Commercial banking

-

Tim Ruby has joined Wells Fargo as its healthcare, higher education and not-for-profit division executive. He will be based in Chicago.

July 14 -

Andrew Nakahata, who led UBS' western public finance region, will now do the same for TD Securities.

March 25 -

Costanzo is only the fourth woman to lead a municipal banking division. Huntington has hired Citi's entire Midwest public finance banking group, and Costanzo said the firm intends to further grow its footprint in the municipal space.

March 7 -

Cabrera Capital Markets is welcoming three new public finance hires who are joining the firm from UBS: Shawn Dralle, Shawnell Holman and Chris Bergstrom.

March 7 -

Loop Capital Markets is adding four seasoned public finance professionals from Citi and UBS: John Malpiede, John Giammarino, Alain Garcia and Candace Kelly.

March 6 -

Coolidge joins Oppenheimer from UBS, which closed its public finance business in October.

January 16 -

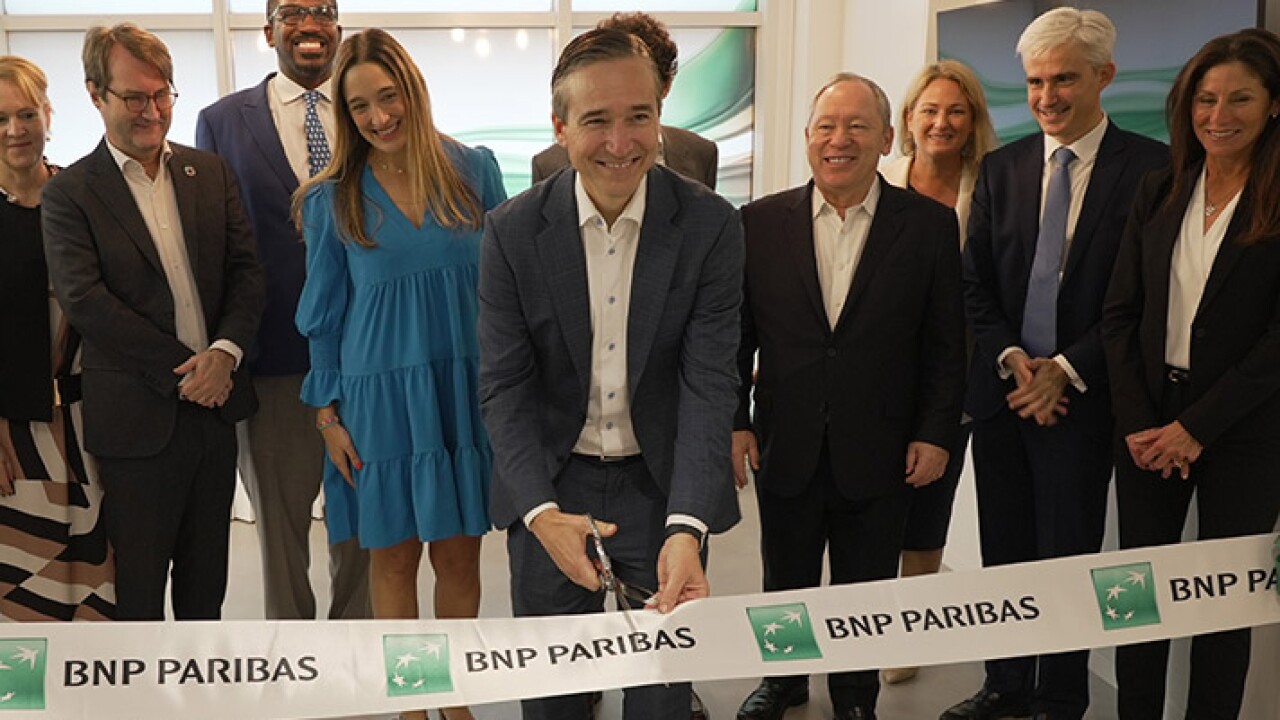

"BNP Paribas choosing Miami to open its newest office reinforces our community's status as a top financial market within the global economy," said Miami-Dade County Mayor Daniella Levine Cava.

December 7 -

Texas Attorney General Ken Paxton's office said it's reviewing whether 10 financial companies, including Bank of America and JPMorgan Chase, violate a state law that punishes firms for restricting their work with the oil-and-gas industry because of climate-change concerns.

October 18 -

The top three trustee banks have an average dollar amount of more than $20 billion in the first half of 2023.

September 7 -

The bank hasn't managed debt sales in Texas since a measure took effect in 2021 that bars governmental entities from working with companies that "discriminate" against firearms businesses. BofA's "current risk-based framework and policies" can comply with that law, a lawyer for the bank has told the state.

June 27 -

The decrease in long-term interest rates this year has helped banks' bond portfolios recover a bit. Some of them may consider restructuring their securities portfolios in the short run, and longer-term changes are also possible as the fallout from last month's crisis continues.

April 12 -

Shares in Silicon Valley Bank's parent company plunged 60% after executives announced they would sell a large bond portfolio at a big loss. The market "seems to be pricing in greater liquidity needs" than the bank currently anticipates, one analyst said.

March 9 -

Steven Kantor, a regional managing director based in New York, was among those cut, sources said.

January 19 -

Prepaid gas deals were notably absent from 2020's record-breaking municipal market as COVID-19 caused market disruptions for banks that provide credit support.

January 13 -

As it reaches its 50th year in business, Ramirez ranks 15th industry wide among all negotiated and competitive underwriters with 47 deals totaling $6.1 billion in 2020.

January 5 -

UMB plans to focus on higher education with its initial thrust into advisory services.

July 21 -

Getting crisis leadership right is vital to the well-being of employees, customers, and ultimately the business itself.

June 4 -

Oppenheimer will have its work cut out for it with the aim of being a major player in California's municipal banking business.

June 2 -

Richard G. Bartow and his son Richard T. Bartow joined the office this week and will focus on K-12 education.

March 4 -

The turmoil that’s gripped repo markets has turned into a stream of low-risk profits for some banks.

September 30