-

The back half of July is starting "much like the front half with ongoing UST volatility and municipal supply staying in the forefront," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 18 -

Olson, a 20-year municipal bond veteran, replaces Marjorie Henning who retired at the end of April. In his new position, he will be in charge of the Bureau of Public Finance, which manages the city's borrowing for the comptroller.

June 6 -

While fiscal 2023 and 2024 budgets remain balanced, outyear gaps increase to $4.2 billion, $6.0 billion and $7.0 billion in fiscal 2025 through 2027, respectively.

April 28 -

Mayor Eric Adams executive budget "will be released in just 51 days, giving us limited time to marshal the substantial resources we will need to stay balanced in fiscal 2023 and 2024," said OMB Director Jacques Jiha.

March 7 -

"As we spoke with our underwriting partners and our municipal advisors, given [market] volatility, we shortened that retail order period to one day," says OMB's David Womack.

February 17 -

"The large taxable refunding or combined transactions were accomplished earlier in the year when rates were relatively low," says John Hallacy.

February 10 -

"I think ESG is here to stay in our market. I think it's a natural fit with the types of infrastructure that our market finances," said MSRB CEO Mark Kim.

February 9 -

"The overall tone of the budget is one of prudency, which is correct during this current period where federal pandemic aid is winding down and there are questions about whether we enter into a recession," said Howard Cure of Evercore Wealth Management.

January 13 -

"An increase in social distancing and remote work has resulted in growing vacant office space since late 2020. Office rents have also trended down and remained depressed into 2022," according to the Popular Annual Financial Report.

November 22 -

New York City will also release the first quarter update to the fiscal 2023 financial plan this month.

November 15 -

The upcoming Federal Open Market Committee meeting on Tuesday and Wednesday has led to a lighter new-issue calendar with $2.72 billion on tap.

October 28 -

The municipal market was a tale of two halves in fiscal 2022, the report says.

October 28 -

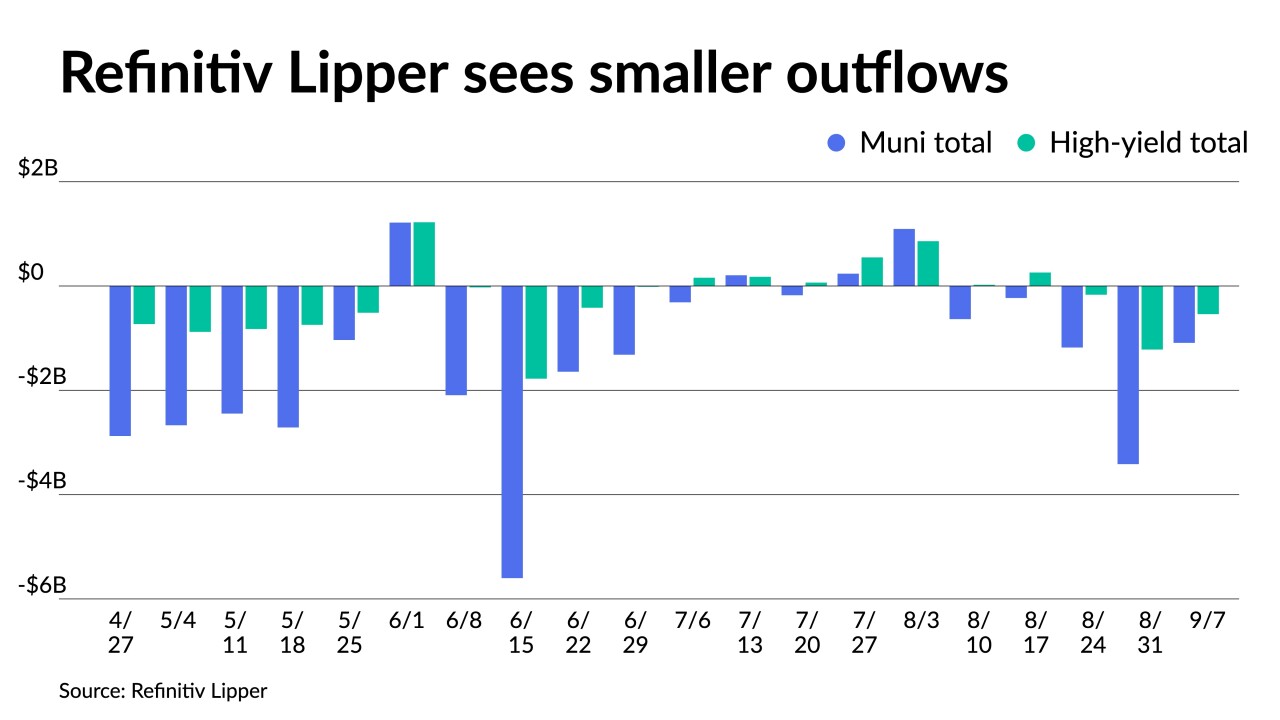

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

Brad Lander says using municipal bonds could be one way to help move recent immigrants into mainstream society and provide a long-term economic boost to the city.

September 16 -

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

The Investment Company Institute reported $230 million of inflows into muni bond mutual funds in the week ending August 17. ETFs see second week of outflows.

August 24 -

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

August 19 -

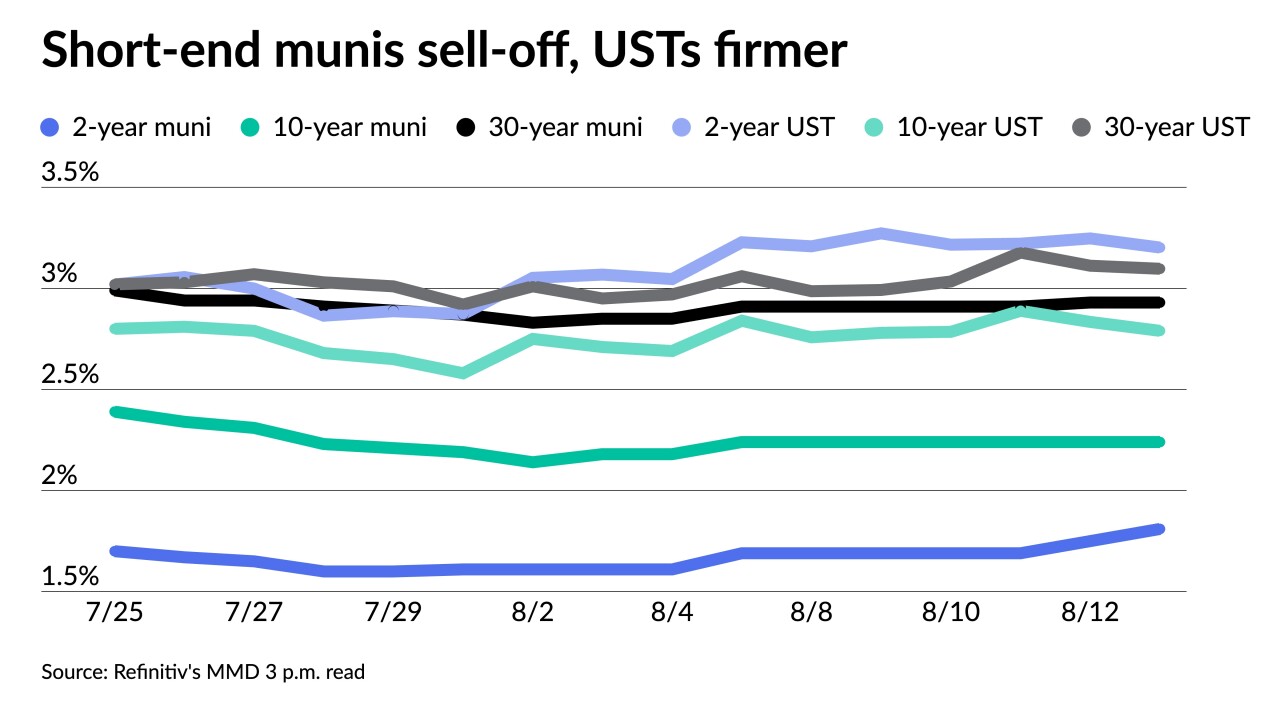

"Demand for low-duration tax-exempts has been so strong that short maturity benchmark yields are now lower than the after-tax yields for comparably rated benchmark taxable muni and corporate bonds," said CreditSights strategists Pat Luby and John Ceffalio.

August 15 -

The Investment Company Institute reported investors pulled $4.590 billion from muni bond mutual funds in the week ending June 22, down from $6.243 billion of outflows in the previous week.

June 29 -

The final budget sets aside about $8.3 billion in budget reserves, which bring them to the highest level in the city's history.

June 10