-

The municipal bond industry has been following the rest of Wall Street down the path to a cold world of statistics driven by algorithms and various formulas to try to perfect an imperfect product.

October 30

-

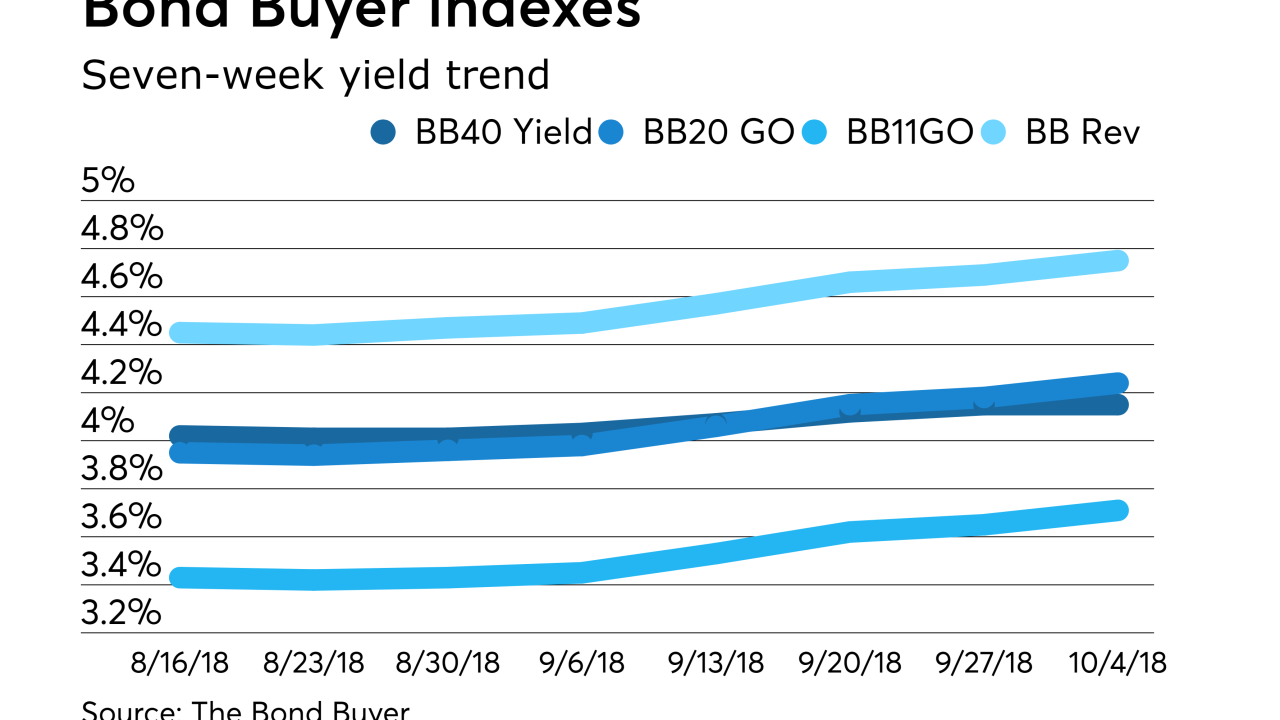

In the week ended October 25, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell to 4.25% from 4.28% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

October 25 -

The city is also considering its first general obligation bond issue since 2017.

October 18 -

The Boston-based firm announced digital enhancements for investor communications, treasury management and disclosure compliance.

October 16 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged from 4.15%.

October 4 -

In the week ended September 27, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 4.15% from 4.12% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

September 27 -

Connecticut’s planned issue of credit revenue bonds is a “potentially terrible long-term solution,” says Municipal Market Analytics.

September 19 -

U.S. Bank’s Tom Gallo looks to the future after a five-decade career that has encompassed everything from pink sheets to the financial crisis.

September 19 -

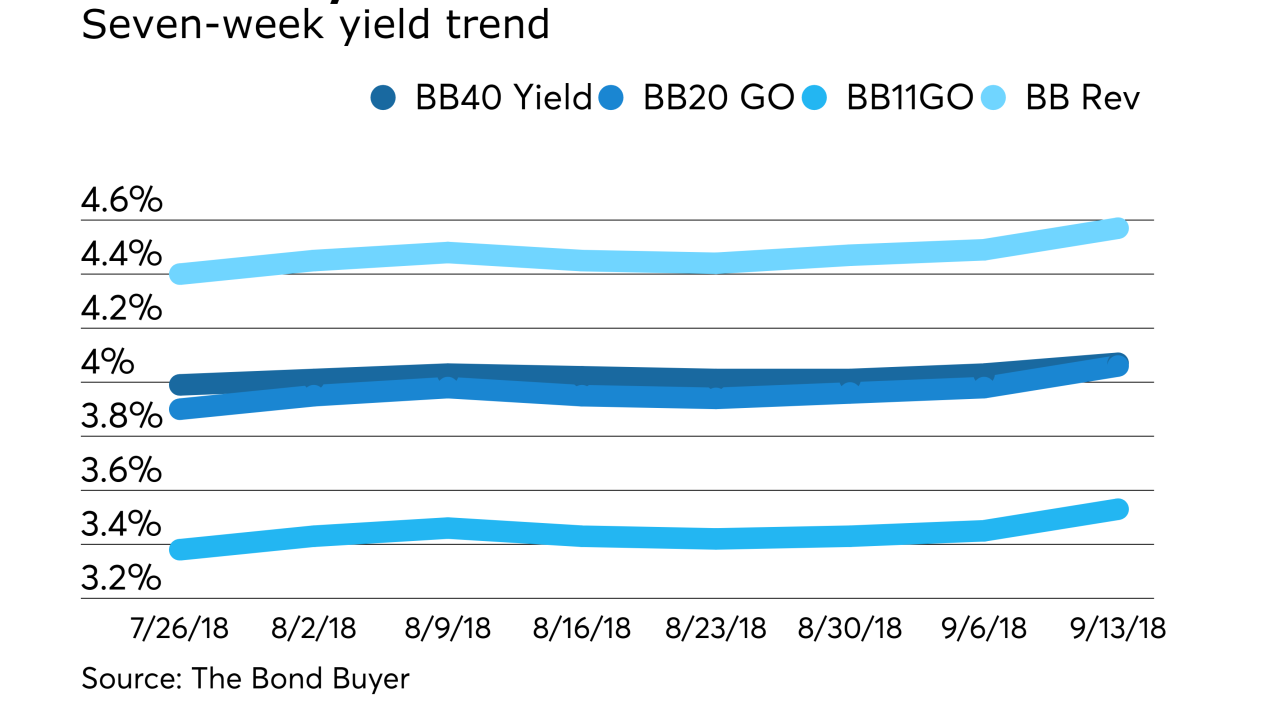

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 4.07% from 4.03% the week before.

September 13 -

The Boston-based muni technology provider has added Tom Paolicelli, John Murphy and Brendan McGrail.

September 11