-

MSRB worries about "pennying," "filtering," bank loans, pricing

October 18 -

The MSRB expects its new executive budget summary to increase transparency about how the board collects and spends its money.

October 17 -

After infrastructure and health care legislation failed to materialize, the municipal industry turns its attention to the potential benefits – and risks – of tax reforms now before Congress.

October 17John Hallacy Consulting LLC -

Ameriprise Financial Services, Cabrera Capital Markets, R. Seelaus & Co., Performance Trust Capital Partners, and Murray Sinclaire of Ross Sinclaire & Associates signed settlement agreements.

October 16 -

The city brings still-solid credit ratings to its pricing of bonds and certificates of obligation.

October 16 -

Wenatchee, Wash. is back to investment grade after a rough couple of years.

October 13 -

Tax-exempts important, but not enough, infrastructure advocates tell Congress.

October 11 -

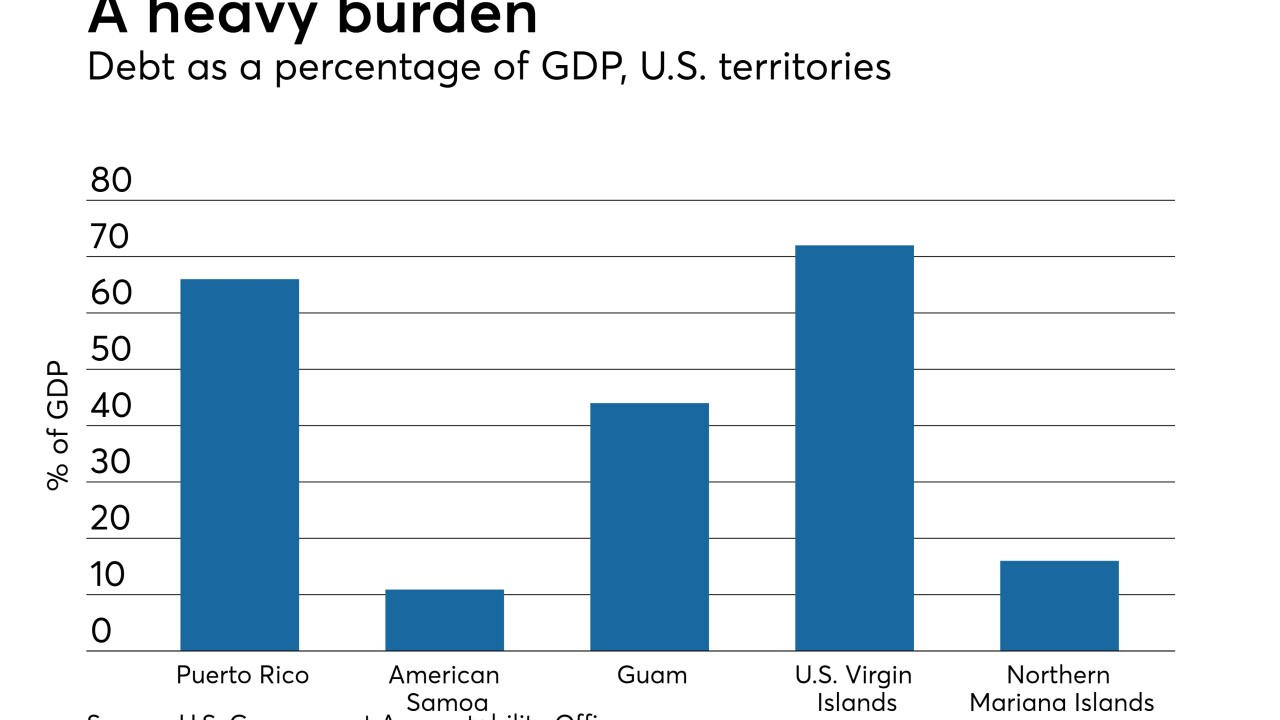

The Government Accountability Office sees big challenges for three U.S. territories.

October 10 -

Muni advisors can expect more exams and need to work on compliance, SEC officials said.

October 6 -

The awards were presented were presented at a meeting in Chicago.

October 6 -

SEC muni enforcement lawyers have become sophisticated and have a wealth of data to mine.

October 5 -

Some lawyers like the more targeted process, others have concerns,

October 5 -

New National Association of Bond Lawyers president Sandy MacLennan wants to publish more research.

October 3 -

C. Willis Ritter wrote initial muni rules at Treasury and developed many financing techniques.

October 3 -

The MSRB said its rules prohibit municipal advisors from passing on fees to municipal issuers.

October 2 -

IRS examiners will focus on compliance with arbitrage, PAB requirements for munis.

October 2 -

Municpal advisor firms would have to pay $500 rather than $300 annually for each MA professional.

September 29 -

The tax reform plan does not mention munis and market participants would rather see it in writing than have assurances from the White House.

September 27 -

Not everyone appreciates the MSRB's disclosure warnings.

September 27 -

Underwriters are "holding the price" for five days even if they don't need to.

September 25