DALLAS -- Underfunding of Colorado’s retirement system led S&P Global Ratings to revise its outlook on Colorado’s AA issuer credit rating to negative from stable.

"The negative outlook on all ratings reflects the state's long trend of annually contributing less than its actuarially determined contribution to its retirement systems," said S&P Global Ratings analyst Oladunni Ososami, "as well as decreasing pension funded ratios that have fallen well below those of similarly rated states."

If the state’s combined pension funded ratios continue to decline during the two-year outlook horizon, with no significant plan in place to improve pension funding, S&P sees a one-in-three possibility of a downgrade.

“Should the state enact credible measures that will that will sustainably improve funded ratios, we could return our outlook to stable,” Ososami said.

The negative outlook applies to S&P’s AA-minus rating on Colorado’s new $49.7 million lease-purchase agreement certificates of participation in two series.

Proceeds from the series 2017A COPs will fund some of the costs of a new Health Education Outreach Center on Colorado State University's Fort Collins campus, while proceeds from the 2017B COPs will fund other improvements on the campus.

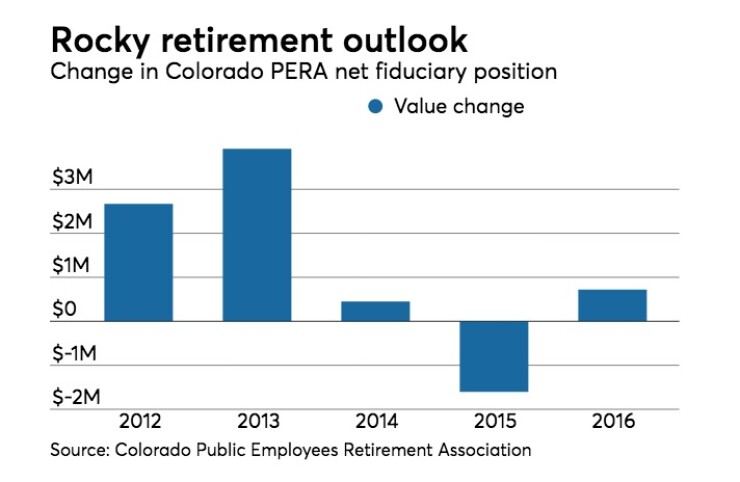

At the end of 2016 the funded ratio for Public Employee’s Retirement Association’s five defined benefit pension trust funds was 58.1% compared to 62.1% on December 31, 2015, the agency reported. The unfunded liability as of Dec. 31, 2016, was $32.2 billion, an increase of approximately $5.4 billion from the previous year, according to PERA’s annual financial report.

The PERA board also lowered the assumed investment rate of return and discount rate to 7.25% from 7.5% to reflect market conditions. As a result of all the revised actuarial assumptions, the unfunded liability increased by $3.9 billion, which was predominantly attributable to the changes to the mortality tables and the lowering of the assumed investment rate of return and discount rate, the board explained.

On Sept. 22, the board voted to endorse a comprehensive package of reforms designed to reduce the overall risk profile of the plan and improve PERA’s funded status. The proposed reforms would need legislative approval in the session that begins in January.