-

The Federal Open Market Committee's Summary of Economic Projections probably won't offer the 130 basis points of cuts next year that the market expects.

December 12 -

With a high of $450 billion and a low of $330 billion, no firms currently see issuance surpassing the records hit in 2020 and 2021.

December 5 -

All eyes are on the Federal Reserve and monetary policy. Join us as Scott Anderson, chief U.S. economist and managing director at BMO Economics, breaks down the latest FOMC meeting.

-

The large drop in yields since the end of October can be reflected in sentiment that investors expect a potentially dovish Fed next year, and that a soft landing narrative gives them "permission to finally purchase the bonds they've been admiring," said MMA's Matt Fabian.

November 21 -

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

This could be the first time the bond market has posted three consecutive negative total return years, according to John Hancock Investment Management Co-Chief Investment Strategist Matt Miskin.

October 30 -

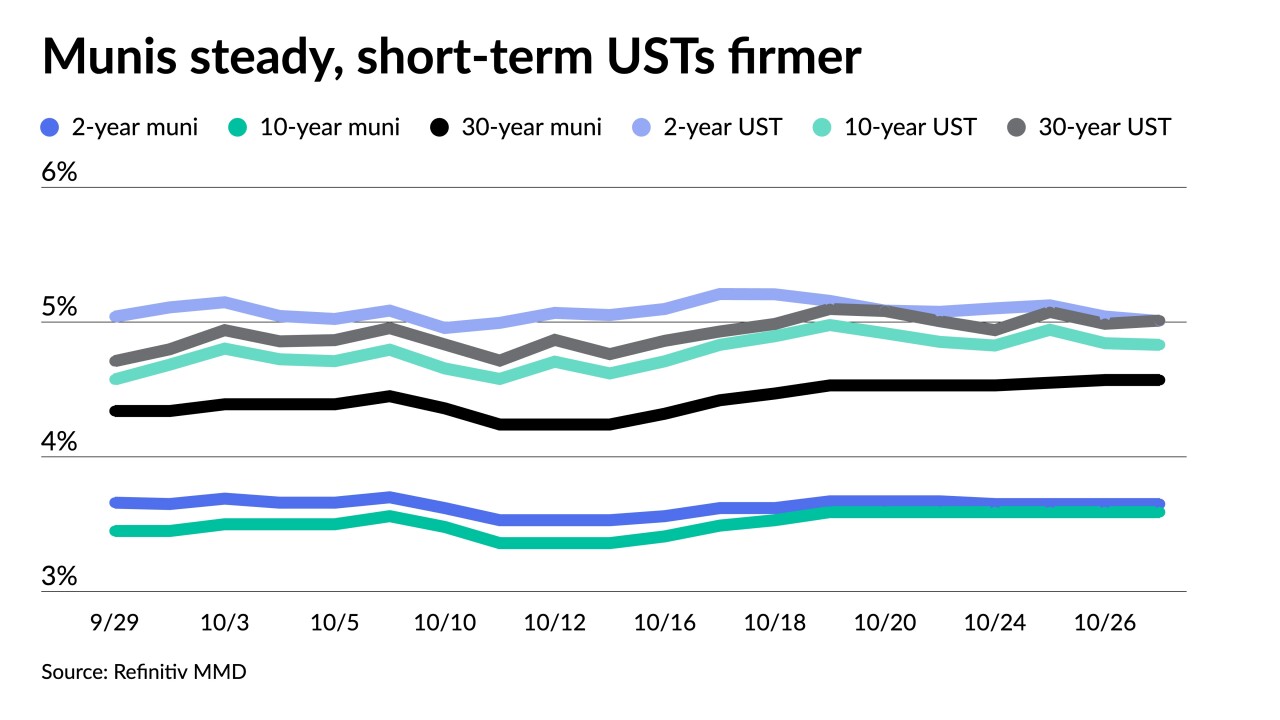

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

With nearly two years of volatility, The Bond Buyer wants to know your expectations for the year to come, from interest rates and bond volume to ESG and technology.

October 26 Arizent, The Bond Buyer

Arizent, The Bond Buyer -

"That is not how you drive policy and it's certainly not how you drive policy when the impact of policy happens with a lag," Mohamed El-Erian said. "This is the first Fed I know that has not gotten it."

October 20