-

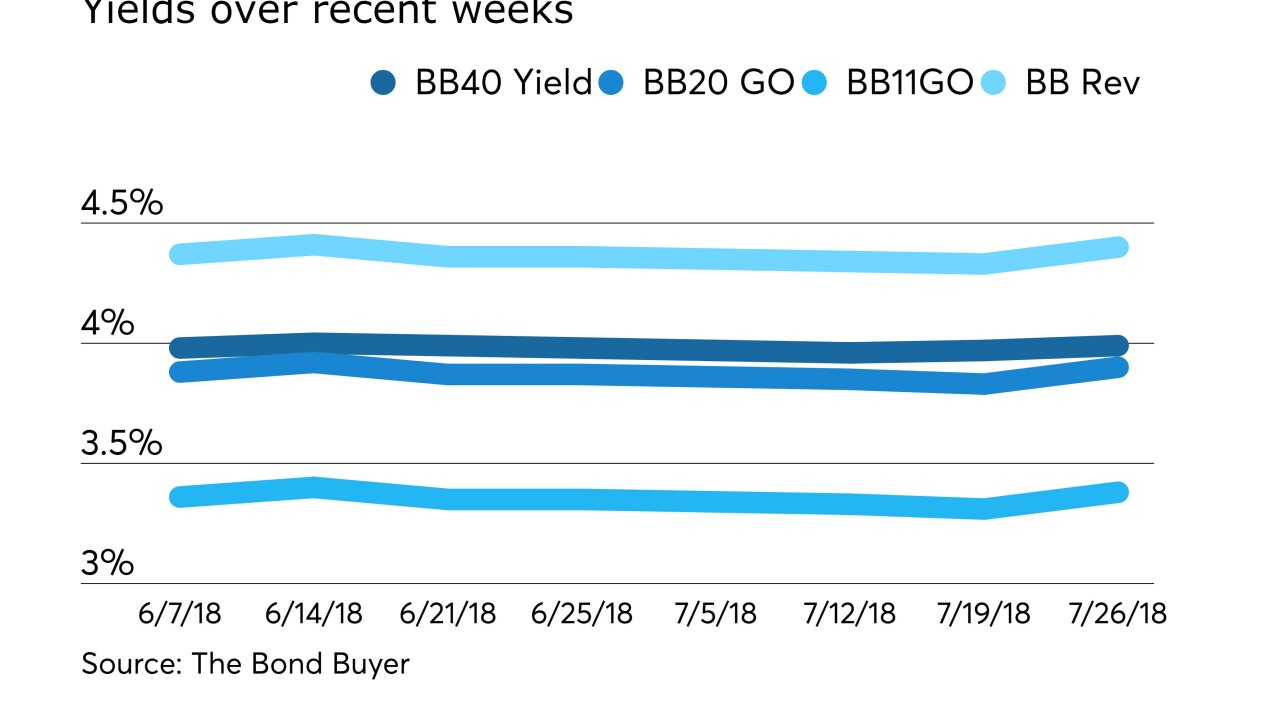

In the week ended August 2, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 4.01% from 3.99% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

August 2 -

CFO Carole Brown says the Windy City is being shortchanged in terms of ratings and yields.

August 1 -

For the first time this year, the municipal bond market generated more volume than it did in the same month of 2017, as July issuance edged 1.3% higher.

July 31 -

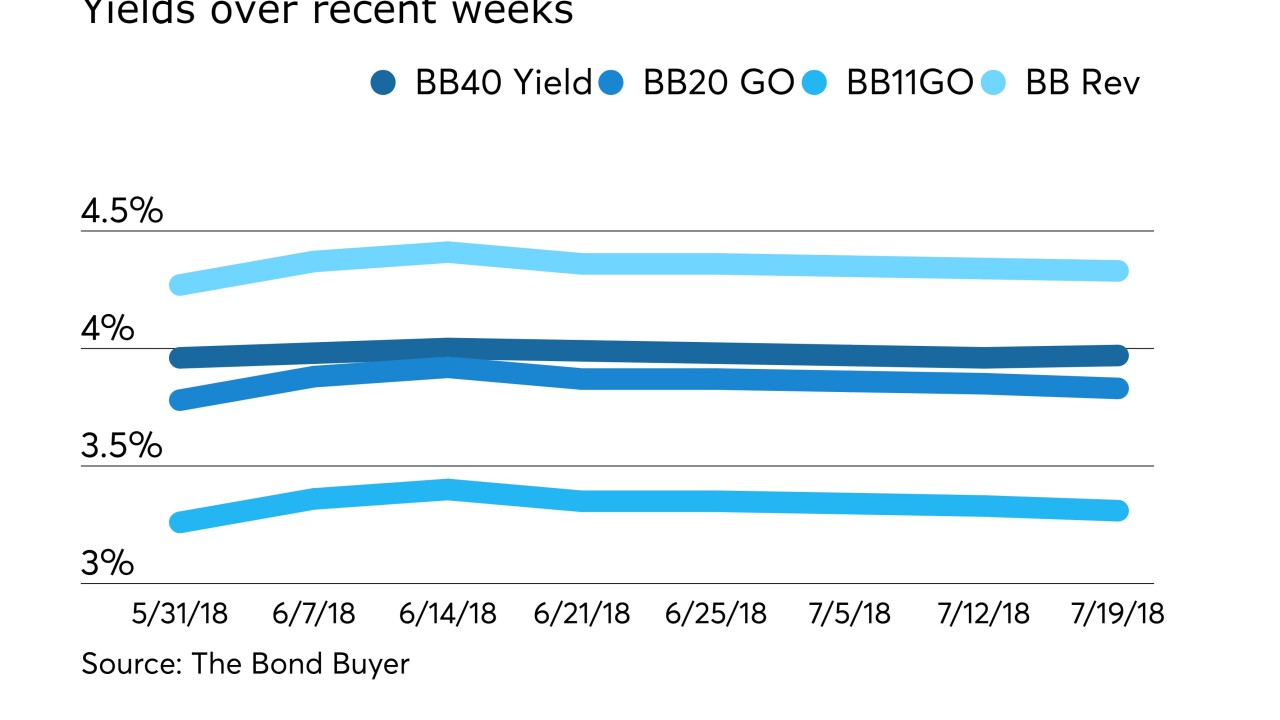

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.99% from 3.97% the week before.

July 26 -

During the new issue pricing period is when institutions place their orders. Independent advisors and their clients are wise to follow the money.

July 24 280 CapMarkets

280 CapMarkets -

Public-purpose need has become an important marker for green bond deals as the market evolves.

July 20 -

In the week ended July 19, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.97% from 3.96% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

July 19 -

With limited supply available, an analyst said North Carolina’s $400 million deal should attract ‘significant demand’ from investors.

July 17 -

The Bond Buyer is proud to kick off the third-annual Rising Stars program, showcasing the brightest young minds in the municipal bond industry. Click to learn how to nominate an emerging leader in muni finance.

July 17 The Bond Buyer

The Bond Buyer -

Luke Bronin, in an interview at the Brookings Municipal Finance Conference, said Connecticut's capital city is "in a stronger position than we’ve been in a long time."

July 17