-

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

Issuers in five Far West states increased their borrowing the first half of the year, while four saw sizable decreases.

August 23 -

The region's municipal bond volume grew by 42.4%, outpacing the nationwide 32% increase in a first-half marked by gas prepay deals and Brightline's big sale.

August 22 -

Issuers in the eight-state region sold $50.6 billion of bonds with Texas accounting for 65% of the volume.

August 20 -

Part of the surge in issuance came from issuers tapping the capital market after several years due to the inability to no longer postpone long-delayed projects and the drying up of pandemic aid.

August 19 -

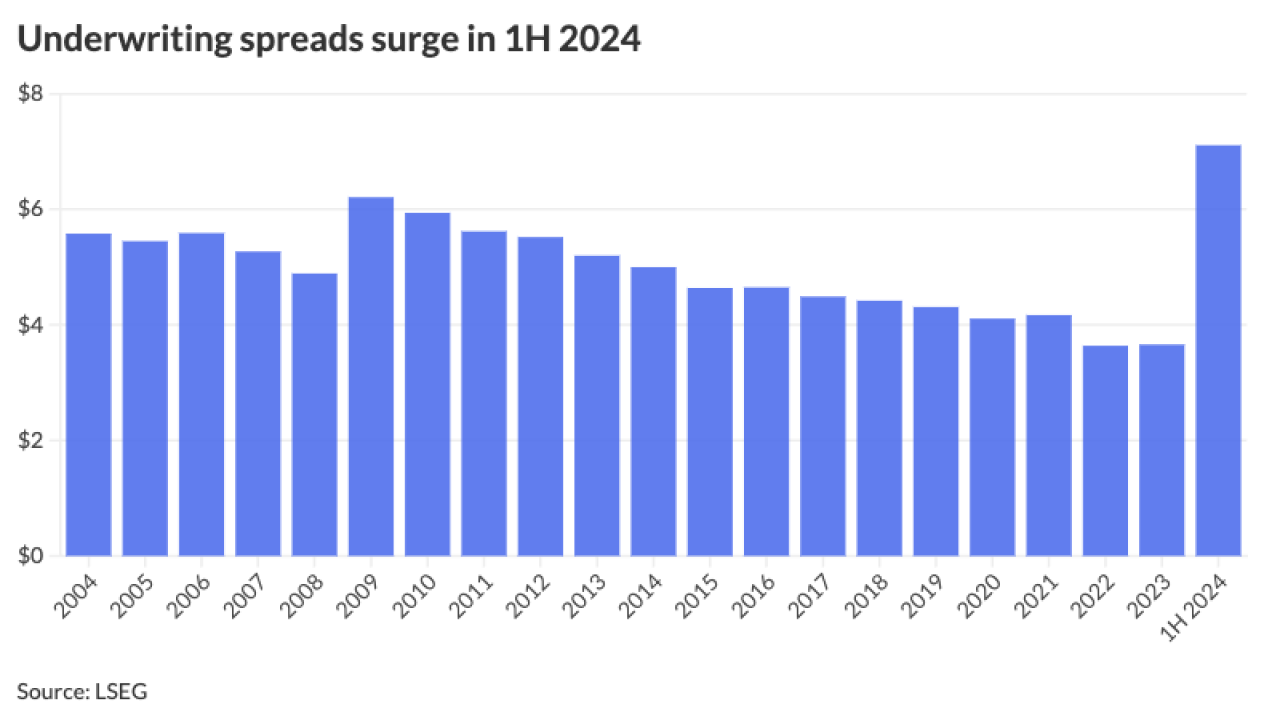

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

Data shows the average bids per competitive sale is up noticeably over the past few quarters, Justin Marlowe said, rising to 8.5 bids in Q1 2024 from 6.1 bids in Q1 2022.

August 5 -

Issuance was lumpy in July, with three weeks of $10 billion issuance sandwiched between lower issuance due to the Fourth of July holiday at the start of the month and the FOMC meeting the last week.

July 31 -

In a week that culminated in headline-grabbing events — a presidential debate, several Supreme Court decisions, more macroeconomic data to add to Fed policy expectations — municipals closed on a quiet note and in the black for June.

June 28 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28