Munis sold off Monday with triple-A benchmarks seeing double-digit cuts, following a rout in U.S. Treasuries while equities ended with losses.

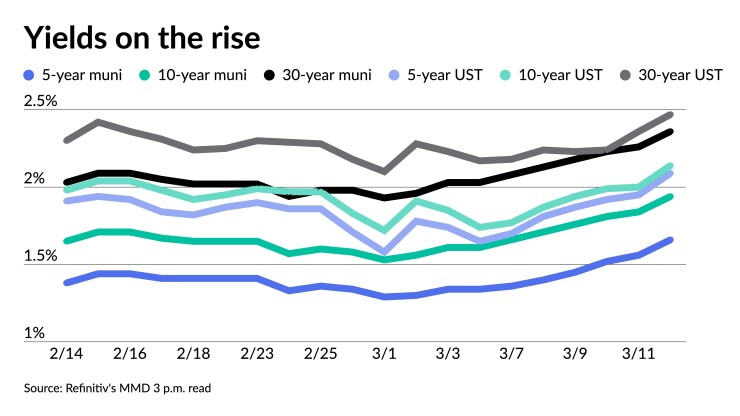

Municipals could not ignore the moves in the Treasury market and triple-A yield curves saw cuts up to 11 basis points, with the muni 10- and 30-year triple-A hitting the highest yield since March 23, 2020. The muni 10-year is inching closer to 2%. USTs saw yields rise by as much as 16 basis points on the five-, seven- and 10-year. The seven- and 10-year UST inverted while the 10-year hit a high not seen since June 2019 and the 30-year at the highest level since August 2019.

Municipal to UST ratios showed the five-year at to 80%, 91% in 10-years and 96% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 77%, the 10 at 94% and the 30 at 96% at a 4 p.m. read.

“The municipal market is cheaper across the board in sympathy with Treasury yields, which have spiked dramatically,” Roberto Roffo, managing director and portfolio manager at SWBC Investment Company, said Monday.

The market is being driven by the prospect of higher long-term inflation and the potential that the Federal Reserve may have to raise rates further than expected, he said.

Municipal bond sales are down approximately 8% from the same time last year, with around $7 billion in sales in the last two weeks, said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

“In a market with lower volatility and normal fund flows, this would provide a technical tailwind to performance as demand would well outstrip supply,” he said. “However, the lack of new-issue sales while muni funds are leaking assets has clouded price discovery and contributed to spreads widening out.”

He said the mood and direction of credit in the tax-exempt sector is starting to show signing of rolling over after nearly two years of persistent tightening.

In recent weeks, municipal spreads have widened. Investment-grade municipals' option-adjusted spreads are up roughly 10 basis points, while high-yield municipals' spreads are back over 200 basis points, the widest since October 2021, he said. Revenue spreads in the double-A and single-A categories, as well as state spreads, are all significantly above average, according to Kazatsky.

With several forecasts for municipal sales in the high $400 billion range for 2022, the pace will have to pick up dramatically to meet that target by year's end. While strategists may be frustrated, he said market players are fine with the lack of sales amid market volatility since they are concerned that deals on future issues will be considerably wider. This would therefore have a significant impact on the secondary market and dealer inventories. While spreads have widened, fewer primary sales have held the turn in credit at bay.

“While there is approximately $5 billion in new issuance this week, if the current pace continues I doubt that the yearly total will come close to some of the higher projections,” Roffo said.

In the primary Tuesday, J.P. Morgan Securities held a one-day retail order period for the Dormitory Authority of the State of New York (/AA+/AA+/) for $2.330 billion of tax-exempt general purpose state personal income tax revenue bonds, Series 2022A. Bonds in 3/2023 with a 5% coupon yield 1.13%, 5s of 2027 at 1.83%, 5s of 2032 at 2.29%, 4s of 2038 at 2.91%, 4s of 2042 at 3.02%, 5s of 2047 at 2.93% and 3.375s of 2052 at 3.56%, callable in 3/15/2032.

Jefferies held a one-day retail order period for the city of Los Angeles, California (/AA/AA/AA/) for $377.01 million of wastewater system subordinate revenue bonds, Refunding Series 2022-C. Bonds in 6/2023 with a 5% coupon yield 1.13%, 5s of 2027 at 1.75% and 5s of 2032 at 2.09%, noncall.

Last week was a busy trading week. The total amount of par value traded was up 31% from the previous week and more than 50% greater than the one-year average, according to CreditSights strategists Patrick Luby and John Ceffalio.

Per Bloomberg, institutional bid desired volume was the most since the week ending April 3, 2020. The total par value of bonds was up 18% from the previous week and 85% higher than the one-year average.

They said muni ETF secondary market turnover was more than double the one-year average and net primary market asset flows were more than double the prior week's total.

Luby and Ceffalio said individual investors are more concerned with absolute return than relative return when it

“Because relative value and income oriented investors may be more active in rising-rate or volatile market conditions, we expect that fixed income ETF flows will not necessarily follow the same path as mutual funds,” they said.

Last week, investors in municipal bond mutual funds were net sellers, as funds lost assets for the eighth week in a row.

However, they said increased rates appear to be luring ETF investors, as muni ETFs received $485 million. Assets in muni ETFs grew by $931 million in the calendar week ended Friday, March 4, more than tripling the amount of inflows, when investors contributed $291 million in net new assets.

Double-A tax-exempt and taxable municipal bond yields from roughly 10-years and longer are equivalent for investors subject to the federal corporate income tax of 21%, although both are richer than corporate after-tax yields, they said.

Additionally, tax-exempt single-A muni rates are more appealing than taxable muni after-tax yields, but corporate bond after-tax yields are higher across the curve, similar to double-A yields.

Secondary trading

California 5s of 2024 at 1.55%. Vermont 5s of 2025 at 1.40-1.49%. Oregon Department of Transportation 5s of 2025 at 1.61%.

New York UDC PITs 5s of 2026 at 1.74% versus 1.65% Thursday. New York City TFA multi-modal 5s of 2026 at 1.81%-1.78%. New York City TFA PITs 5s of 2026 at 1.83%. Utah 5s of 2026 at 1.63%. North Carolina 5s of 2027 at 1.72%. Indiana Finance Authority 5s of 2027 at 1.84%. North Carolina 5s of 2028 at 1.83% versus 1.45% on 3/3. Columbia University 5s of 2028 at 1.83%-1.85%.

Maryland 5s of 2031 at 2.02%. New York City 5s of 2033 at 2.37% versus 2.19%-2.21% Wednesday. NYC Municipal Water Finance Authority 5s of 2034 at 2.37% versus 2.28% Friday and 2.22%-2.25% Thursday.

Washington 5s of 2038 at 2.41% versus 2.09% on 3/7. California 5s of 2041 at 2.58% versus 1.97%-2.02% on 3/2

Washington 5s of 2044 at 2.62% versus 2.24-2.25% on 3/7. LA DPW 5s of 2046 at 2.64-2.67%. LA DPW 5s of 2047 at 2.69% versus 2.55%-2.57% Friday and 2.44%-2.46% Wednesday.

AAA scales

Refinitiv MMD's scale saw 10 basis point cuts at the 3 p.m. read: the one-year at 1.13% (+10) and 1.39% (+10) in two years. The five-year at 1.66% (+10), the 10-year at 1.94% (+10) and the 30-year at 2.36% (+10).

The ICE municipal yield curve was cut four to 10 basis points: 1.06% (+4) in 2023 and 1.40% (+7) in 2024. The five-year at 1.64% (+9), the 10-year was at 1.99% (+10) and the 30-year yield was at 2.38% (+9) in a 4 p.m. read.

The IHS Markit municipal curve was also cut: 1.12% (+10) in 2023 and 1.39% (+10) in 2024. The five-year at 1.66% (+10), the 10-year at 1.94% (+10) and the 30-year at 2.34% (+10) at a 4 p.m. read.

Bloomberg BVAL saw 10 to 11 basis point cuts: 1.10% (+10) in 2023 and 1.35% (+10) in 2024. The five-year at 1.64% (+10), the 10-year at 1.93% (+10) and the 30-year at 2.35% (+11) at a 4 p.m. read.

Treasuries were weaker while equities ended mixed.

The two-year UST was yielding 1.860%, the five-year was yielding 2.096%, the seven-year 2.156%, the 10-year yielding 2.142%, and the 30-year Treasury was yielding 2.481% at the close. The Dow Jones Industrial Average gained one point or 0.03%, the S&P was down 0.74% while the Nasdaq lost 2.04% at the close.

FOMC redux

Going into its meeting this week the Federal Open Market Committee has a lot on its plate: rising inflation, a flattening yield curve, slowing economic growth and the Russian invasion of Ukraine and the issues it’s causing, just to name a few.

Getting through the meeting “will be a positive inflection for the market,” according to Jay Hatfield, chief investment officer at ICAP, “as the quarterly release of the dot plot will create a level of certainty around the path of future rate increases.

ICAP expects six hikes this year, with Fed Chair Jerome Powell careful to pronounce “the Fed is aware of its dual mandate and does not want to invert the yield curve and produce a recession,” he said. A tilt to the dovish side is likely after most of President Biden’s nominees are seated on the board, Hatfield noted.

The Summary of Economic Projections’ dot plot will interest John Hancock Investment Management's Co-Chief Investment Strategists Emily Roland and Matt Miskin. While they see a 25-basis-point hike as a given, the last dot plot suggested three rate hikes this year and three next year; “those very likely move higher based on the increasingly urgent need to tackle elevated inflation,” they said.

“The potential for contagion from a Russian default/write-downs is complicating the Fed’s job, as it creates a risk to the growth outlook and is contributing to tighter financial conditions already (as evidenced by high yield bonds spreads),” Roland and Miskin said.

Despite the risk, they said, the FOMC will raise rates because “the economy is strong enough to handle it,” and policymakers want some room to cut rates in the future if there is an economic downturn, Roland and Miskin said.

While the bond market still expects about six rate hikes this year, Roland and Miskin see four or five, since the Fed will be wary of inverting the yield curve, since the 2/10 Treasury is at 25 basis points, much lower than the usual 150-200 basis points at the beginning of rate hike cycles.

Recession is possible next year, they said, “as tighter policy collides with a slowing economy,” and it wouldn’t surprise them if the Fed was forced to cut rates in 2023. “In this environment, investors will be best served by increasing duration,” Roland and Miskin said. “The cycle is moving at a rapid clip; now is not a great time to abandon bonds.”

Inflation will be the key, according to David Kelly, chief global strategist at JPMorgan Funds. “The Fed’s decision will be guided by twin assessments, first, that the economy is strong enough to withstand the higher commodity prices and greater uncertainty emanating from Putin’s brutal invasion of Ukraine and second, that they cannot afford to wait any longer in taking some action to counteract the highest U.S. inflation in 40 years.”

Expect a disclaimer from the Fed “that monetary tightening is not on a pre-set course,” he said. “However, for investors, the critical issue is to assess the Fed’s determination to proceed along a path of monetary normalization and the potential for events in Ukraine, China and elsewhere in Washington to divert them from that path.”

The SEP, Kelly said, will show tweaks to inflation (higher), unemployment (possibly lower) and economic growth (also lower).

While the pandemic winding down should boost growth somewhat, he said, “higher energy costs and lower consumer confidence could act as a drag on consumer spending while uncertainty concerning the impact of Ukraine on the global economy could soften an expected liftoff in capital spending.”

Inflation, spurred by energy costs, “look likely to be higher by the end of the year than previously thought even if they recede from today’s very elevated levels,” Kelly said. “In addition, further supply chain disruptions from the war in Ukraine or a broader COVID outbreak in China could add to inflation throughout the year.

And although prices are “still likely close to [a] peak, it is a higher peak than the Fed likely expected back in December and the PCE deflator could still be well above 3% by the end of 2022.”

Still the growing economic uncertainty, mostly involving Russia, “should make them a little more cautious in tightening,” he said.

Morgan Stanley Research sees six rate hikes in 2022, with quantitative tightening announced and starting in May. The post-meeting statement, while acknowledging risk from “recent geopolitical developments,” will signal future rate hikes and state “it will ‘soon be appropriate’ to begin reducing the size of its balance sheet.”

As for the Fed’s projections, Morgan Stanley expects “lower growth, higher inflation, and lower unemployment in the projections, while the expectations for policy tightening are likely to shift higher, putting rates on course to rise above neutral.”

The dot plot could impact the dollar, they said, strengthening “if the median 2024 dot implies that the FOMC is inclined to raise rates above 2.5%, or if the Fed chooses to emphasize its significant flexibility in the size of its next rate hike.”

The dollar would “soften if the Fed signals that it is ‘closely’ monitoring the situation in Eastern Europe,” Morgan Stanley said.

“The Fed has little choice but to respond more forcefully than it has in more recent tightening cycles in order to slow inflation that is already running at 40 years highs and likely to move higher in the months ahead as the impacts of the Russia-Ukraine conflict on energy, food, and transportation costs wash over the U.S. economy,” said Scott Anderson, chief economist at Bank of the West.

Engineering a soft landing is difficult under the best circumstances, he said, “but with brand new supply shocks from energy, food, and manufacturing supply-chains in addition to already runaway inflation, and the Fed likely will need to do more than tap on the monetary brakes to slowdown this inflation freight train.”

The Fed’s action will cause “much tighter financial conditions with more frequent bouts of financial instability,” Anderson said. “Much slower economic growth or even outright recession is a very real possibility by next year.”

Consumer inflation will continue growing “over the next few months due to eye-popping commodity price increases over the past month no matter how much the Fed hikes rates at upcoming meetings,” he said.

Stagflation is now a consideration, Anderson said. “The Fed’s battle on inflation has just begun and the impact on the U.S. economy and markets may be just as uncertain as the conflict raging in Europe today.”

Primary to come:

The Regents of the University of Michigan (Aaa/AAA//) is on the day-to-day calendar with $582.74 million of taxable general revenue bonds, Series 2022C. Goldman Sachs.

University of Massachusetts Building Authority (Aa2/AA-/AA/) is set to price Tuesday $571.84 million of taxable senior bonds, consisting of $351.95 million of project revenue bonds, Series 2022-2, serials 2024-2037, terms 2042 and 2052 and $219.89 million of refunding revenue bonds, Series 2022-3, serials 2022-2037, term 2041. Citigroup Global Markets.

Francis Howell R-III School District, Missouri (/AA//) is set to price Thursday $146.645 million of general obligation bonds, Series 2022, serials 2023-2024 and 2026-2042. Stifel, Nicolaus & Co.

The Arizona Sports and Tourism Authority (/AA//) is set to price daily $144.835 million of senior revenue and revenue refunding bonds, Series 2022, serials 2023-2036, insured by Build America Mutual. RBC Capital Markets.

Competitive:

Guilford County, North Carolina (Aaa/AAA/AAA/) is set to sell $41 million of general obligation public improvement bonds, Series 2022A at 11:30 a.m. eastern Tuesday.

Guilford County, North Carolina (Aaa/AAA/AAA/) is set to sell $120 million of general obligation school bonds, Series 2022B at 11 a.m. Tuesday.