-

The firm’s project finance & public finance practice comprises more than 50 attorneys and professional colleagues and is looking to add.

July 14 -

Siebert's Suzanne Shank and Bill Thompson have joined with NBA veteran player Chris Webber in a new program launched by New York State to fund the growth of the cannabis industry that eliminates barriers for equitable participation.

July 1 -

Outflows continue with the Investment Company Institute reporting $6.167 billion pulled from muni bond mutual funds in the week ending May 4, up from $5.371 billion of outflows in the previous week.

May 11 -

New York Dormitory Authority school bonds and Northwell Health priced and upsized, while Wisconsin and Oregon offered general obligation bonds. Analysts say municipal curves are oversold, creating a buying opportunity.

May 10 -

Despite outsized volatility and liquidity challenges ahead, the possibility of relief for munis is not too far off, analysts say, but USTs lead the way for exempts.

May 9 -

Despite the pandemic, operating revenues increased 7.6% from 2019 to 2020 and 8.25% from 2020 to 2021.

May 9 -

Munis again outperformed U.S. Treasuries. Participants note that municipal to Treasury ratios and nominal yield levels are “extremely attractive,” which is generating some renewed interest among the retail crowd.

May 6 -

Bond investors are understandably cautious in response to recent market volatility and ahead of what is expected to be a Fed rate hike Wednesday, participants say.

March 15 -

The market is being driven by the prospect of higher long-term inflation and the potential that the Federal Reserve may have to raise rates further than expected.

March 14 -

DASNY leads the calendar with $2.3 billion of exempt personal income tax bonds and $662.32 million of taxables. Potential volume is slated to be $5.11 billion, with $4.392 billion of negotiated deals and $718.1 million of competitive loans.

March 11 -

Municipal bond issuance in the region was down 11.7% year-over-year in 2021, as new money, refunding, taxable and tax-exempt volume all slipped.

February 25 -

The Volcker Alliance looks at the state’s outstanding municipal bonds and $83 billion in other obligations and suggests improved transparency and oversight.

February 11 -

Municipal yield curves were little changed for the seventh straight session while Refinitiv Lipper reported the 40th week of inflows into municipal bond mutual funds, with high-yield seeing a large increase week over week.

December 9 -

Month over month, the municipal market is in a much better position, as heavy demand and flows continue to drive it.

November 18 -

The Dormitory Authority of the State of New York overtook California for the most issuance, while New York issuers made up half of the top 10.

July 8 -

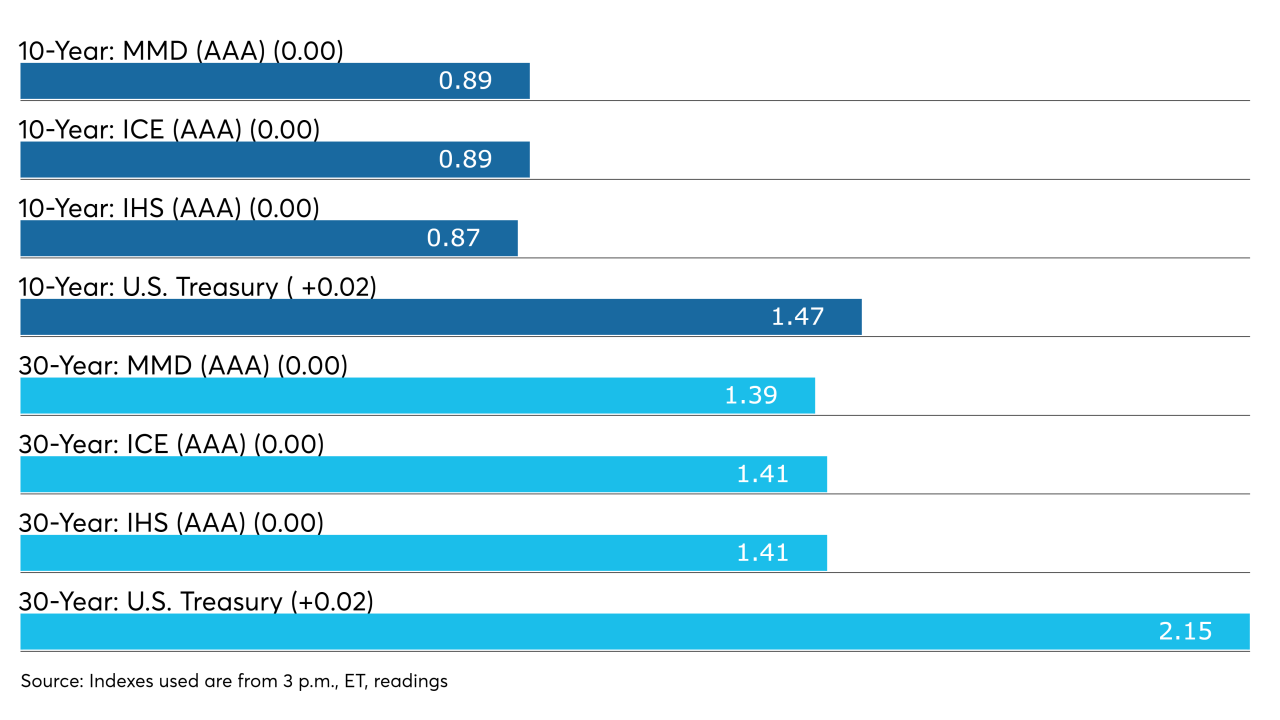

Yields on top-quality munis were flat on the AAA scales Friday; yields were seven to nine basis points lower on the week.

June 11 -

While the pressure was on municipal yields, which rose two to four basis points, the Investment Company Institute reported another week of inflows, with $928 million coming into municipal bond mutual funds and another $285 million into ETFs.

May 12 -

First quarter FDIC data show a $10.75 billion-plus jump in U.S. banks’ net purchases of municipal securities, the eighth biggest quarter since 2003, MMA says.

May 11 -

The municipal market was steady Monday as the investors gear up for three separate billion-dollar deals heading to market from California, New York, and Connecticut issuers.

April 19 -

Municipal bond issuers in the State of New York accounted for half of the top 10, while issuers from California held two of the top four spots.

April 9