Municipal supply slacks off this week as bond yields continue to inch higher. Weekly bond volume is expected to total $3.3 billion this week in a slate comprised of $2.5 billion of negotiated deals and $837 million of competitive sales.

Primary market

On Monday, King County, Wash., sold $125.235 million of Series 2018B sewer revenue bonds.

JPMorgan Securities won the deal with a true interest cost of 2.9211%. Proceeds will be used to provide funds for improvements to the county’s sewer system.

Piper Jaffray is the financial advisor while Pacifica Law Group is the bond counsel.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

In the negotiated sector, the Siebert Cisneros Shank is set to price New Jersey Sports and Exposition Authority’s $99 million of Series 2018A state contract refunding bonds.

The deal is rated Baa2 by Moody’s, BBB-plus by S&P and A-minus by Fitch Ratings.

On Tuesday, Goldman Sachs is slated to price the Central Plains Energy Project’s $527 million of gas project revenue bonds, including fixed rate, LIBOR index rate and SIFMA index rate bonds. The deal, coming out of Nebraska, is rated A3 by Moody’s and A by S&P.

Piper Jaffray is expected to price Portland Community College, Ore.’s $172 million of full faith credit pension taxable bonds on Tuesday. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

The Virginia College Building Authority will competitively sell almost $215 million of educational facility revenue bonds and taxable bonds in two sales on Tuesday. The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Prior week's top underwriters

The top municipal bond underwriters of last week included Citigroup, JPMorgan, Siebert Cisneros Shank & Co., Wells Fargo Securities and Morgan Stanley, according to Thomson Reuters data.

In the week of Oct. 28 to Nov. 3, Citi underwrote $1.1 billion, JPMorgan $892.3 million, SCSCO $591.6 million, Wells Fargo $513.1 million and Morgan Stanley $511.6 million.

Bond Buyer 30-day visible supply at $5.65B

The Bond Buyer's 30-day visible supply calendar increased $531.9 million to $5.65 billion for Monday. The total is comprised of $1.93 billion of competitive sales and $3.72 billion of negotiated deals.

Prior week's top FAs

The top municipal financial advisors of last week included PFM Financial Advisors, Kaufman Hall & Associates, Davenport & Co., Frasca & Associates and Public Resources Advisory Group, according to Thomson Reuters data.

In the week of Oct. 28 to Nov. 3, PFM advised on $1.0 billion, Kaufman $530.4 million, Davenport $291.0 million, Frasca $289.2 million and PRAG $282.0 million.

Secondary market

Municipal bonds were weaker on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point in the six- to 30-year maturities, falling less than a basis point in the one-to four-year maturities and remaining unchanged in the five-year maturity.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were mixed as stocks also traded mixed.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 86.2% while the 30-year muni-to-Treasury ratio stood at 99.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,301 trades on Friday on volume of $12.43 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 19.914% of the of the market, the Empire State taking 12.291% and the Lone Star State taking 8.867%.

Week's actively traded issues

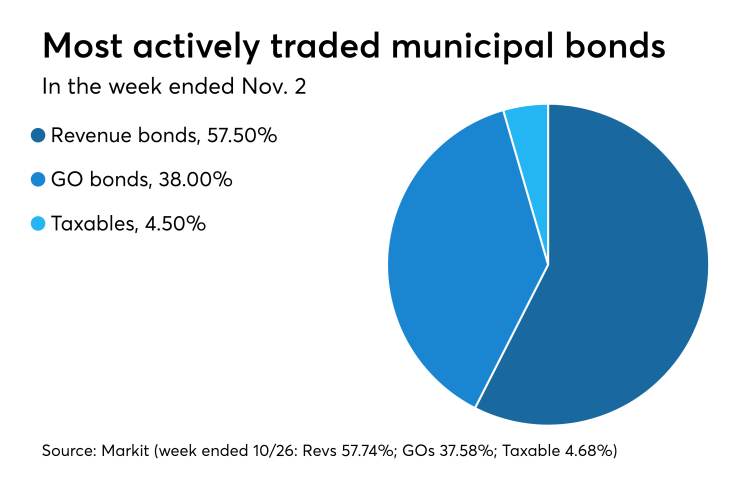

Revenue bonds comprised 57.50% of total new issuance in the week ended Nov. 2, down from 57.74% in the prior week, according to

New Jersey and Kentucky names were among the most actively quoted bonds in the week ended.

On the bid side, the South Jersey Port Corp. taxable 7.365s of 2040 were quoted by 50 unique dealers. On the ask side, the Paducah Independent School District, Ky.’s revenue 3.5s of 2035 were quoted by 290 dealers. And among two-sided quotes, the South Jersey Port Corp. taxable 7.365s of 2040 were quoted by 28 dealers.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Tuesday. There are currently $110.004 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Tuesday.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the $45 billion of three-months incurred a 2.320% high rate, up from 2.305% the prior week, and the $39 billion of six-months incurred a 2.450% high rate, up from 2.430% the week before.

Coupon equivalents were 2.366% and 2.515%, respectively. The price for the 91s was 99.413556 and that for the 182s was 98.761389.

The median bid on the 91s was 2.290%. The low bid was 2.260%. Tenders at the high rate were allotted 58.73%. The bid-to-cover ratio was 3.07.

The median bid for the 182s was 2.430%. The low bid was 2.400%. Tenders at the high rate were allotted 64.57%. The bid-to-cover ratio was 3.11.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.