-

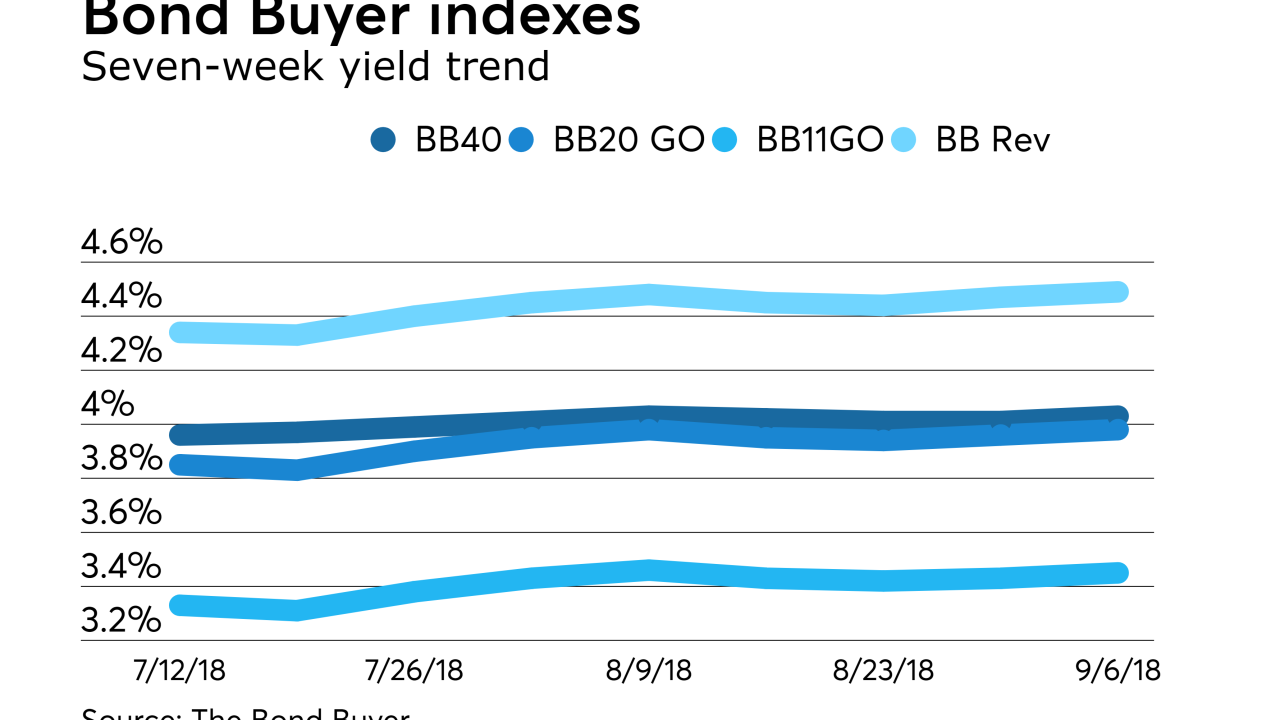

In the week ended September 6, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 4.03% from 4.01% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

September 6 -

In the week ended August 30, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index was unchanged from 4.01% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

August 30 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 4.01% from 4.02% the week before.

August 23 -

Citi's assessment is conditioned on pension obligation bonds being part of a package to tackle the city's pension liabilities.

August 23 -

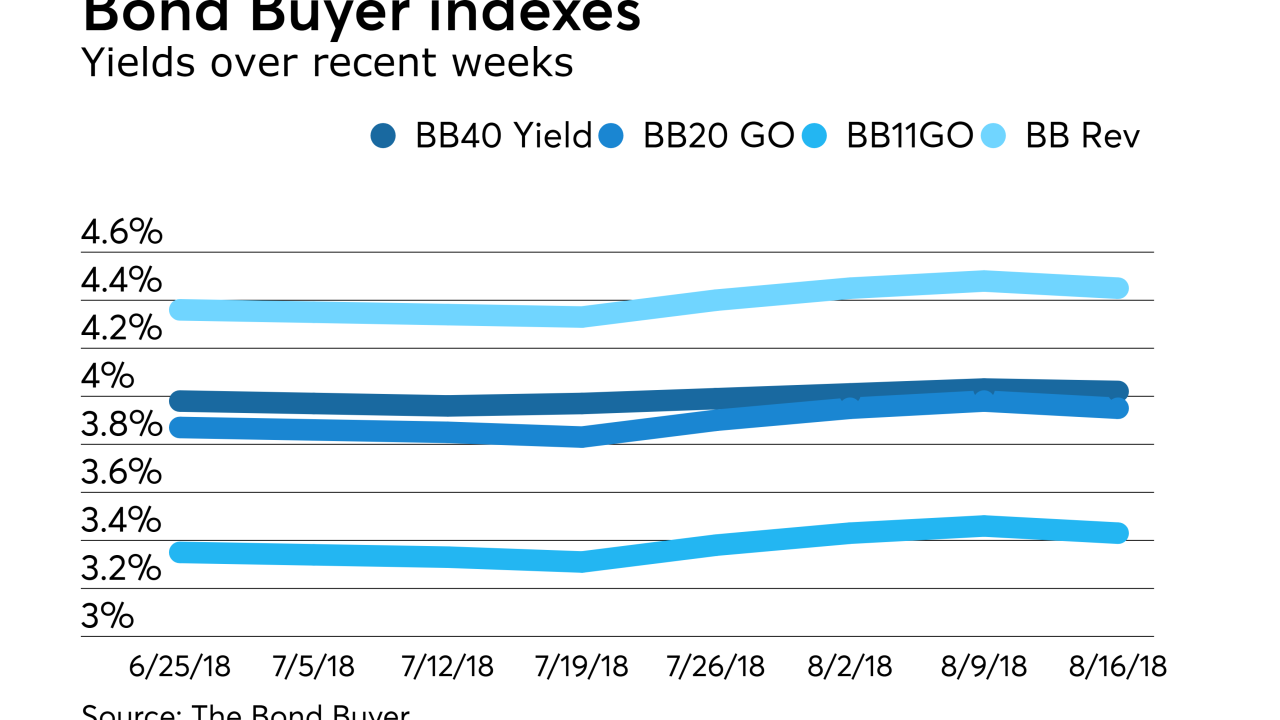

In the week ended August 16, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index dipped to 4.02% from 4.03% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

August 16 -

The new site is evidence of its commitment to transparency, the state's finance secretary says.

August 16 -

Studies of the pricing benefits of the two approaches have been far from conclusive.

August 16John Hallacy Consulting LLC -

The potential sale comes as asset managers grapple with narrowing margins as fees fall and regulatory costs mount.

August 10 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 4.03% from 4.01% the week before.

August 9 -

Bond investors had mixed reactions to the city's announcement that it is exploring a pension bond deal.

August 7