-

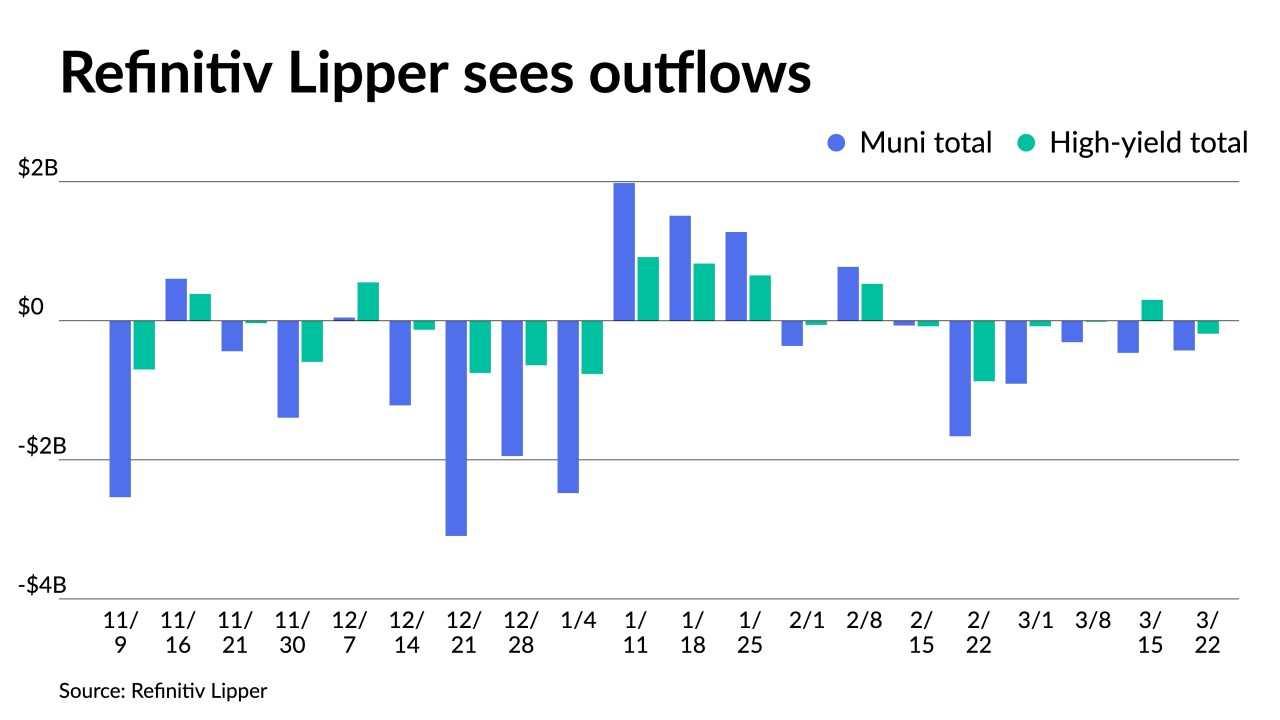

Outflows continued as Refinitiv Lipper reported $427.082 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $461.123 million of outflows the week prior.

March 23 -

"In short, it appears that the end of the current tightening cycle is coming into view," said Wells Fargo Securities Chief Economist Jay Bryson.

March 22 -

Members of the Fed learned the wrong lesson from bizarrely focusing on the 1970s when they said "If history has taught us anything, it's to not let up too soon on inflation."

March 21 Sit Fixed Income

Sit Fixed Income -

The reverberations from the Silicon Valley Bank and Signature Bank failures make the outcome of this week's Federal Open Market Committee meeting unpredictable.

March 20 -

The recent bank failures have changed market thinking about the Federal Reserve's next move.

March 14 -

Disruptions and dislocations associated with more volatile business cycles have already created opportunities for active fixed income management, as the dramatic interest rate increase of 2022 illustrates.

March 8 Schroder Investment Management

Schroder Investment Management -

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

The Federal Reserve said further interest-rate hikes would be required to restore price stability.

March 3 -

Federal Reserve Bank of Atlanta President Raphael Bostic called for continued interest-rate hikes to above 5% ensure that inflation returns to the central bank's target and doesn't reaccelerate in a pattern similar to the 1970s.

March 1 -

Central bankers must augment what they learn from incoming data with clues gleaned from the real economy and avoid putting too much weight on financial markets, said Federal Reserve Bank of Chicago President Austan Goolsbee.

February 28