-

Total volume currently stands at $224.13 billion, up 38.5% from $161.848 billion at this time last year. As the end of the first half approaches, several firms are revisiting their supply projections for the year, given the growth so far this year.

June 25 -

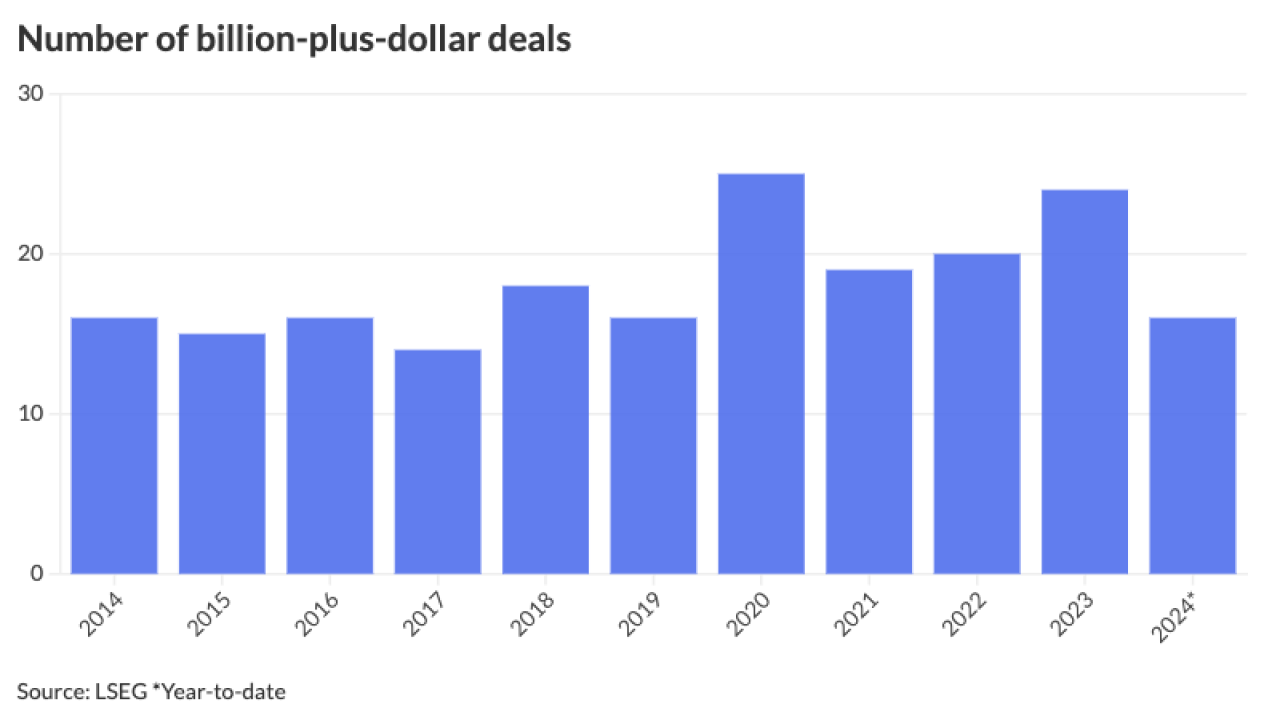

While particpants expect some pressure in the near-term with more than $16 billion on tap, they also say the current yield and ratio levels offer investors opportunity.

May 31 -

May volume "surprised on the high end and it has been one of the fastest starts to the year historically," said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 31 -

"For each May dating to 2021, the average 30-year MMD was 2.74% — or 122 basis points below the current yield," FHN Financial's Kim Olsan said. "The recent adjustment offers better investor value."

May 24 -

A supply surge hits the market as The Bond Buyer 30-day visible bond volume ticks in at $17.67 billion, $10 billion of which will come the first full week of May, just as macroeconomic data moves all markets to rally.

May 3 -

Healthcare issuance is up 122.2% year-over-year through April, rising to $9.062 billion through the first four months of 2024 from $4.078 billion over the same time period in 2023, LSEG data shows.

May 2 -

April's volume stood at $40.456 billion in 653 issues, up 21.2% from $33.377 billion in 666 issues in 2023.

May 1 -

Jeffrey Scruggs, Managing Director and Head of Public Sector and Infrastructure Group at Goldman Sachs, sits down with Bond Buyer Executive Editor Lynne Funk on the state of the muni industry.

April 18 -

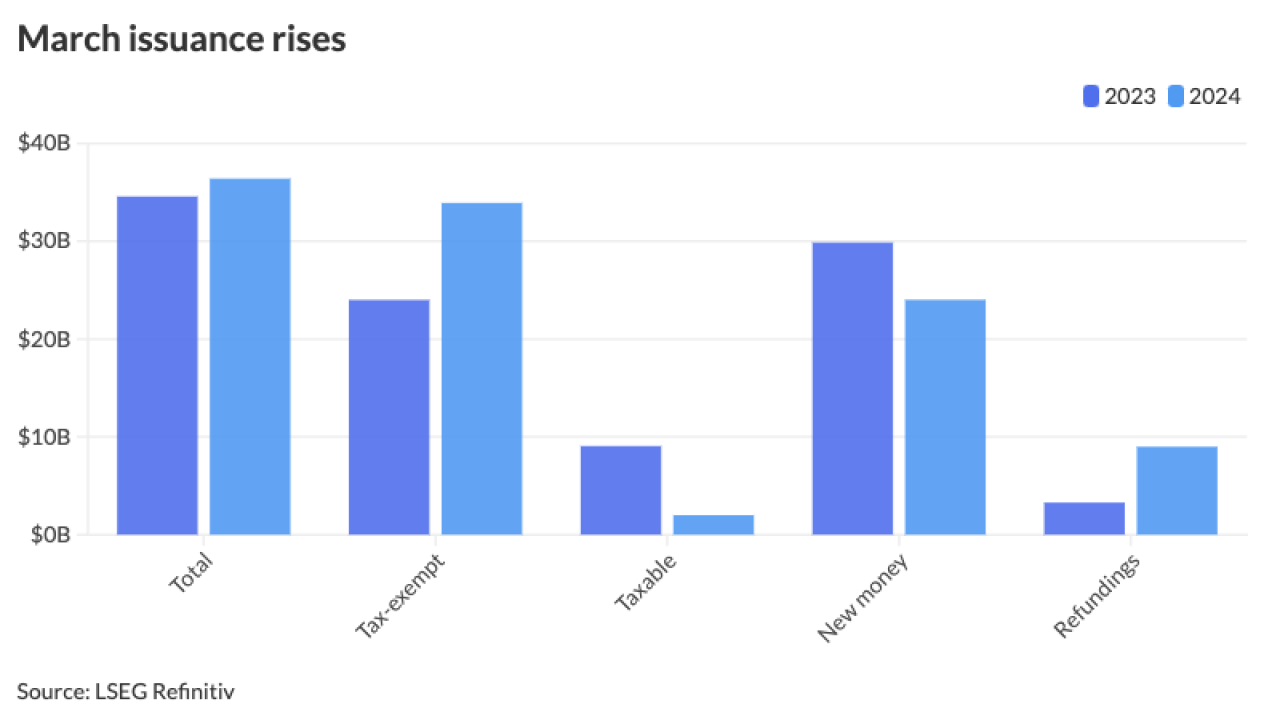

The pace of the issuance and the increase of refundings, surging 59.6% in the first quarter of 2024, have also led some firms to up their overall 2024 issuance projections.

April 11 -

March issuance came in at $36.405 billion, above the $34.579 billion 10-year average, according to LSEG Refinitiv data.

April 1