-

State lawmakers compromised on legislation that provides $2.3 billion of bond authority for transportation and boosts funding for the state's lagging pension fund.

May 10 -

Gov. John Hickenlooper signed a $28.9 billion state budget.

May 1 -

Amid teacher protests, Colorado lawmakers have two weeks to clear a backlog of bills that include a $5 billion transportation bond authorization and a pension funding measure.

April 26 -

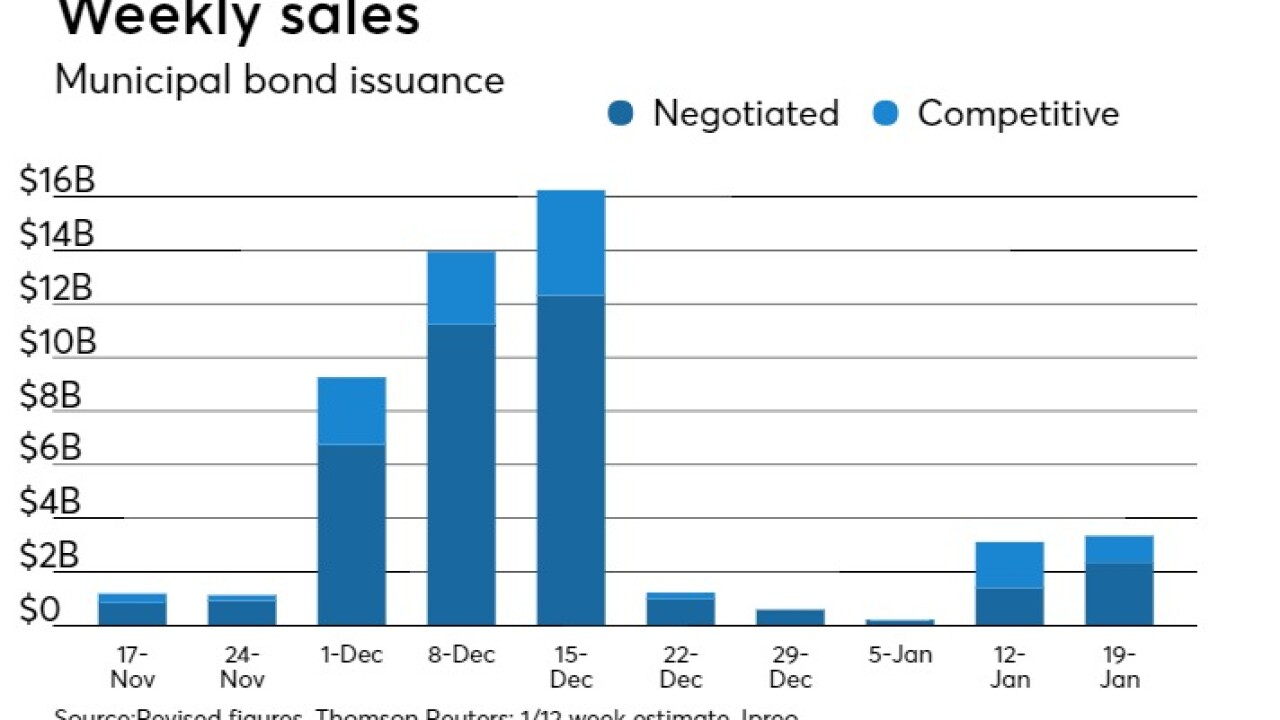

After back to back weeks of decent issuance, the primary muni market will get with a reality check of weekly issuance below $3 billion, thanks mostly to continued tax reform fallout.

March 16 -

The state government is issuing $132.5 million of certificates of participation for upgrades at the venue of the 111-year-old National Western Stock Show

March 12 -

The municipal bond market will see $3.35 billion of new deals hit the screens next in a holiday-shortened week. Ipreo estimates weekly volume at $3.35 billion, up from $3.12 billion this week.

January 12 -

Muni yields rose as much as 10 basis points, as they weakened with treasuries on concern China may stop U.S. debt purchases

January 10 -

Morgan Stanley priced a big taxable deal and won a large note sale as yields on long-dated top-rated municipal bonds rose as much as nine basis points.

January 10 -

The municipal bond primary market will be seeing several big offerings hit the screens on Wednesday — dominated by a taxable deal in the negotiated bond sector and a competitive note sale.

January 10 -

The municipal bond primary market returned to life as issuers in Massachusetts, Virginia and Minnesota offered new tax-exempts to bond-hungry investors.

January 9 -

Colorado lawmakers enter their 2018 session with election-year politics on their mind and more money in their pockets.

January 8 -

Attorney General Jeff Sessions' decision to more vigorously enforce federal marijuana laws probably won't lower state credit ratings, but could impact their tax revenues.

January 5 -

The municipal bond market is getting set for the Thanksgiving holiday as it looks ahead to next week’s $11.73 billion new issue calendar.

November 22 -

Underwriters priced the New York Metropolitan Transportation Authority’s $2 billion advance refunding deal for institutions on Tuesday, the last big offering of the week.

November 21 -

Underwriters priced the New York Metropolitan Transportation Authority’s $2.2 billion advance refunding deal for institutions on Tuesday. In secondary trading, municipals turned weaker.

November 21 -

Underwriters priced the New York Metropolitan Transportation Authority’s $2.2 billion advance refunding deal for institutions on Tuesday. The green bonds were offered to retail buyers on Monday, who ordered about $770 million of the bonds, according to a market source.

November 21 -

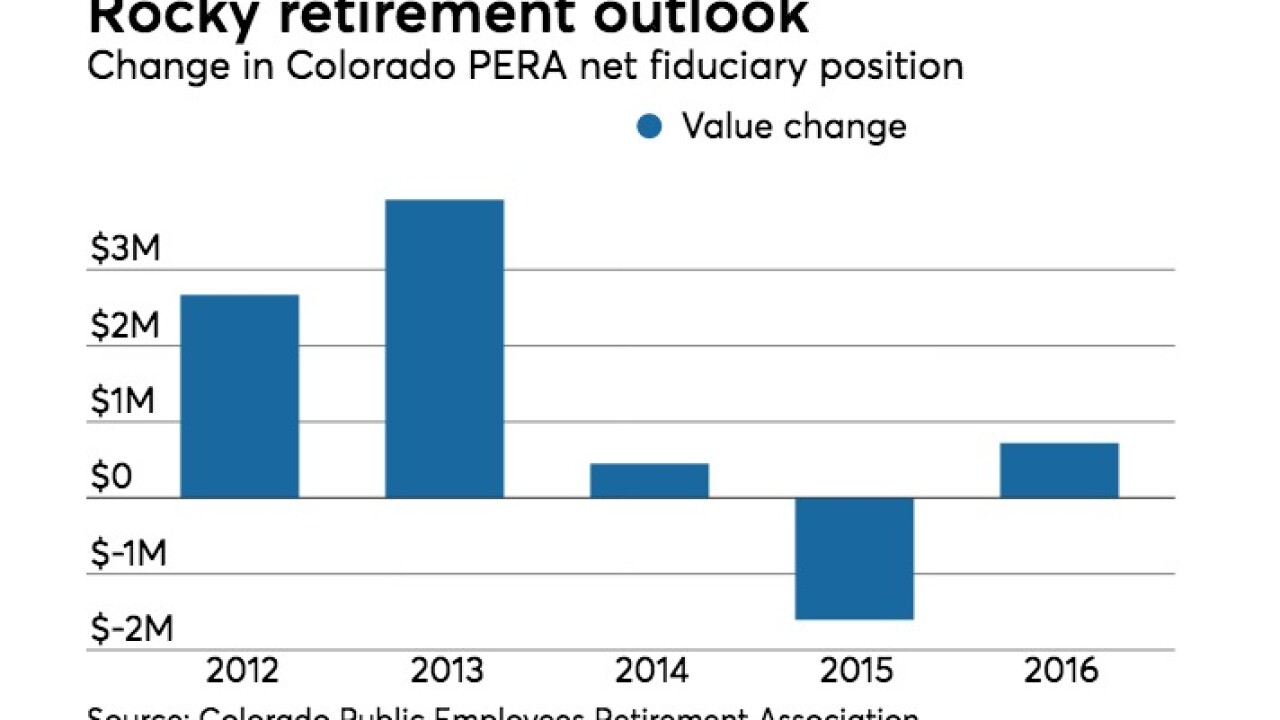

Declining funding for Colorado's retirement accounts led S&P global ratings to revise the state's outlook to negative.

November 16 -

Top-shelf municipal bonds were stronger at mid-session, according to traders, who were looking ahead to next week’s new issue calendar. which Ipreo estimates at $7.66 billion.

July 14 -

Municipal bond traders are waiting to see how much volume the market will encounter next week as they eye volatile muni yields.

July 14