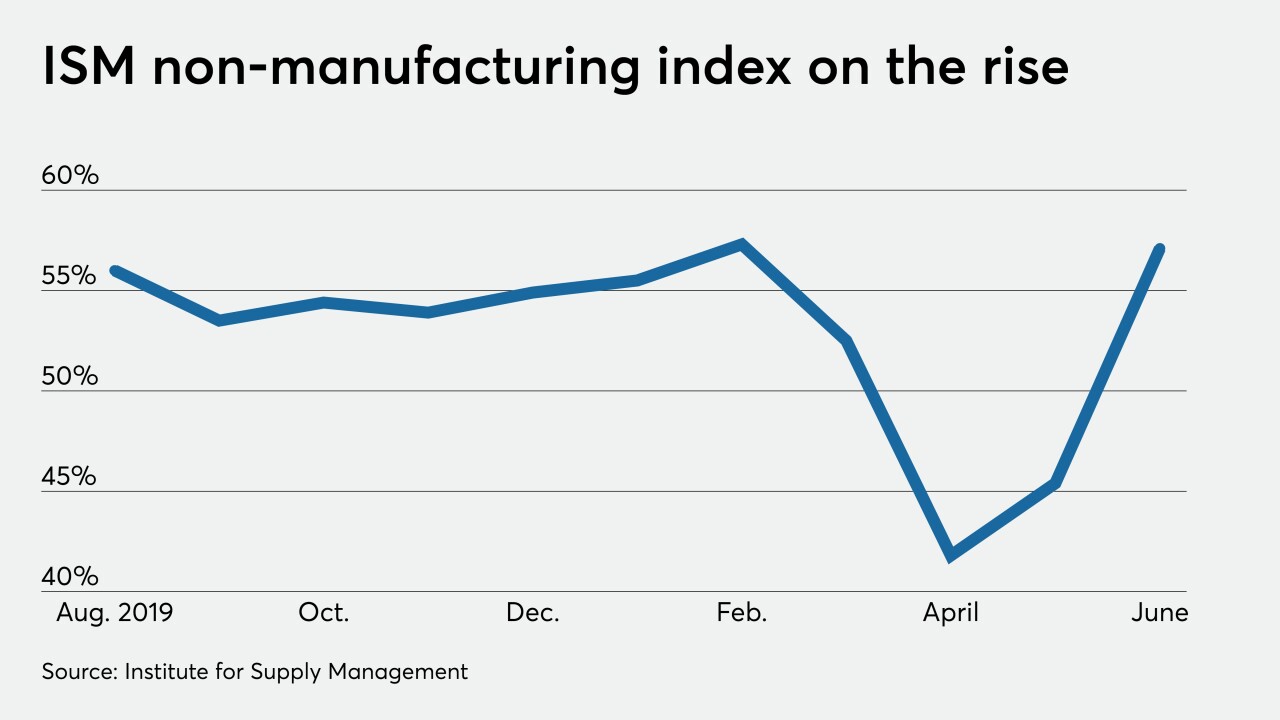

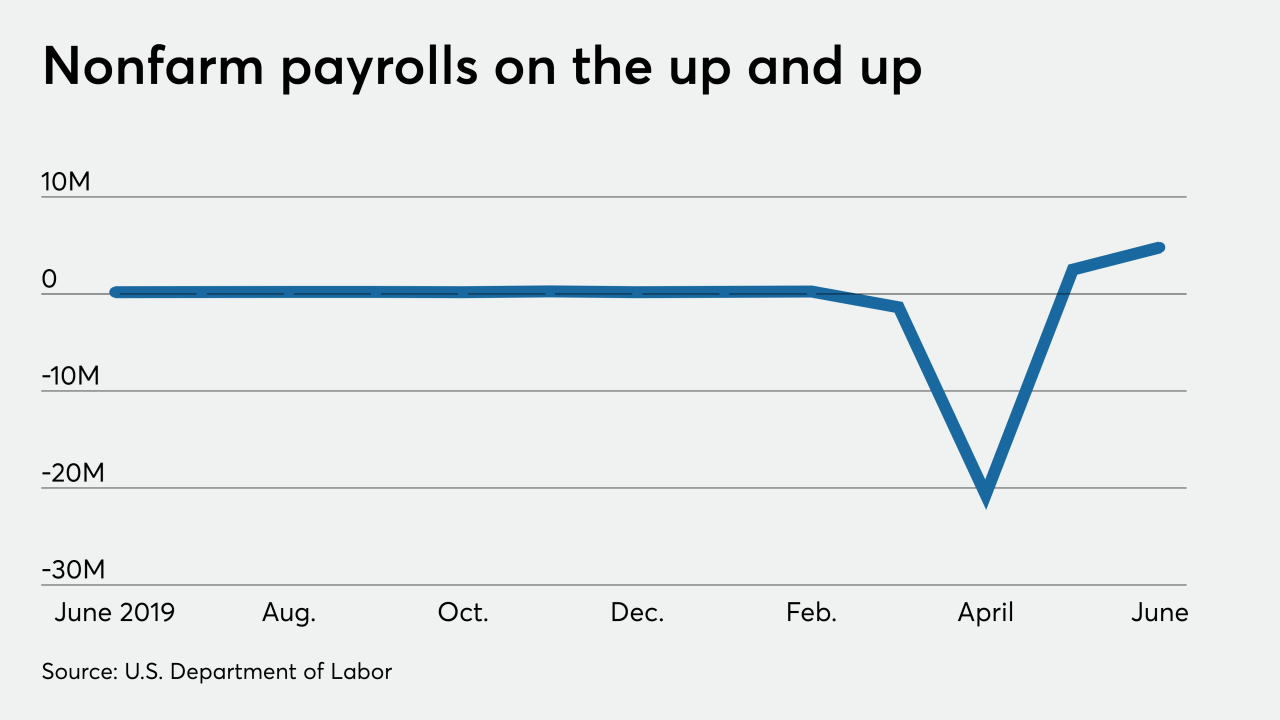

While the worst of the predictions failed to materialize — unemployment never hit the levels expected and most numbers started improving after a month or two — a second wave of the virus could take another bite out of the economy.

July 7 -

Our third monthly survey found almost six out of 10 employers report that their plans for the return to work are stymied by uncertainty — specifically, a lack of clarity on the right timing, and persistent questions about how to provide a safe environment for their employees.

July 7 - Non-profits

They contribute more than $77 billion annually, or 9.4% of city economic output, according to the city comptroller.

July 7 -

Texas reported June revenues improved from May, but still down year-over-year.

July 6 -

The online NGA meeting is the latest in a string of conferences that have been moved to the web this year because of the COVID-19 pandemic.

July 6 -

Analysts remained concerned about the employment numbers as some states had to postpone or reverse some reopening plans.

July 6 -

Jay Clayton's recent testimony to federal lawmakers was "troubling," the dealer group said in a letter to the SEC chairman.

July 6 -

The Bi-State Development Agency, which manages St. Louis public transit, took a two-notch downgrade from S&P Global Ratings over the pandemic's impacts.

July 2 -

The New York/New Jersey agency's issuance of $1.1 billion in taxable notes underscores multi-year revenue challenges it confronts due to the COVID-19 pandemic.

July 2 -

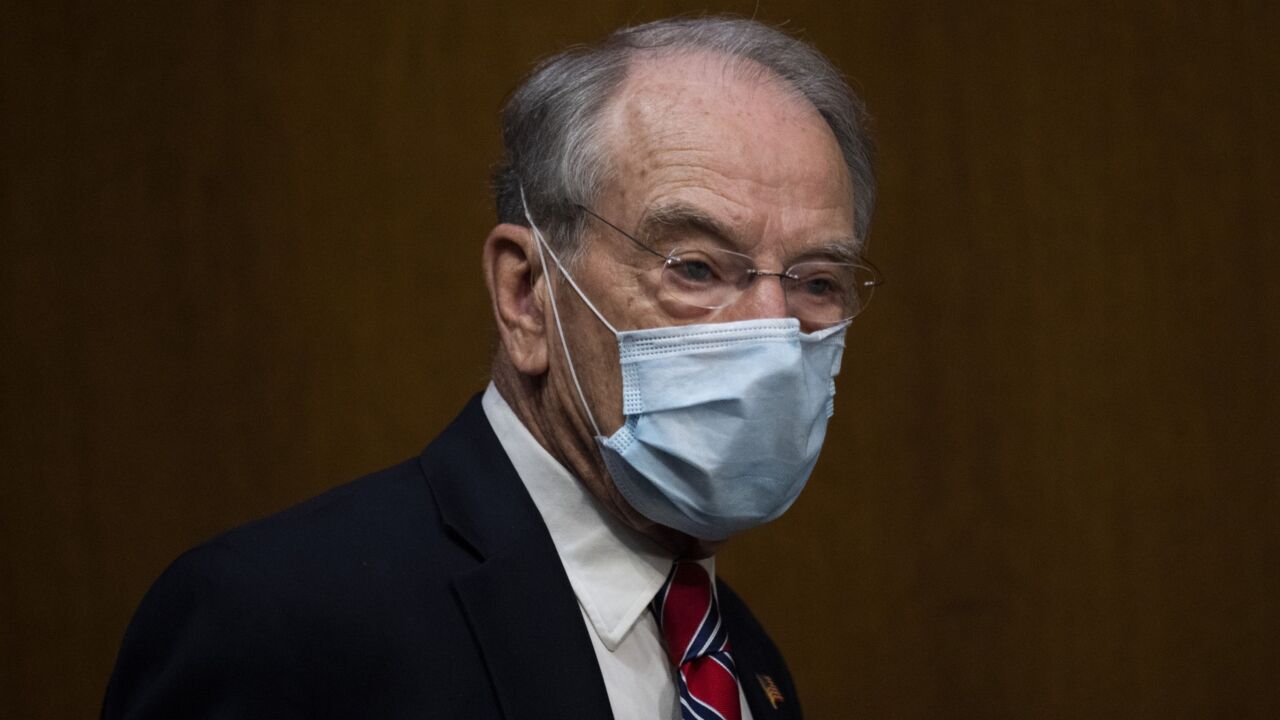

Sen. Chuck Grassley, R-Iowa., said the future needs of issuers are uncertain.

July 2 -

Both the June jobs report and newest jobless claims report came in better than expected as the U.S. economy continues to improve.

July 2 -

Traders and strategists say the dearth of tax-exempt debt and the surge of taxable issuance is keeping the market steady.

July 1 -

The deficits for the next two fiscal years remain unaddressed.

June 30 -

Gov. John Carney signed a $703 million capital bond bill for fiscal 2021 that was reduced by $185 million due to revenue losses caused by the COVID-19 pandemic.

June 30 -

Chicago’s net pension liabilities rose to $31.8 billion in 2019 from $30.1 billion.

June 30 -

Fed Chair Jerome Powell told House Financial Services Committee Chairwoman Maxine Waters that the Fed was looking at ways to adjust the Municipal Liquidity Facility to make some additional issuers eligible.

June 30 -

The local government's inertia and PROMESA's unwieldy structure, along with natural disasters and a global pandemic, have impeded Puerto Rico's recovery.

June 30