-

The nearly 40% year-over-year decrease is a result of various factors including rising interest rates, other financing tools, such as forward delivery bonds, and simply that refundings are in less demand from issuers.

August 31 -

New money volume in the Far West was up 31.9% to $29.5 billion, while refunding volume rose a more modest 11%.

August 26 -

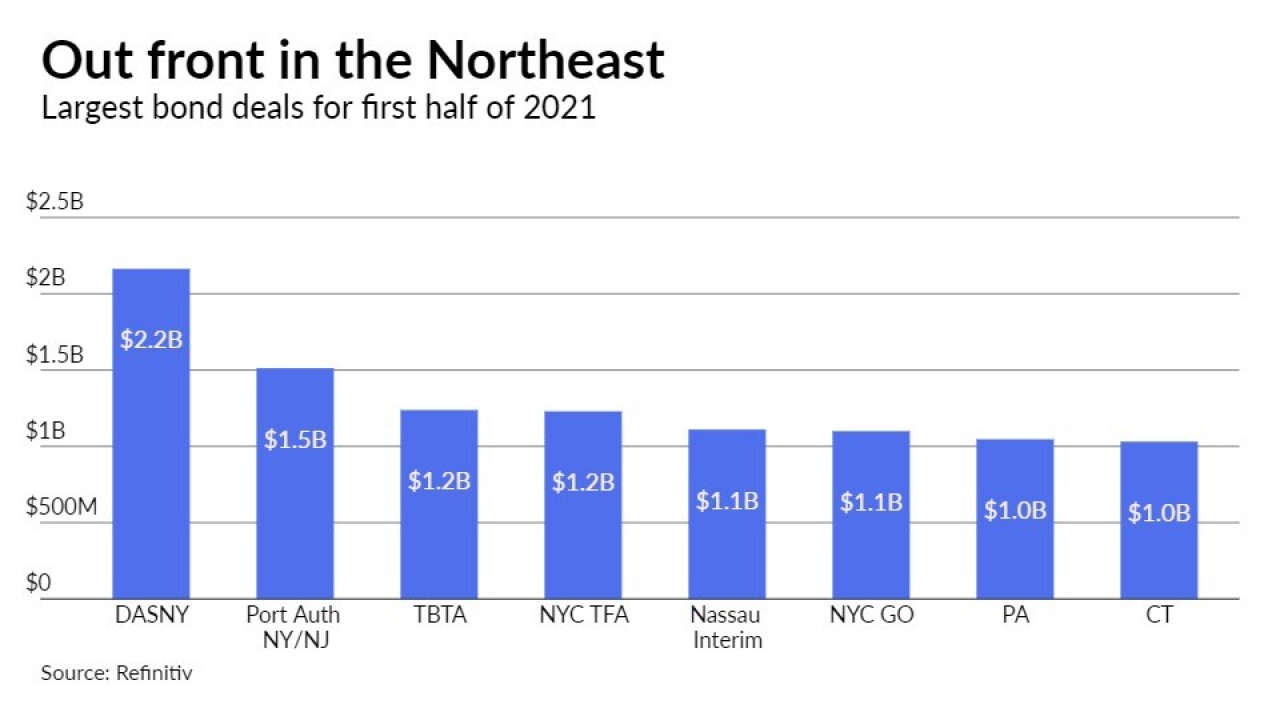

A large increase in new money bond issuance pushed the 11-state region to a big year-over-year volume gain.

August 25 -

An uptick in new money borrowing fell far short of making up for a decline in refundings.

August 24 -

Municipal bond volume in the Southwest region increased in the first half of 2021 as its seven other states more than made up for a decline in Texas.

August 23 -

Despite a slowdown in June, long-term municipal bond volume is ahead of last year's record-breaking pace with more than $231 million in six months.

August 23 -

Issuers sold nearly $60 billion of debt as states, cities and agencies adjusted to the COVID-19 environment and other variables.

August 20 -

July volume was $31.9 billion keeping the annual pace ahead of last year's record-breaking total. Issuance still lags demand by a large amount — $60 billion by many accounts for August alone — as redemptions coupon payments pile up.

July 30 -

While June was lower than 2020 in par, pandemic-related factors skewed last year's issuance totals, making the $42 billion issued this month high on a historical basis. Outside factors, such as federal aid and potential infrastructure plans, may affect issuance going forward.

June 30 -

Even with a 23.3% year-over-year drop in May, with five months now officially in the books, long-term muni volume stands at $169.45 billion, ahead of the $157.96 billion issued in 2020.

May 27