Federal Reserve

Federal Reserve

-

Lawmakers on the House Financial Services Committee clashed over the stalled nominations of Federal Reserve Chairman Jerome Powell and four others Wednesday. It was a prelude to the fireworks that could occur Thursday when Powell is scheduled to testify before the Senate Banking Committee.

March 2 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

February 28 -

February volume was $26.481 billion in 594 deals versus $37.052 billion in 981 issues a year earlier, bringing total volume for the first two months of the year to $51.426 billion, or 20% less than 2021.

February 28 -

Federal Reserve Bank of Atlanta President Raphael Bostic said he favors raising interest rates by 25 basis points at the Federal Open Market Committee’s March meeting but would consider a larger half-point move if monthly inflation readings fail to decline from elevated levels.

February 28 -

The new-issue calendar is $5.45 billion while 30-day visible supply sits at $11.14 billion. The largest deal of the week comes from the New York City Municipal Water Finance Authority with $793.83 million.

February 25 -

“With inflation well above the FOMC’s longer-run objective and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the Fed said.

February 25 -

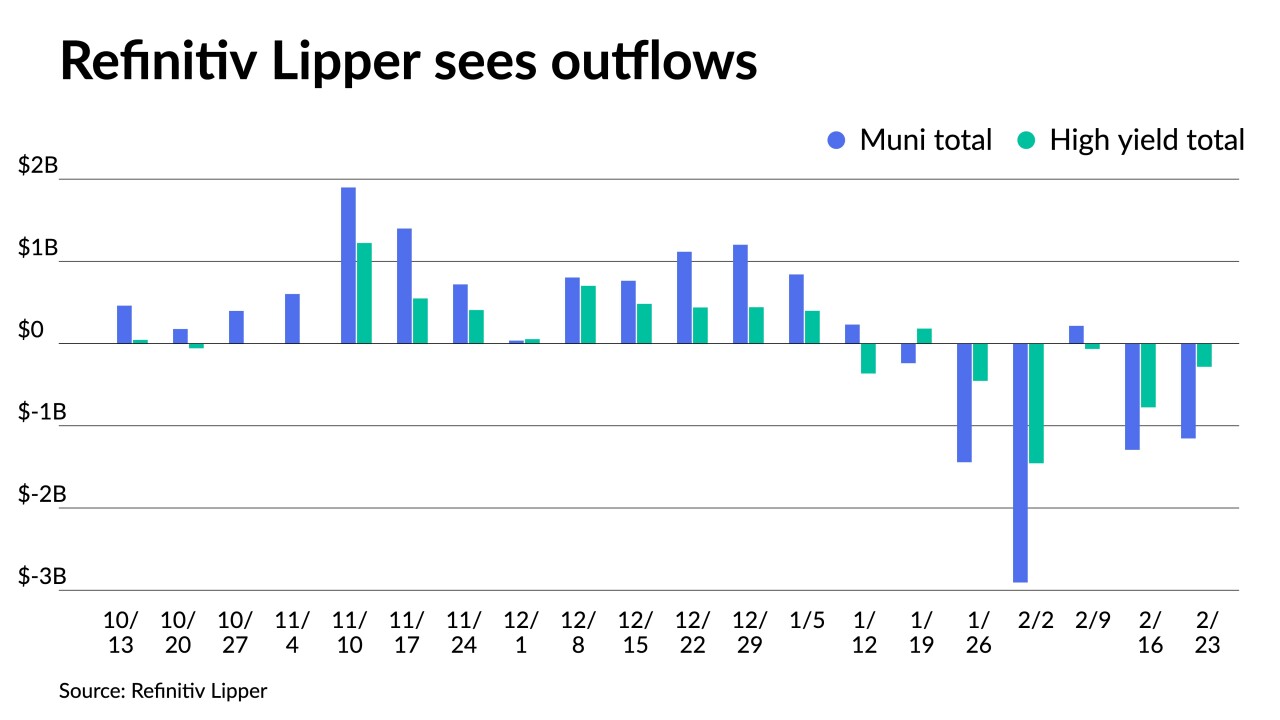

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24 -

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

The Federal Reserve formally adopted tough, sweeping restrictions on officials’ investing and trading, aiming to prevent a repeat of the ethics scandal that engulfed the U.S. central bank last year.

February 18 -

Federal Reserve Bank of Cleveland President Loretta Mester said she supports raising interest rates next month and tightening policy at a faster pace if needed to curb inflation.

February 17 -

Federal Reserve Bank of St. Louis President James Bullard said bringing down inflation may require the central bank to overshoot a neutral target interest rate, which he sees as about 2%.

February 17 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved, with municipal-to-Treasury ratios now on par with their five-year averages.

February 15 -

Republicans on the Senate Banking Committee skipped its scheduled vote on five Federal Reserve appointees, preventing a quorum. Minority Leader Mitch McConnell echoed concerns raised about nominee Sarah Bloom Raskin, saying she wants the Fed to become an “ideological left-wing activist body” that interferes with private-sector credit decisions.

February 15 -

From fund flows to Fed policy, investing in munis requires a more thoughtful strategy.

February 15 -

GOP lawmakers are considering a plan by Sen. Pat Toomey, the top Republican on the Senate Banking Committee, to boycott Tuesday’s committee votes on Raskin and President Biden’s four other Federal Reserve nominees. Such a move would deny Democrats a quorum to move forward.

February 15 -

A crucial centrist vote among Democrats, the Montana lawmaker and Senate Banking Committee member predicts the full chamber will support Raskin's nomination for vice chair for supervision of the Federal Reserve Board if she advances out of committee on Tuesday.

February 14 -

Dennis Gingold, co-founder of the Reserve Trust company, says Republican allegations that central bank nominee Sarah Bloom Raskin behaved unethically in interacting with the Federal Reserve Bank of Kansas City while serving on the company's board are “completely false.”

February 13 -

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

In an interview on Thursday, Federal Reserve Bank of St. Louis President James Bullard discussed his outlook for monetary policy following a report showing surging consumer prices.

February 11