-

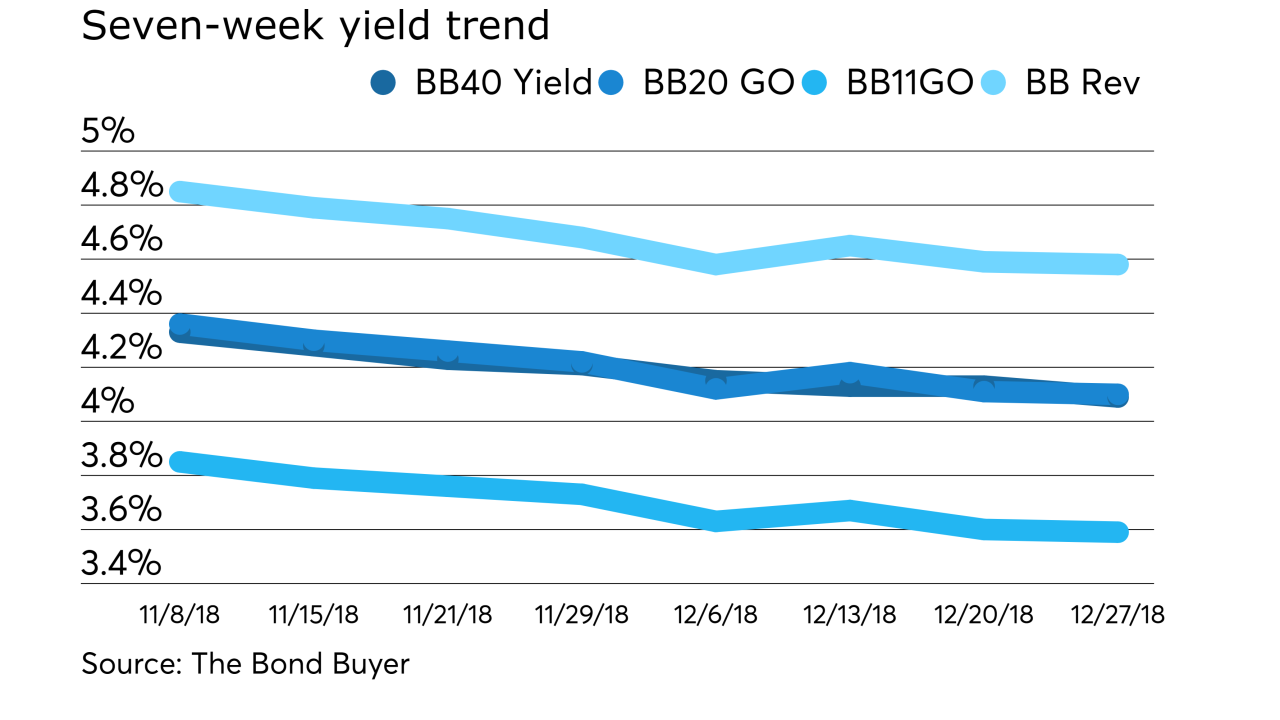

In the week ended Dec. 27, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 4.09% from 4.13% last week.

December 27 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged from 4.13% the week before.

December 20 -

BondLink is teaming up with Municipal Market Analytics to deliver bond market research to BondLink issuer clients.

December 20 -

In the week ended Dec. 13, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 4.13% from 4.15% last week.

December 13 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 4.15% from 4.21% the week before.

December 6 -

In the week ended Nov. 29, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 4.21% from 4.23% last week.

November 29 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 4.28% from 4.33% the week before.

November 15 -

J.B. Pritzker coasted to victory without offering much detail about how he plans to solve the state's fiscal problems.

November 9 -

In the week ended Nov. 8, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 4.33% from 4.26% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

November 8 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, inched up to 4.26% from 4.25% the week before.

November 1