-

Federal Reserve Bank of St. Louis President James Bullard urged policymakers to raise interest rates further, saying the level will need to be higher to meet the central bank's goal to be "sufficiently restrictive" to bring down inflation.

November 17 -

Federal Reserve officials stressed the need to keep raising interest rates while acknowledging recent encouraging news on U.S. consumer prices.

November 15 -

Federal Reserve Governor Christopher Waller said "we've still got a ways to go" before the central bank stops raising interest rates, despite good news last week on consumer prices.

November 14 -

The Federal Reserve looked closer to moderating aggressive interest-rate increases after welcome news on inflation, with three officials backing a downshift even as they stressed that policy needs to stay tight.

November 10 -

Boston Federal Reserve Bank President Susan Collins said monetary policy is entering a new phase that could require smaller rate increases.

November 4 -

High-yield saw outflows of $867.067 million after $594.497 million of outflows the week prior while exchange-traded funds saw inflows of $736.967 million after $444.544 million of inflows the previous week.

November 3 -

Investors pulled $3.843 billion from mutual funds in the week ending Oct. 26 after $3.876 billion of outflows the previous week, according to ICI.

November 2 -

October returns were in the red with the Bloomberg Municipal Index showing a loss of 0.83% for the month, bringing total losses in 2022 to 12.86%. Only May and July saw positive returns for the asset class.

November 1 -

With the Federal Reserve's hike pretty much expected, analysts will search for clues about future moves.

October 31 -

Total October volume was $24.951 billion in 510 deals versus $41.811 billion in 1,068 issues a year earlier, according to Refinitiv data.

October 31 -

The day after the FOMC announces its policy decision, Christian Scherrmann, U.S. Economist at DWS Group, will offer his take on the meeting, Fed Chair Powell's press conference and what comes next.

-

"It should at least be something we're considering at this point, but the data haven't been cooperating," Daly said Friday.

October 21 -

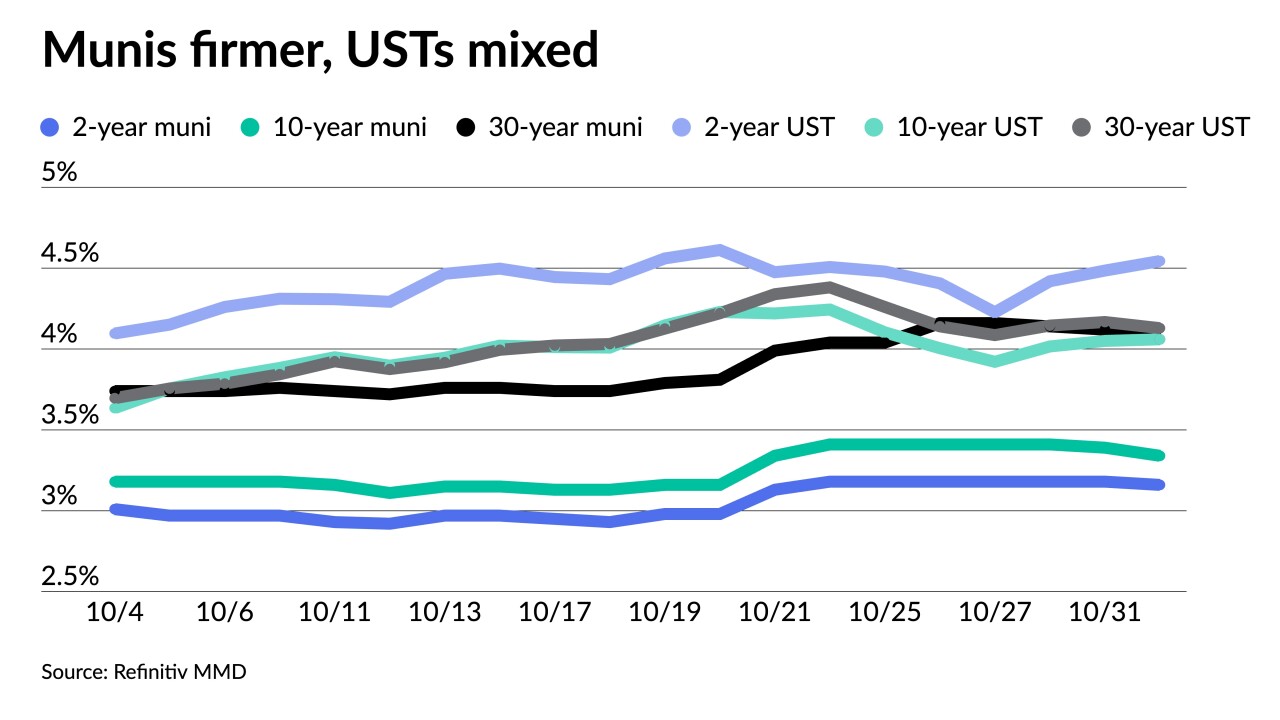

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

Refinitiv Lipper reported $2.262 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.057 billion the week prior.

October 13 -

Triple-A yields rose more than three-quarters of a point on the front end and nearly half a point out long in September as munis posted 3.84% losses.

September 30 -

"All of you who are looking for a pivot, be careful what you wish for," the chief economic adviser at Allianz SE and Gramercy Funds chairman said.

September 30 -

For the first three quarters, total issuance sits at $308.440 billion, down from $361.932 billion in 2021. Taxables are down 48.0% to $45.724 billion from $87.979 billion.

September 30 -

"It will take time for the full effect of tighter financial conditions to work through different sectors and to bring inflation down," Brainard said. "Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target."

September 30 -

"The lack of progress thus far has me thinking much more now that we have to get to a moderately restrictive stance," he told reporters Wednesday.

September 28 -

John Hallacy talks with Chip Barnett about how fiscal and monetary policy is affecting the municipal bond market. He discusses recent data releases, supply forecasts and the midterm elections and the future of ESG in public finance. (20 minutes)

September 27