-

The upcoming Federal Open Market Committee meeting on Tuesday and Wednesday has led to a lighter new-issue calendar with $2.72 billion on tap.

October 28 -

The municipal market was a tale of two halves in fiscal 2022, the report says.

October 28 -

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

Brad Lander says using municipal bonds could be one way to help move recent immigrants into mainstream society and provide a long-term economic boost to the city.

September 16 -

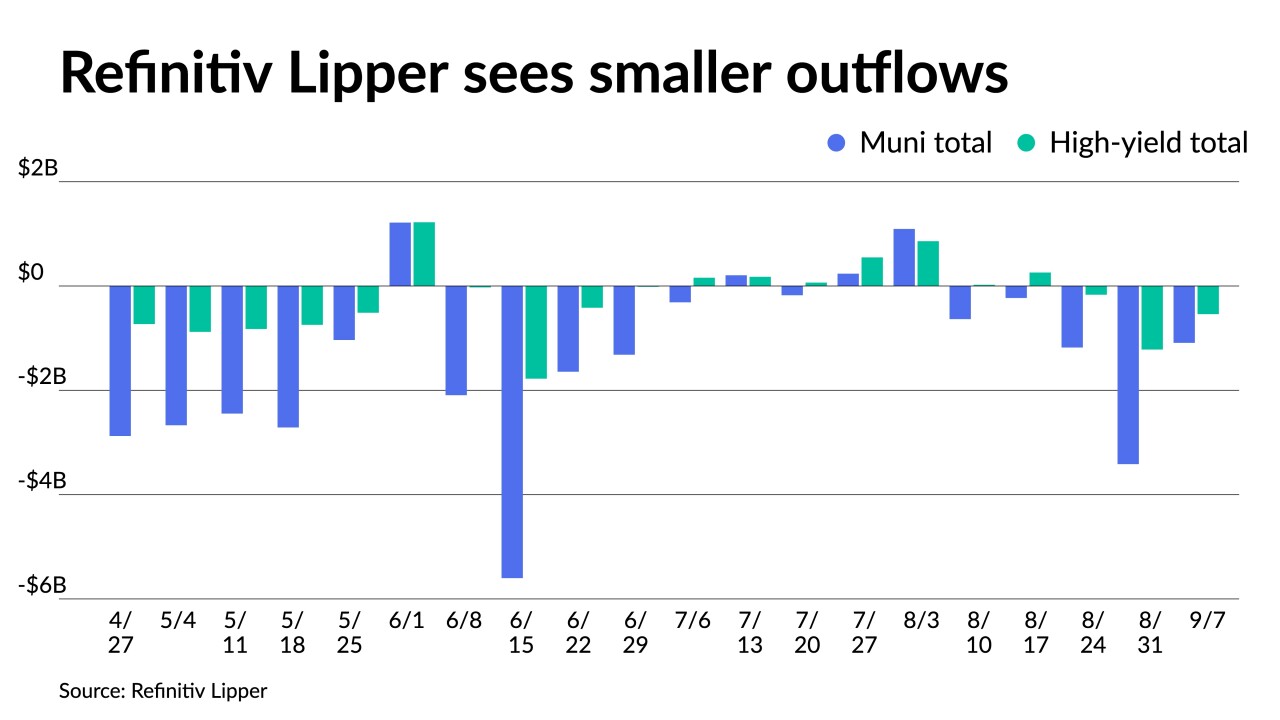

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

The Investment Company Institute reported $230 million of inflows into muni bond mutual funds in the week ending August 17. ETFs see second week of outflows.

August 24 -

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

August 19 -

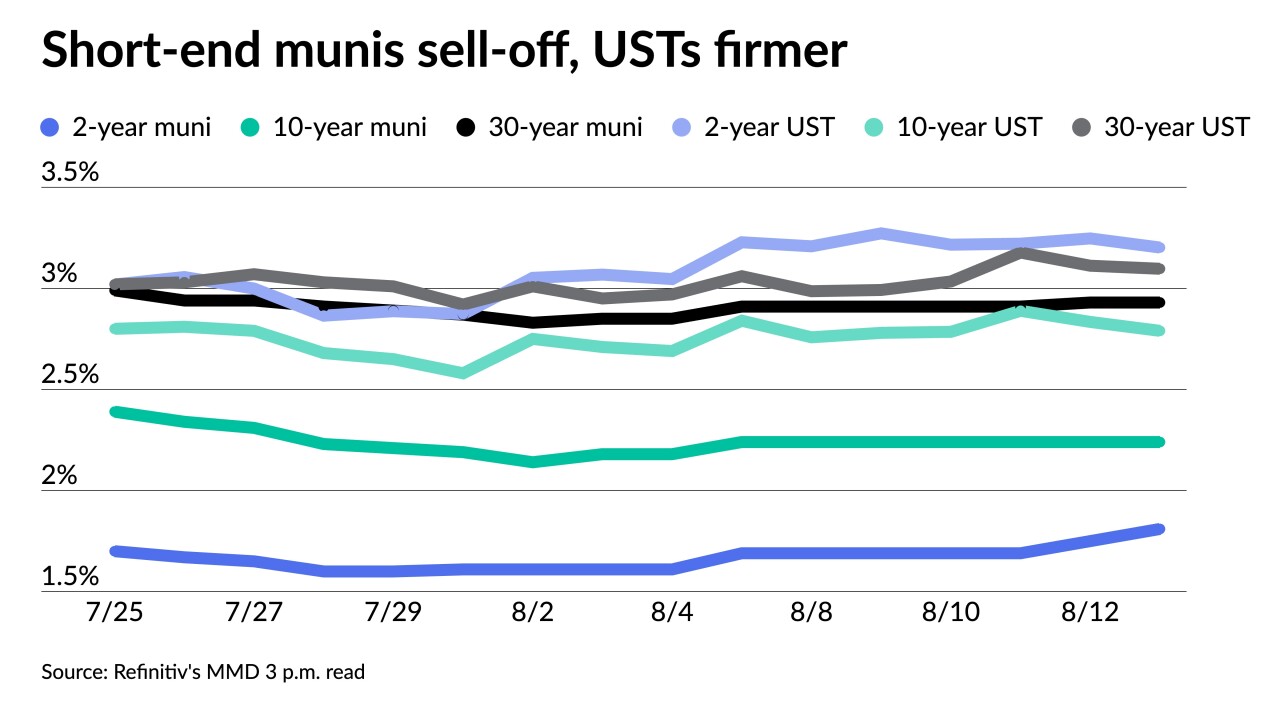

"Demand for low-duration tax-exempts has been so strong that short maturity benchmark yields are now lower than the after-tax yields for comparably rated benchmark taxable muni and corporate bonds," said CreditSights strategists Pat Luby and John Ceffalio.

August 15 -

The Investment Company Institute reported investors pulled $4.590 billion from muni bond mutual funds in the week ending June 22, down from $6.243 billion of outflows in the previous week.

June 29 -

The final budget sets aside about $8.3 billion in budget reserves, which bring them to the highest level in the city's history.

June 10 -

The recommendation would build reserves toward a target of 16% of tax revenues in order to prevent drastic service cuts during a recession.

May 23 -

Improving tax revenues allowed the mayor to increase the size of his spending proposal while keeping the budget balanced.

April 29 -

The Investment Company Institute on Wednesday reported another round of large outflows, this week at $3.502 billion, up from $2.647 billion of outflows in the previous week.

March 9 -

The City Council on Wednesday began the first of a series of hearings on Mayor Eric Adams' $98.5 billion preliminary fiscal 2023 budget.

March 4 -

Refinitiv Lipper reported $238.926 million of outflows, but $182.035 million of inflows to high-yield, reversing last week's outflows. New-issues faced concessions.

January 20 -

The largest deal of the week comes from the New York City Transitional Finance Authority with $950 million of exempts and $250 million of taxables.

January 14 -

Mayor Eric Adams’s proposal to ask the state to raise the Transitional Finance Authority’s bonding authority by $19 billion is being opposed by Comptroller Brad Lander.

January 13 -

Marjorie Henning was named deputy comptroller for public finance and Michael Haddad is interim chief investment officer and deputy comptroller for asset management.

January 3 -

While move-outs still outpace move-ins, the rate at which people are leaving has slowed and returned to near pre-pandemic patterns. A return by workers to offices is also rising, but occupancy in the city remains lower than almost all major metropolitan areas in the U.S. except for San Jose and San Francisco in California.

October 8 -

ICI reported $1.99 billion of inflows into municipal bond mutual funds, bringing the total to $69 billion for 2021.

September 1