-

The Investment Company Institute reported investors pulled $7.2 billion from municipal bond mutual funds, the largest figure since the outlier months of March 2020 when investors yanked $24 billion in two weeks.

April 20 -

Investors pulled more from municipal bond mutual funds as the Investment Company Institute reported $4.5 billion of outflows in the week ending March 30.

April 6 -

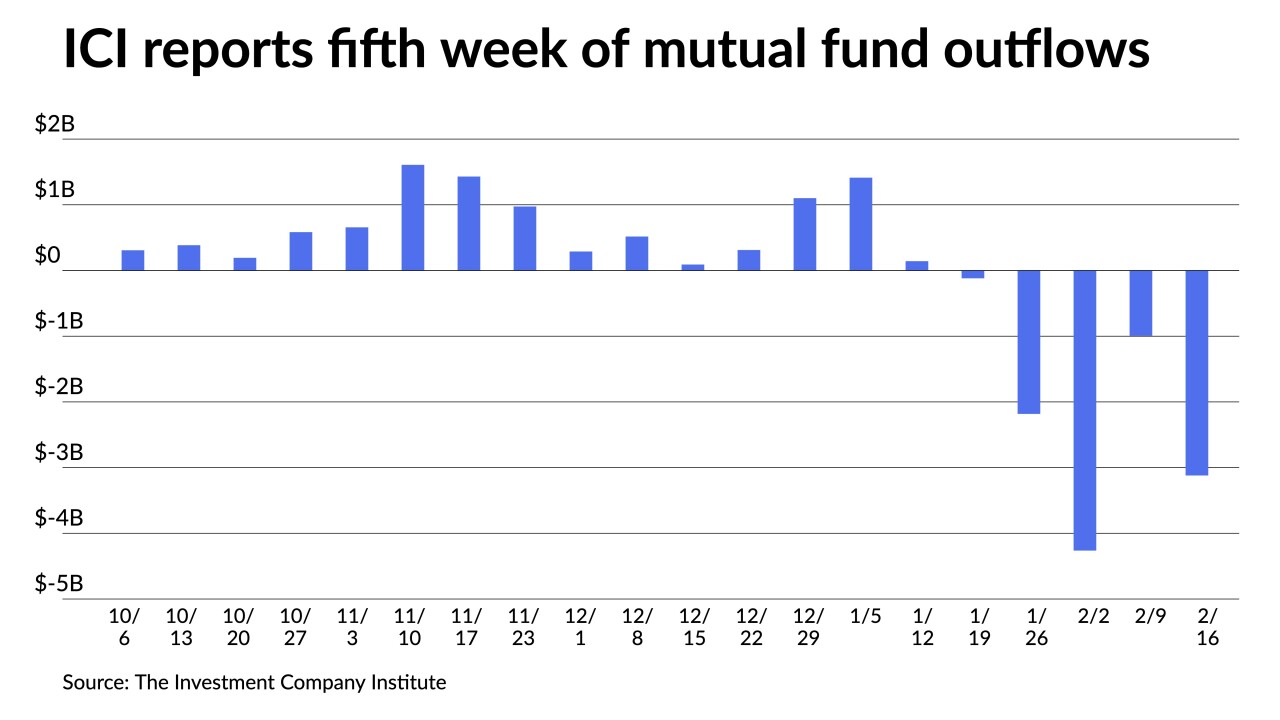

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

Markets were somewhat comforted by Federal Reserve Bank of Atlanta President Raphael Bostic’s comments suggesting the Fed will not be as aggressive as the markets suspect.

February 9 -

Buyers appeared to return to the market the past two sessions after the January correction moved yields and ratios higher. Secondary trading was up again on Wednesday and new deals were well-received.

February 2 -

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

The majority of the spending was $21.36 million devoted to lobbying members of Congress and federal agencies over the 12 months that ended June 30.

October 16 -

The changes will slim down underwriters' disclosures to issuers, which many believed had become too lengthy and wordy to be useful.

November 11 -

The group sent a letter to the Securities and Exchange Commission this week asking for fair dealing rule guidance to be better tailored to 529 savings plans.

August 27 -

Groups active in the muni market are spending millions of dollars to influence policy and elect candidates, records show.

October 11 -

The top executives of FINRA, the MSRB, and some industry groups received total compensation of more than $1 million, The Bond Buyer’s latest survey of compensation levels at 23 municipal market-related groups shows.

September 7 -

SIFMA is urging the MSRB to be more forthcoming in providing interpretive guidance to dealers and other regulated entities.

January 24 -

Undoing the floating net asset value requirement for money market funds would give municipalities more flexibility, GFOA testifies.

November 3