-

A lack of depth in the market is partly to blame for low trading activity, according to one manager.

November 5 -

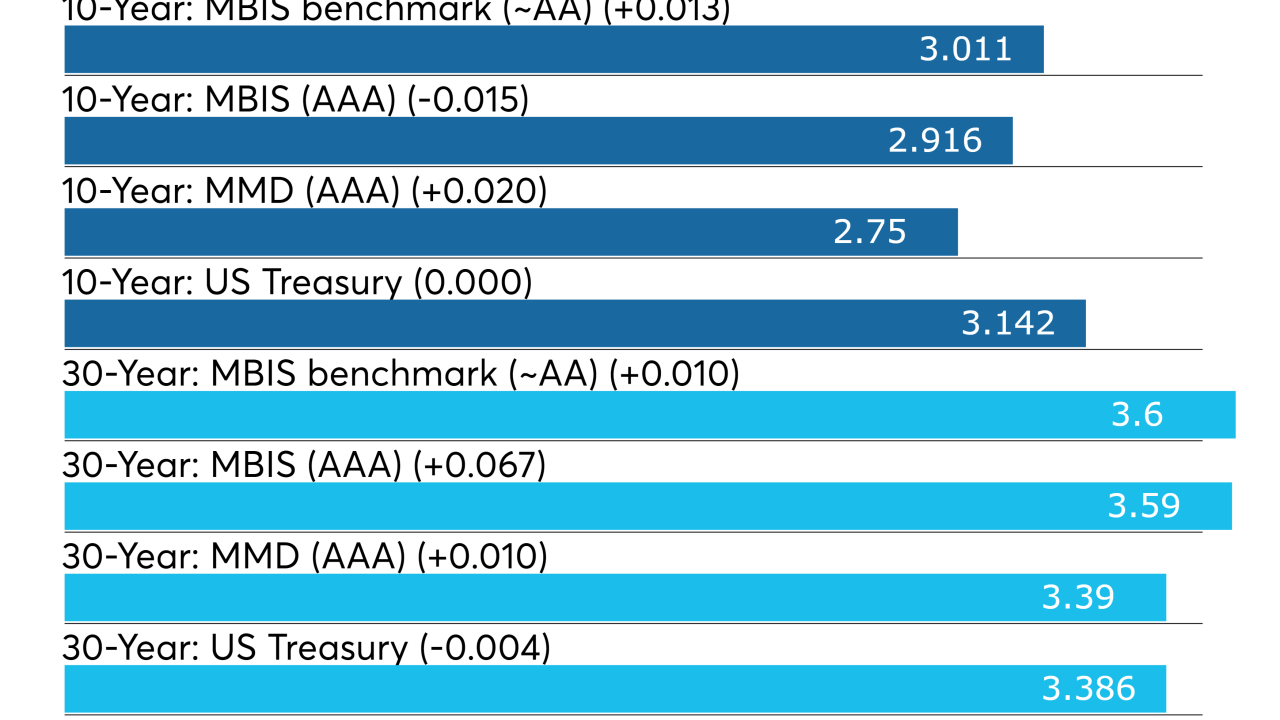

Municipal supply slacks off this week as bond yields continue to inch higher.

November 5 -

The muni market continued its recent trend of weakening everyday, while the October labor data was strong, with nonfarm payrolls jumping to 250,000 versus the expected number of 190,000.

November 2 -

Munis will see the last weekly issuance roll in - as the past few days hasn’t gone as planned, with rising yields and rocky market conditions causing the biggest deal of the week to postpone the deal.

November 1 -

The municipal bond market is gearing up for what should be a busy week, with a bunch of good sized deals and one mega deal.

October 29 -

Municipal bond supply takes a leap forward next week as Chicago’s Sales Tax Securitization Corp.’s $1.31 billion deal headlines the new issue calendar.

October 26 -

Municipals remained mixed as deals from Phoenix airport and Chicago issuers came to market.

October 25 -

Municipals were mostly stronger at mid-session as the last of the week’s big deals came to market.

October 25 -

Volatility in the equity market spurred a flight to quality.

October 23 -

Municipals were stronger at mid-session as new supply started to trickle into the market.

October 23 -

Puerto Rico bonds gained in a mixed muni market as a revised fiscal plan projected a bigger surplus.

October 22 -

Municipal bonds were stronger on Monday ahead of this week’s rather paltry new issue supply calendar.

October 22 -

Municipal bond supply plunges to under $6 billion next week after seeing over $10 billion of new issues priced this week.

October 19 -

California revenues were $1.03 billion ahead of estimates in the first quarter of the fiscal year, according to the state's Department of Finance.

October 18 -

The last of the large municipal bond deals came to market on Thursday, led by a $1.5 billion healthcare offering from Ohio.

October 18 -

Proposition 4 would authorize $1.5 billion in state GO bonds for 13 childrens' hospitals around the state, eight of them private nonprofits.

October 18 -

Things began to quiet down in the municipal bond market on Thursday, as most of the big deals have come and gone for the week.

October 18 -

Investors saw more volume hit the market on Wednesday as California sold nearly $900 million of municipal bonds.

October 17 -

An initiative that would create a separate property tax assessment system for non-residential properties qualified for the 2020 ballot.

October 16 -

The New York City issuer led Tuesday's new issue supply surge as municipals traded mixed.

October 16