-

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dropped to 3.75% from 3.78% the week before.

May 16 -

Preston Hollow can proceed with a lawsuit that accuses the municipal bond giant of a campaign of intimidation, a Delaware judge ruled.

May 14 -

Merrigan, a Vietnam veteran who led Ziegler's municipal research team, has died at 68.

May 14 -

In the week ended May 9, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.78% from 3.82% the previous week.

May 9 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.82% from 3.87% the week before.

May 2 -

The municipal bond industry veteran, formerly of PNC and Janney, will head municipal strategy and credit at Hilltop.

April 29 -

In the week ended April 25, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.87% from 3.89% the previous week.

April 25 -

Franklin, with preliminary assets under management of $712.3 billion, including $63.4 billion of tax exempts, has suffered net outflows since 2014.

April 23 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.89% from 3.88% the week before.

April 18 -

Nuveen, in its defense against Preston Hollow's lawsuit, says its conduct in the fight for bond business was legal whether the other firm likes it or not.

April 18 -

Mayor-elect Lori Lightfoot opted not to try to block votes on controversial subsidies that could top $2 billion for two economic development projects.

April 11 -

Lori Lightfoot picked Jeffrey Bethke to help address the city's pension and budget demands when she takes the helm next month.

April 10 -

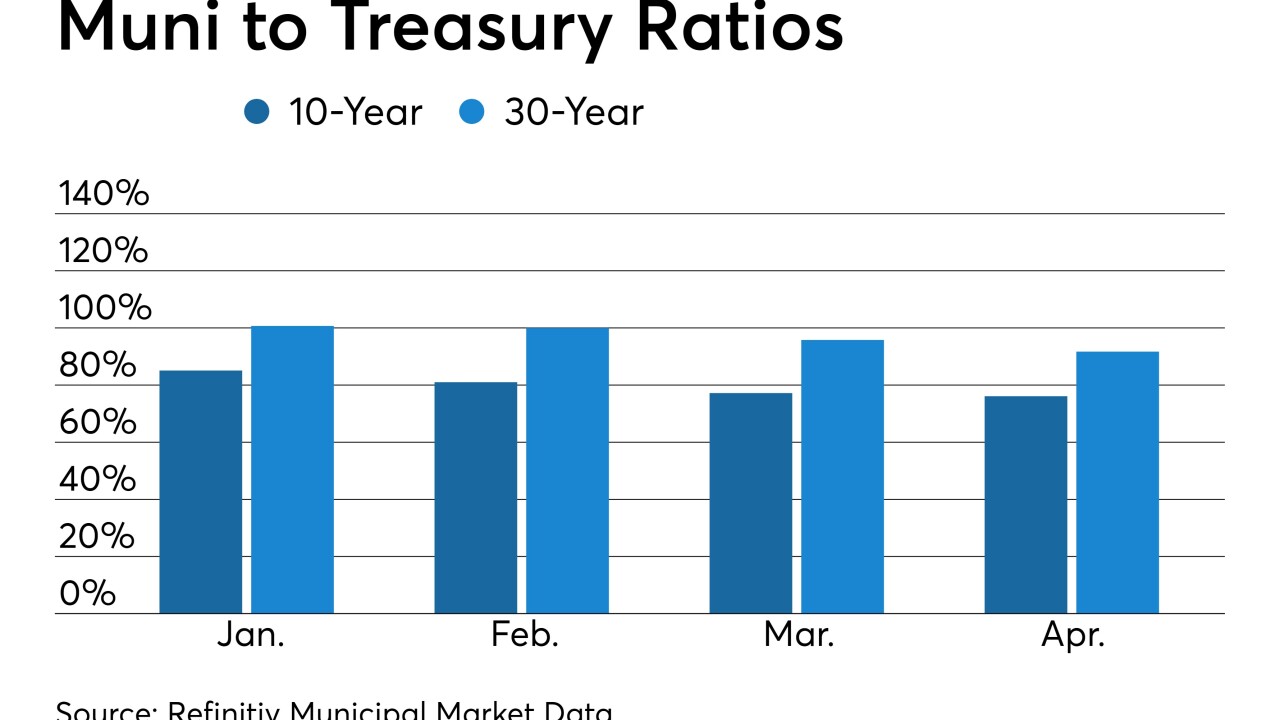

Undersupply and demand for the muni exemption in high tax states are expected to help municipal bonds outperform in the second quarter.

April 5 -

Climate analytics business risQ is partnering with Municipal Markets Analytics to get a better handle on the risk climate change creates for municipal debt.

April 4 -

Twenty-three members of Congress are urging the Oversight Board to pull back the bonds' underwriting and other fees.

April 3 -

In the week ended March 28, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.87% from 3.96% the previous week.

March 28 -

After decades of managing risk for investment clients in volatile markets, Thornburg managing director Chris Ryon is preparing to retire at the end of the year.

March 21 -

Next week's Illinois GO sale will be a muni market referendum on the governor's budget, tax and pension proposals.

March 20 -

The Bond Buyer will be rolling out some changes to how we cover and communicate with the professionals and the leaders who work in and around municipal finance.

March 19 The Bond Buyer

The Bond Buyer -

Preston Hollow's accusations against Nuveen of bully tactics underscore the cutthroat competition for market share.

March 15